Brexit and Its Long-term Effects on European Markets

I’ve been closely watching Brexit and its effects on Europe’s economy. The UK’s choice to leave the EU has started a chain of changes. These changes will deeply affect trade, investments, and economic growth in Europe. Brexit’s impact will be vast, especially on trade costs between the UK and Europe. These costs will include tariffs […]

Crude Calculations: Oil Prices Amidst Middle Eastern Political Shifts

The Arabian Gulf is key in world politics and the economy. This is because of its location and lots of oil. Gulf countries depend on oil sales for their plans. This sometimes causes tension with other countries. Knowing how the Gulf’s oil plans change is important for less conflict and world peace. Saudi Arabia, Kuwait, […]

Aerospace Stocks on the Rise: The Effect of Increased Defense Spending

Geopolitical tensions and empty weapon stores are making defense spending go up all over the world. A 2022 report by Markets and Markets showed that global defense spending hit $1.7 trillion. The biggest spenders were the United States, China, Russia, India, and Saudi Arabia. This increase in defense spending is boosting the aerospace industry. As […]

Political Instability and Its Impact on Foreign Investments

Hi! Today, I’ll share the interesting link between political instability and foreign investments. Countries worldwide are trying to attract foreign direct investment (FDI). They want to boost their economies. But, the political stability of a country is key to its success. Political instability involves civil unrest, frequent changes in leadership, or unpredictable policies. This makes […]

Currency Wars: How Political Moves Influence Exchange Rates

Welcome to my article on currency wars. Here, we’ll see how political decisions can change exchange rates. Currency wars are a big deal in the world economy today. Countries use strategies to boost their economies and get ahead in international trade. A currency war happens when countries lower the value of their money against others. […]

The Economics of Trade Wars: What Investors Need to Know

Trade wars are a big deal in the world’s economy. They matter a lot to investors. The fight between the United States and China has made trading prices and investments unpredictable. It’s important for investors to keep up and understand how trade wars might affect them. The recent agreement between the US and China has […]

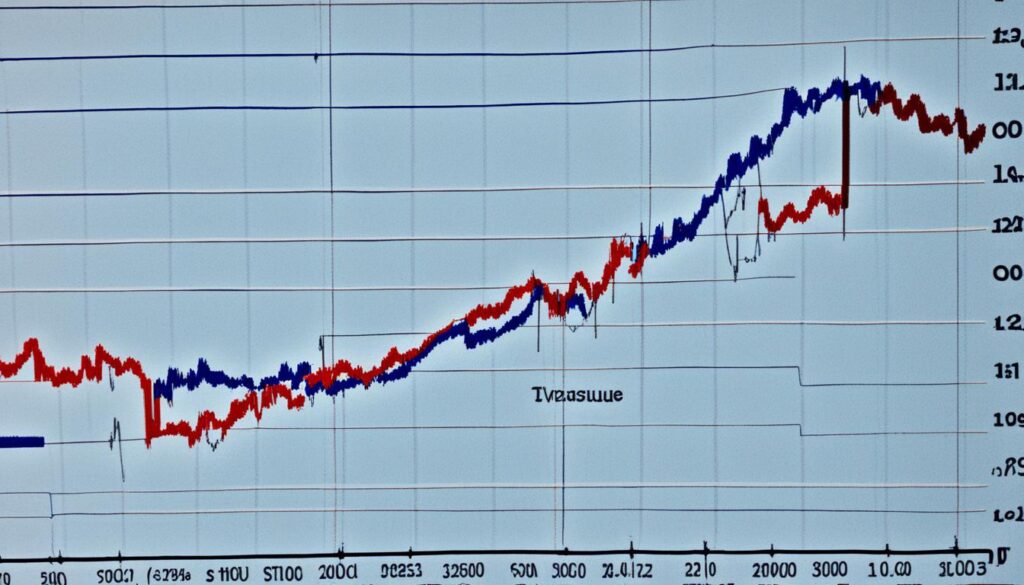

Election Outcomes and Their Turbulent Effect on Markets

The 2024 U.S. presidential election could majorly impact the market. It might change investments and the economy. Investors watch election results to predict market swings. Election results can shake up markets for a short time. But, in the long run, their effects are small. Economic trends and inflation matter more for market results. Investors pay […]

Economic Sanctions: Unraveling Their Impact on Global Trade

The world of global trade is more connected than ever. Yet, economic sanctions can shake up this system. They disrupt how countries trade with each other. Sanctions are a way for countries to pressure others. They might use trade limits, money rules, or stop selling weapons. These are used for various reasons, like stopping nuclear […]

How Geopolitical Events Shake the Stock Markets

Geopolitical events often shake the stock markets, affecting global investments. “Geopolitical risk” means threats from political, economic, or military conflicts between places. This covers things like wars, climate changes, and big political changes, such as Brexit. The Geopolitical Risk Index (GPR) helps measure these risks. It looks at how often newspapers mention military conflicts, wars, […]

Navigating Global Political Risk: Strategies for Investors

Understanding global political risk is key for investors aiming to boost returns and protect their assets. The choices made by governments can greatly influence the financial markets. This leads to market swings and impacts investment outcomes. Knowing how to assess political risks is vital for a strong investment plan. Investors can look at how markets […]