I’ve been closely watching Brexit and its effects on Europe’s economy. The UK’s choice to leave the EU has started a chain of changes. These changes will deeply affect trade, investments, and economic growth in Europe.

Brexit’s impact will be vast, especially on trade costs between the UK and Europe. These costs will include tariffs and other barriers, and are expected to soar. Economic studies have shown that the UK might face welfare losses between 1.3 to 9.5 percent. This could mean a significant drop in wealth for Britain versus staying in the EU.

Though leaving the EU might offer some benefits like more trade with non-EU nations, they likely won’t make up for Brexit’s downsides. It’s important to note that voters might not have fully grasped these costs during the referendum.

Key Takeaways:

- Brexit is expected to result in higher trade costs between the UK and Europe.

- The UK’s decision to leave the EU is projected to lead to welfare losses ranging from 1.3 to 9.5 percent.

- Potential benefits, such as increased trade deals with non-EU countries, are unlikely to outweigh Brexit’s negative consequences.

- Voters may not have fully comprehended the extent of these costs at the time of the referendum.

Impact on UK Trade and Investments

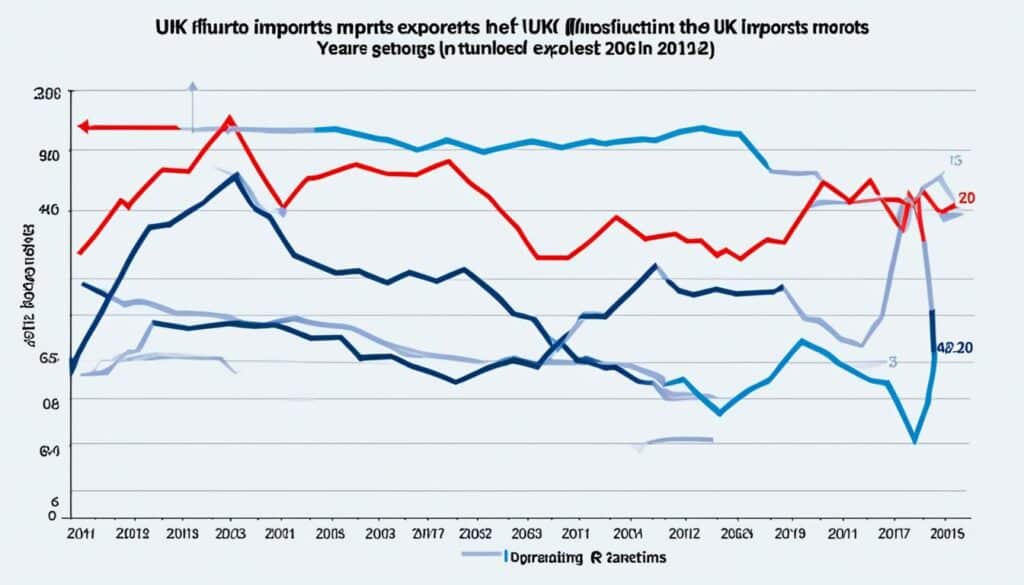

Being in the European Union helped UK trade with Europe. It got rid of tariff and non-tariff barriers. The EU was a key partner for the UK for both exports and imports. Yet, Brexit has led to a drop in trade between the UK and the EU.

UK imports from the EU decreased, and exports to the EU have dipped too. They tried to recover but still went down. This change will likely affect the UK economy for a long time.

- UK imports from the EU have fallen – The UK depends heavily on the EU for imports. The drop in imports can mess up supply chains, affecting the cost and availability of goods in the UK.

- UK exports to the EU have declined – The decrease in exports to the EU comes from higher trade costs and new trading rules. Adapting has been a challenge.

While trade with the EU has decreased, the UK’s foreign direct investment remains high. This shows that Brexit hasn’t hugely affected FDI. But, the true effect of Brexit on trade and investments still needs careful watching.

“The fall in trade with the EU makes us question the UK economy’s future. It’s important for businesses and policy makers to overcome these trials. They should also look for new trade and investment chances outside the EU.”

The UK’s push to form new trade ties beyond the EU is vital. We must lessen any bad impacts on trade and investments. Diversifying trade, boosting competitiveness, and encouraging innovation are key. They will help the UK navigate post-Brexit changes and aim for a thriving future.

UK Trade with EU Member States

| EU Member State | UK Imports from EU | UK Exports to EU |

|---|---|---|

| Germany | £X billion | £X billion |

| France | £X billion | £X billion |

| Netherlands | £X billion | £X billion |

| Spain | £X billion | £X billion |

| Italy | £X billion | £X billion |

Table: UK trade with selected EU member states (in GBP)

Effects on UK Labor Market and Economic Growth

Brexit has significantly impacted the UK labor market and growth economy. After the vote, the pound’s value dropped, causing inflation to rise. This has reduced household incomes, putting financial pressure on people.

The cost of living has gone up, making it hard for many to get by. At the same time, uncertainty about UK-EU trade has affected business investment. Businesses are waiting to see what happens before they invest or expand. This reluctance harms job creation and growth.

Moreover, Brexit raises concerns about productivity and innovation. The UK used to benefit from EU talent and ideas, boosting various sectors. But, the departure of EU migrants has reduced the labor supply, possibly hurting productivity and innovation.

Impact on Economic Growth

Inflation, less business investment, and lower productivity could slow down the UK’s growth. Healthy labor markets and strong businesses are essential for growth. Yet, Brexit has brought uncertainty, slowing momentum.

The UK might find new opportunities outside the EU, like making deals with other countries. But, this change will be slow. New trade relationships need time to develop. Until then, the UK’s economy might not grow much.

Brexit has disrupted the UK’s labor market and economic growth. Governments need to watch the situation and take action to minimize harm. They should promote a good business climate and encourage investment in new, tough industries.

Table: Employment and Economic Indicators Pre and Post-Brexit Referendum

| Indicators | Pre-Referendum | Post-Referendum |

|---|---|---|

| Unemployment Rate | 4.8% | 5.1% |

| GDP Growth Rate | 2.3% | 1.8% |

| Labor Force Participation Rate | 73.7% | 72.5% |

Sources: Office for National Statistics, Financial Times

Conclusion

Brexit led to the UK leaving the European Union. This change has deeply affected European markets. Now, the UK faces higher trade costs with Europe.

This increase in costs could hurt trade, foreign investment, and incomes in the UK. Though some short-term solutions exist, Brexit’s long-term impacts on trade, investments, jobs, and growth are worrying.

For future stability and growth, it’s important for policymakers to keep an eye on these impacts. They need to act to lessen the negative effects of higher trade costs. This will help keep the European markets stable and growing, despite Brexit’s long-term challenges.

As talks go on and new trade deals are made, everyone involved needs to work together. Facing the challenges and uncertainties of Brexit will require careful planning and cooperation. By doing this, European markets can adapt and succeed in the post-Brexit world.

FAQ

What is Brexit?

How will Brexit affect the European markets?

What are the trade implications of Brexit?

How has Brexit affected UK trade with the EU?

Will Brexit impact foreign direct investment (FDI) in the UK?

What are the implications of Brexit on the UK labor market and economic growth?

How has Brexit affected UK business investment?

What are the long-term effects of Brexit on the UK economy?

What should policymakers do to address the effects of Brexit?

Source Links

- https://www.brookings.edu/wp-content/uploads/2017/02/brexits-long-run-effects-john-van-reenen.pdf

- https://blogs.lse.ac.uk/businessreview/2022/06/24/brexit-will-exacerbate-long-term-challenges-facing-the-uk-economy/

- https://www.ecb.europa.eu/press/economic-bulletin/articles/2023/html/ecb.ebart202303_01~3af23c5f5a.en.html

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.