Geopolitical events often shake the stock markets, affecting global investments. “Geopolitical risk” means threats from political, economic, or military conflicts between places. This covers things like wars, climate changes, and big political changes, such as Brexit.

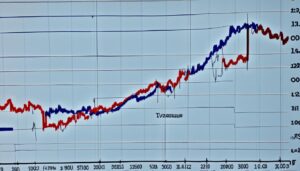

The Geopolitical Risk Index (GPR) helps measure these risks. It looks at how often newspapers mention military conflicts, wars, and terrorism. The GPR went up during the Trump presidency, showing more geopolitical worries.

Many studies show investors are most scared of geopolitical risks. These fears impact economies and markets, often more than the events themselves. When risks grow, investors get cautious, slowing down big investments.

Geopolitical risks have wide effects. They can hurt stock market gains, slow money going to developing places, and lower US Treasury yields. They may even drop oil prices, which shows a weaker economy.

For investors, it’s key to keep up with global events affecting markets. By knowing and managing these risks, investors can make better, informed choices.

Key Takeaways:

- Geopolitical events have a significant impact on stock markets and investments.

- Geopolitical risks refer to threats arising from political, economic, or military tensions between countries or regions.

- The Geopolitical Risk index (GPR) measures the level of geopolitical risk.

- Investors should be cautious and consider diversifying investments to mitigate risk.

- Geopolitical risks can negatively affect equity market returns, capital flows, and oil prices.

Market Behavior and How Investors Should Respond to Rising Geopolitical Risk

Geopolitical threats and uncertainties shape the market profoundly. These threats stem from global political events. When political risk rises, assessing market trends becomes tricky.

Economic and financial variables get swayed by politics and foreign policy. Studies reveal that geopolitics impact economic activity and markets deeply. More than the actual events happening.

For investors, caution is key in the face of geopolitical risks. Political uncertainties can spike market volatility. This can lead to losses if we’re not careful.

To lower risk, spreading investments across various assets is crucial. This strategy helps investors reduce their risk exposure. Having a mix of asset types and global investments helps.

Looking at non-traditional assets can also be wise. Assets like real estate and cryptocurrencies offer more variety. They could protect against market swings due to geopolitical issues.

Traders might prefer quick strategies under geopolitical tension. They aim to profit from market shifts by taking specific stock positions. But, understanding both politics and finance deeply is a must here.

Experts in politics and economics are needed more than ever. Their skills help navigate through geopolitical complexities. Combining political and financial know-how, they guide investment decisions wisely.

Policy-making gets tougher with high geopolitical risk. Central banks face challenges in decision-making. Their choices must consider the geopolitical impacts carefully.

Investment Strategies in the Face of Geopolitical Risks

Adapting investment strategies is crucial when geopolitical risks loom. Here are some strategies for investors:

- Diversification: Spread investments across various asset classes and geographic regions to reduce exposure to specific geopolitical risks.

- Emerging Market Opportunities: Evaluate investment opportunities in emerging markets where geopolitical risks may be priced in, providing a potential for higher returns.

- Active Risk Management: Continually monitor geopolitical events and adjust investment positions accordingly. Actively managing risk can help protect portfolios during periods of increased uncertainty.

- Alternative Investments: Explore alternative assets, such as real estate, commodities, or infrastructure projects, as they may offer a degree of insulation from geopolitical risks.

| Investment Strategy | Advantages | Considerations |

|---|---|---|

| Diversification | Reduces exposure to specific geopolitical risks | May not fully protect against broad market downturns |

| Emerging Market Opportunities | Potential for higher returns | Higher volatility and political instability |

| Active Risk Management | Protection during periods of increased uncertainty | Requires proactive monitoring and analysis |

| Alternative Investments | Potential insulation from traditional market volatility | May have limited liquidity and higher barriers to entry |

Conclusion

Geopolitical events majorly affect stock markets and investments. In recent years, rising geopolitical risks have made financial markets more uncertain and volatile. As an investor, it’s key to watch these developments closely. This helps in understanding their possible effects on the economy and markets.

To deal with uncertainties from geopolitical risks, adopting some strategies is crucial. Spreading out investments and looking into alternative assets can lessen the effects of geopolitical events. Plus, using strategies to lower risks can soften the blow of market swings.

Having professionals who know politics, the big economic picture, and finances is valuable. They can dig into the complexities of geopolitical risks. This expertise guides investors to make better and more informed choices.

Markets can act in unpredictable ways when political risks are high. But, managing investments actively and staying updated can reduce possible losses. By being proactive and using smart strategies, investors can deal with the impacts of geopolitical events. This way, they keep their investments safe.

FAQ

How do geopolitical events impact the stock markets and investments?

What is geopolitical risk?

How is geopolitical risk measured?

What impact does geopolitical risk have on market behavior?

How should investors respond to rising geopolitical risk?

What skills are in demand to navigate geopolitical risks?

Source Links

- https://mybrand.schroders.com/m/b43f7ed9b00d47de/original/2019_Sept_Measuring-the-market-impact-of-geopolitics_KW_IL_CS1696.pdf

- https://finance.yahoo.com/news/rising-dollar-geopolitical-tensions-shake-180000379.html

- https://www.ft.com/content/9152bc6f-1b8e-4edc-a071-9b274d8bbe45

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.