Wheat Rally Persists Amid Climate Concerns and European Crop Worries

Wheat futures have continued to rise, driven by a confluence of factors, including climate change-induced European crop worries, weather-related issues worldwide, and increasing global demand for wheat. Climate Change Impacts: Rising Temperatures: Climate change results in rising temperatures, negatively impacting wheat production. Wheat requires specific temperature ranges, and higher temperatures can lead to decreased yields […]

Global Wheat Market: A Complex Tapestry of Supply, Demand, and Uncertainty

The global wheat market, a cornerstone of global food security, is experiencing a dynamic interplay of supply, demand, and geopolitical factors. This analysis examines recent developments, price trends, and key influencing factors shaping the wheat market landscape. Key Developments Southern Hemisphere Harvests: While representing a relatively small portion of global wheat production, Australia and Argentina […]

Wall Street Analysts Predict that the Price of Gold Will Approach $3,000

Gold has performed better than the broader U.S. stock market this year, and Wall Street is becoming more positive about the precious metal as the Federal Reserve moves closer to rate cuts. On Friday, gold surged as much as 2.2% to a new record high, surpassing $2,500 per ounce. Market Indicators and Predictions Although concerns […]

The Orange Juice Crisis: A Global Challenge Fueled by Climate Change

The once ubiquitous glass of orange juice is facing a bitter reality: soaring prices and dwindling supplies. A confluence of climate-related challenges has crippled the citrus industry, sending orange juice futures to record highs and leaving consumers to bear the brunt. This crisis underscores the fragility of our food supply and highlights the urgent need […]

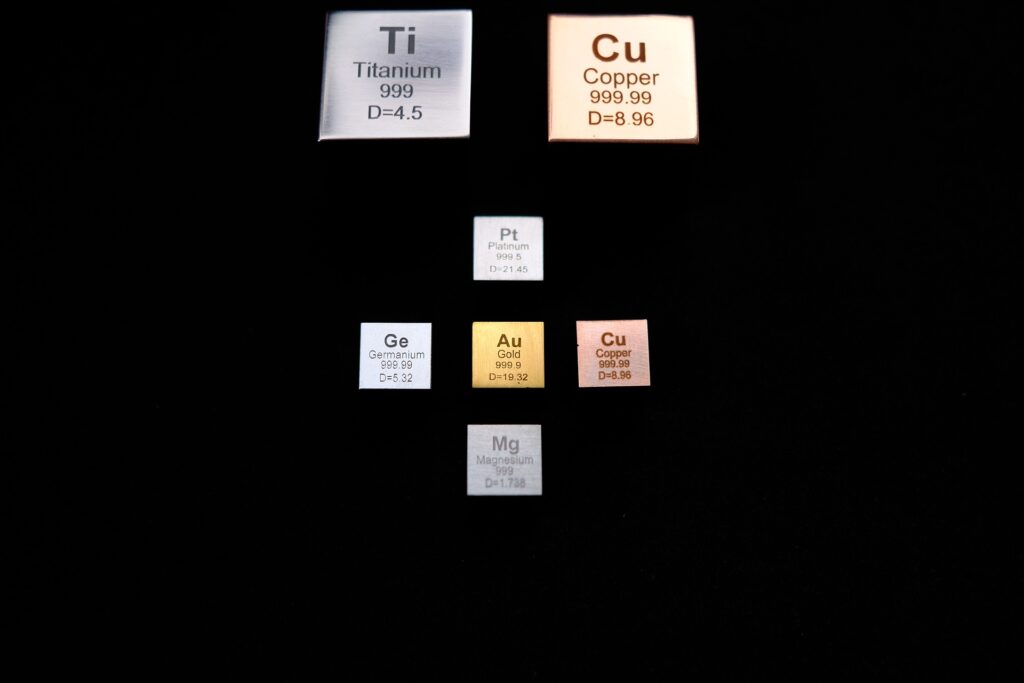

The Platinum Conundrum: A Tale of Supply, Demand, and Geopolitical Shadows

The platinum market has been a complex tapestry in the first half of 2024, woven with threads of supply deficits, robust demand, and the ever-present shadow of geopolitical uncertainty. While the metal has displayed volatility, the underlying fundamentals suggest a bullish outlook, tempered by the weight of historical inventories. Market Dynamics: A Delicate Balance The […]

Understanding the Surge in Oil Prices: Geopolitical and Economic Factors at Play

In the ever-fluctuating world of commodities, oil stands as a particularly sensitive barometer of global stability and economic health. Recent developments indicate a looming surge in oil prices, driven by a confluence of geopolitical tensions, economic uncertainties, and market dynamics. As a risk management professional, it’s essential to unpack these factors to understand their implications […]

Could the Silver Price Hit $100 per Ounce?

The silver market has always intrigued investors with its potential for high returns, and recent discussions have fueled speculation about its future. Keith Neumeyer, CEO of First Majestic Silver, has been a prominent voice predicting that silver could reach the $100 per ounce mark, or even higher. But what factors could drive Silver to these […]

European Gas Market Volatility: Causes, Impacts, and Future Outlook

European gas prices experienced significant fluctuations yesterday, with the Dutch TTF gas price rising by up to 13% before settling 5.23% higher. This surge highlights ongoing supply concerns, exacerbated by unplanned outages in Norway, including the Nyhamna processing plant and the Easington terminal in the UK. The immediate cause is linked to a pipeline crack […]

Orange Juice Crisis Prompts Search for Alternative Fruits

In a remarkable turn of events, the global orange juice industry is grappling with an unprecedented crisis. Bad weather and disease in Brazil, the world’s largest exporter of oranges, have driven orange juice futures prices to record highs. This has prompted manufacturers to explore alternative fruits, such as mandarins, to produce the popular beverage. Record […]

“Copper prices could skyrocket to $40,000,” according to top trader Andurand.

Copper prices may potentially rise to $40,000 per tonne in the next few years, as predicted by hedge fund manager Pierre Andurand in an interview with the Financial Times. The metal has surged by almost 20% this year, reaching a record $11,000 per tonne ($5.00/lb) this week. Drivers of Demand Andurand explained, “We are moving […]