Copper prices may potentially rise to $40,000 per tonne in the next few years, as predicted by hedge fund manager Pierre Andurand in an interview with the Financial Times.

The metal has surged by almost 20% this year, reaching a record $11,000 per tonne ($5.00/lb) this week.

Drivers of Demand

Andurand explained, “We are moving towards a doubling of demand growth for copper due to the electrification of the world, including electric vehicles, solar panels, wind farms, as well as military usage and data centers.”

Andurand, a former Goldman Sachs trader who co-founded BlueGold Capital before launching Andurand Capital, manages approximately $2 billion in assets.

Predictions and PerspectivesPredictions and Perspectives

“I think we could see prices up to $40,000 per tonne ($18.18/lb) over the next four years or so. I’m not saying it will stay there indefinitely; eventually, we will get a supply response, but that supply response will take more than five years.”

Former Goldman Sachs executive Jeff Currie, who is now chief strategy officer of energy pathways at asset manager Carlyle, offered a positive assessment in a recent interview with Bloomberg. According to him, the trade in copper “is the highest conviction trade I have ever seen.”

Currie sees copper prices reaching $15,000 a tonne ($6.80/lb).

Future Demand Projections

The demand for copper in the transport sector alone is projected to increase by 11.1 times by 2050, compared to 2022. Electric vehicles, for example, can contain more than a mile of copper wiring.

Furthermore, the demand for copper needed to expand the global electricity grid is projected to increase by 4.8 times by 2050, compared to 2022.

By 2030, the copper supply gap is projected to approach 10 million tonnes, according to BloombergNEF estimates.

Andurand’s Track Record

The hedge fund manager Pierre Andurand is not widely known among American investors, but he has a strong track record in commodities trading. His Andurand Capital funds, particularly the $1.3 billion Commodities Discretionary Enhanced fund, have seen an 83% increase in value so far this year. Andurand is now bullish on copper, predicting that it could soar to $40,000 per metric ton from its current trading price of around $10,290 per ton.

Market Dynamics and Impact

Copper prices have already risen about 21% this year, reaching a record high of $11,000 per ton. Andurand believes that this rally has a long way to go, as demand for copper is outstripping its supply due to the increasing global electrification, including the demand for electric vehicles (EVs), solar panels, wind farms, military usage, and data centers. He anticipates that it could take up to four years for copper to reach $40,000 per ton, and even after that, a supply response would take more than five years, as highlighted by a study from S&P Global indicating that it takes an average of 15.7 years from discovery to production for mines.

Challenges in Supply

The recent bid for rival Anglo American by BHP Group is evidence of the increasing difficulty and expense of building new mines, as opposed to acquiring existing ones with copper mines. Andurand is not the only one optimistic about copper and metals in general. Recent buying from futures market traders has driven metal prices, including copper and gold, to all-time highs. The rally in copper has also positively impacted the prices of other industrial metals, such as aluminum and zinc.

Historical Context and Future Needs

Strong demand depleted inventories to historic lows last year, making this surge in metal prices unsurprising, despite Wall Street’s shorting of metals. Looking specifically at copper, a study from the International Energy Forum (IEF) highlighted the need to mine 115% more copper in the next 30 years than has been mined historically. Additionally, to electrify the global vehicle fleet, producers must bring 55% more new mines into production than would otherwise be necessary.

Growing Demand in Developing Countries

The demand for copper was exceptionally strong in 2023, with a 7.3% year-on-year growth in the first 10 months, according to the World Bureau of Metal Statistics (WBMS). It’s important to note that most of this demand growth came from the developing world, especially China, India, and Indonesia.

While China is already the largest consumer of copper, India and Indonesia are also experiencing significant growth in copper demand.

Experts expect India to increase its annual copper consumption nearly four-fold over the coming decade, similar to the exponential growth in Chinese copper demand between 2000 and 2010. They also forecast that Indonesia will consume five times its current rate of copper in about a decade.

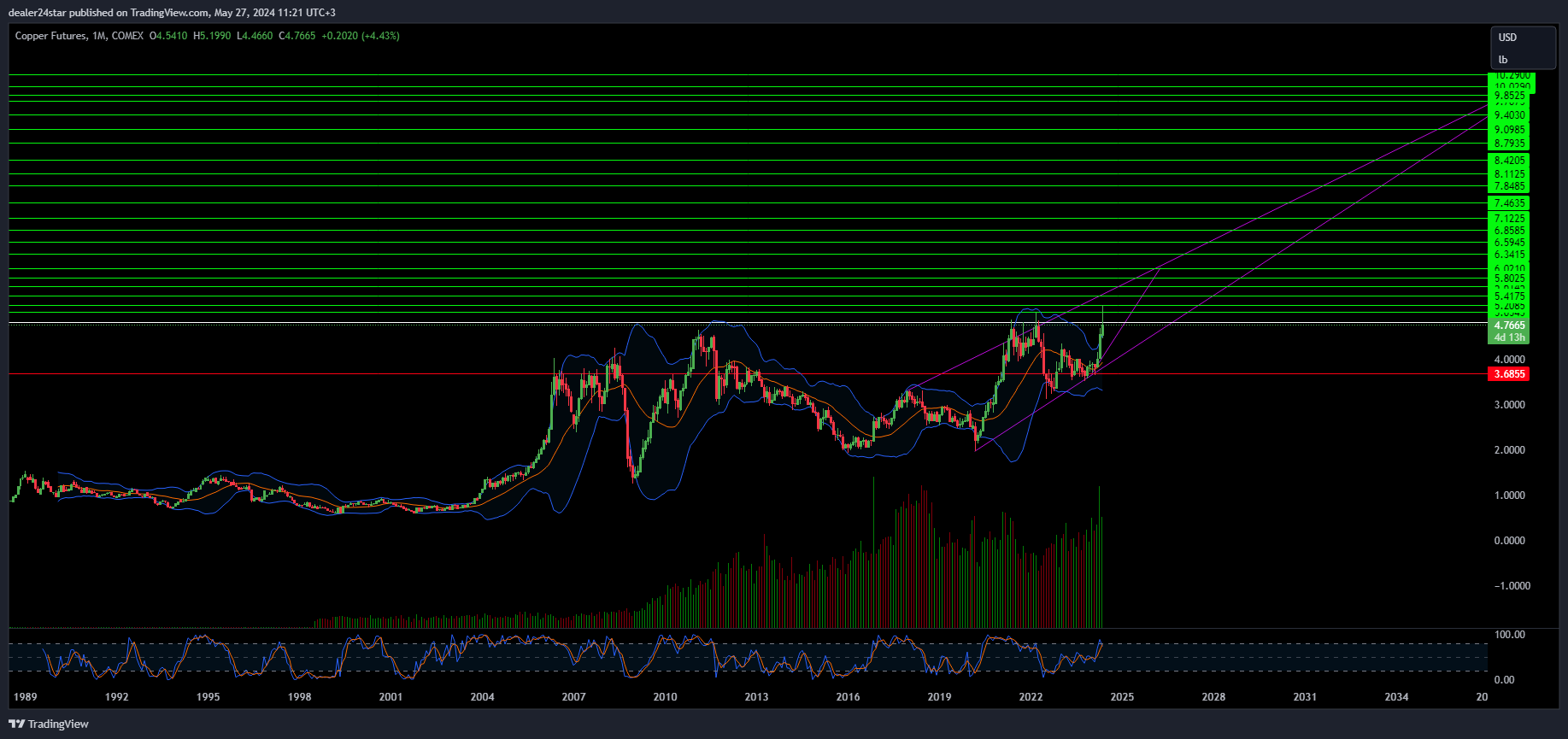

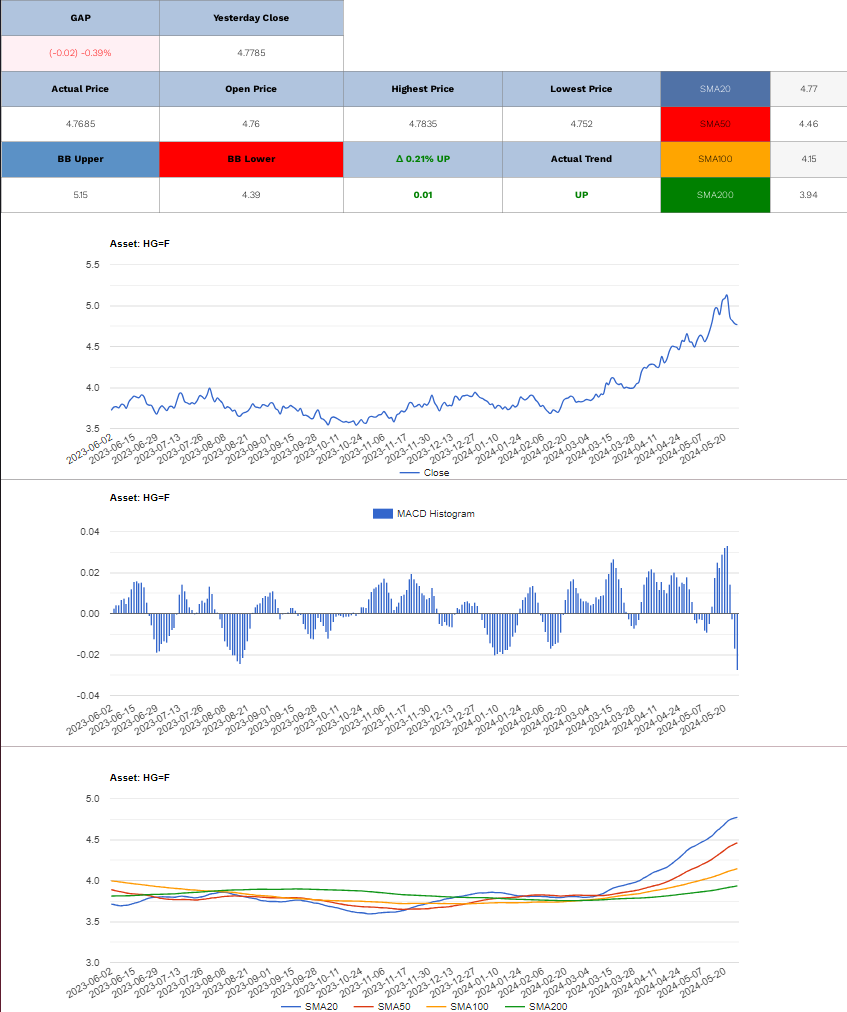

Copper Long (Buy)

Enter At: 4.8195

T.P_1: 5.0545

T.P_2: 5.2085

T.P_3: 5.4175

T.P_4: 5.6145

T.P_5: 5.8025

T.P_6: 6.0210

T.P_7: 6.3415

T.P_8: 6.5945

T.P_9: 6.8585

T.P_10: 7.1225

T.P_11: 7.4635

T.P_12: 7.8485

T.P_13: 8.1125

T.P_14: 8.4205

T.P_15: 8.7935

T.P_16: 9.0985

T.P_17: 9.4030

T.P_18: 9.7075

T.P_19: 9.8525

T.P_20: 10.0290

T.P_21: 10.2900

S.L: 3.6855

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.