The anticipated recession of 2023 has yet to materialize, and recent economic data indicate more signs of strength than weakness. In light of this, David Bailin, Chief Investment Officer at Citi Global Wealth Investments, has coined the term “rolling recession” to describe the current state of the US economy, where Certain sectors are experiencing decline while others, such as travel and leisure, remain strong.

Bailin explains that commercial real estate and some segments of basic consumer manufacturing are currently in recession, representing shrinking businesses in the United States. However, the overall economy continues to grow. Despite the S&P Global US manufacturing PMI index falling below expectations at 46.3 (with anything below 50 indicating contraction), other survey data suggests that: the economy is expanding.

The impact of interest rates is far-reaching. The Federal Reserve’s attempts to cool the economy through rapid interest rate hikes to manage inflation have faced challenges. Economists warn that the longer interest rates remain at their current level, the greater the likelihood of other sectors being affected. Bailin notes that smaller and medium-sized companies with capital needs are now at a disadvantage, which may constrain their growth, resulting in layoffs or even leading to business closures.

Although the labor market is slowing, it continues to add jobs. In May – 399,000 jobs were created, surpassing Wall Street estimates of 195,000. Unemployment in the US stands at 3.7%. Liz Ann Sonders, Chief Investment Strategist at Charles Schwab, believes that the full impact on the labor market is yet to come, and she suggests that companies’ cost structures, particularly labor, will provide crucial insights into the potential next phase of economic challenges.

Despite these concerns, some strategists remain cautious about labeling the current situation a recession in the near term until more significant cracks emerge. Goldman Sachs economists recently revised their judgmental probability of a US recession within the next 12 months to 25% (previously 35%). Jay Hatfield, CEO of Infrastructure Capital Management, points to the resilient residential housing sector as an indicator that it is premature to predict a recession, citing a shortage of homes for sale as a contributing factor.

Consumer spending also reflects signs of strength. May’s retail sales, not adjusted for inflation, increased by 0.3% month-over-month, defying expectations of a decline of 0.2%. Oren Klachkin, lead US economist at Oxford Economics, emphasizes the resilience of consumer spending in a recent note, stating that “the recession will be delayed as long as consumers continue to spend.”

For now, the Federal Reserve faces the challenge of maintaining a delicate balance. While the central bank has paused rate hikes, it has cautioned that one or two more increases may be implemented later this year to continue the fight against inflation without tipping the economy into recession.

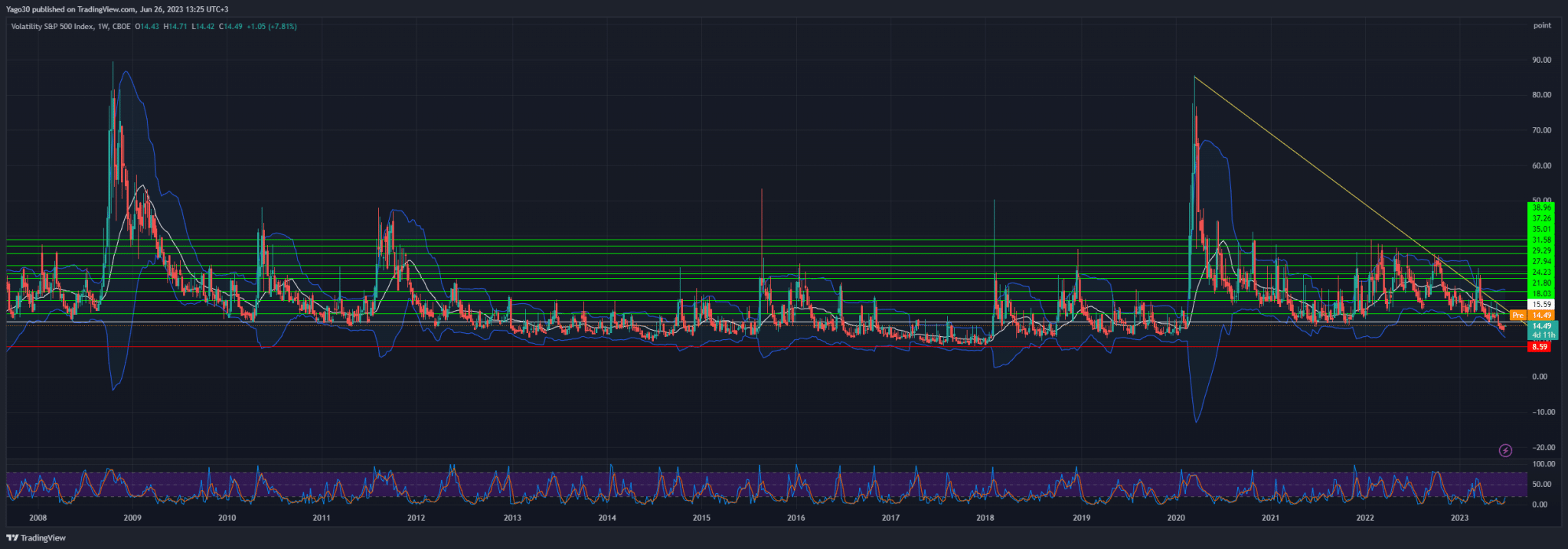

VIX Long (Buy)

Enter At: 15.59

T.P_1: 18.03

T.P_2: 21.80

T.P_3: 24.23

T.P_4: 27.94

T.P_5: 29.29

T.P_6: 31.58

T.P_7: 35.01

T.P_8: 37.26

T.P_9: 38.96

S.L: 8.59

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.