WeWork, a US-based company that provides office spaces, was once valued at $47 billion by SoftBank.

However, in its second-quarter earnings report, WeWork has expressed doubts for the first time about its ability to sustain as a going concern.

The company’s future outlook is dependent on several plans, including restructuring and acquiring additional capital over the next 12 months.

David Tolley, who is currently serving as interim CEO, attributed the company’s underperformance in recent months to economic and property market conditions. He added that higher competition in flexible space and macroeconomic volatility resulted in a slight decline in memberships.

WeWork has been revamping its business model after co-founder Adam Neumann’s failed attempt to go public in 2019. The company has already exited or amended 590 leases, reducing future lease commitments by $12.7 billion. Tolley said that WeWork would “double down” on its real estate portfolio optimization efforts.

The company currently has a membership of 512,000 in 610 locations spread out across 33 countries. Unfortunately, the company experienced a 3% decline in membership, and occupancy in its buildings decreased from 73% to 72% from the previous year.

When excluding locations in China, Israel, and South Africa, where the company receives a management fee, WeWork’s revenues increased by 4% to $844mn in the second quarter, meeting the lower end of its previous guidance.

Although net losses were almost halved compared to $635mn a year ago, adjusted losses before interest, tax, depreciation, and amortization were far below the expected range. This news came after WeWork completed a financial restructuring that reduced its debt load by about $1.2bn.

WeWork’s shares had already decreased by 95% in the past year and fell another third in after-hours trading to 14 cents. Additionally, its 2025 bonds last traded at 34 cents on the dollar.

The company stated that continuing as a going concern would depend on a series of actions, including negotiating more favorable leases, controlling costs, and seeking fresh capital via the issuance of debt or stock, or asset sales. At the end of June, the company had $680mn of liquidity, including $205mn of cash.

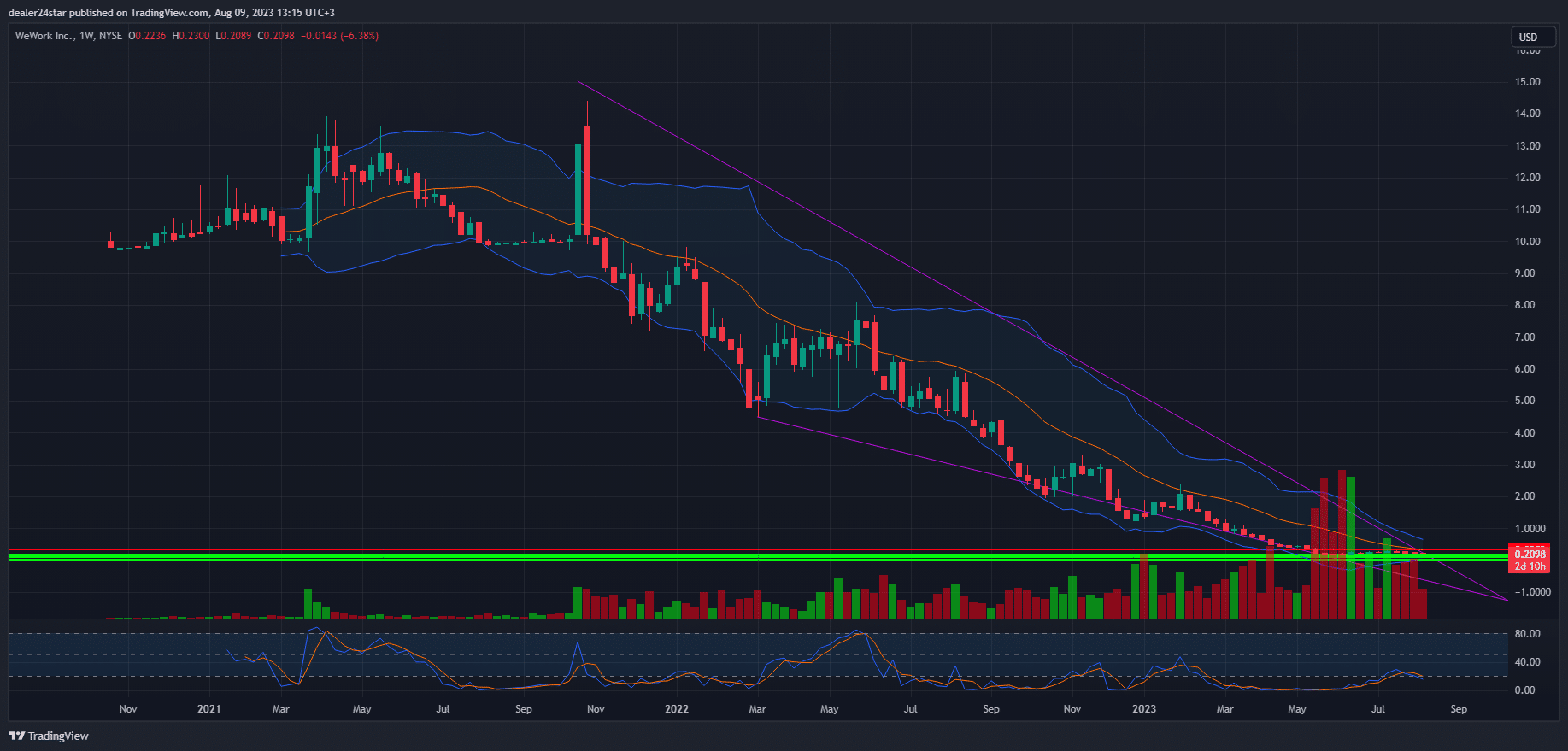

WeWork Short (Sell)

Enter At: 0.2053

T.P_1: 0.1914

T.P_2: 0.1753

T.P_3: 0.1639

T.P_4: 0.1424

T.P_5: 0.1157

T.P_6: 0.0818

T.P_7: 0.0451

T.P_8: 0.0000

S.L: 0.3252

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.