Commodity supply and demand dynamics play a crucial role in shaping the global economy. Quantifying the relative importance of supply and demand in price movements of commodities is essential for analyzing market trends. As commodities account for two-thirds of the value of Australia’s exports, understanding these dynamics becomes even more critical for the Australian economy.

Commodity prices are influenced by various factors, including supply disruptions, global economic activity, and consumer preferences. By comprehending the dynamics of these factors, market participants can anticipate how changes in commodity prices might impact the Australian economy.

Changes in commodity prices have significant implications for the terms of trade, Australian dollar, national income, and aggregate demand. Hence, staying informed about the dynamics of commodity supply and demand is crucial for investors, traders, and policymakers.

Key Takeaways:

- Quantifying supply and demand is important for understanding commodity price movements.

- Commodities account for two-thirds of Australia’s exports.

- The prices of commodities impact the terms of trade, Australian dollar, national income, and aggregate demand.

- Factors influencing commodity prices include supply disruptions, global economic activity, and consumer preferences.

- Understanding supply and demand dynamics helps participants navigate the complexities of commodity markets.

Why Do Commodity Prices Matter for the Australian Economy?

Commodities play a crucial role in the Australian economy, accounting for two-thirds of the value of the country’s exports. The prices of these commodities have a direct impact on the terms of trade, Australian dollar, national income, and aggregate demand.

Understanding the underlying drivers of commodity price changes, specifically supply and demand, is essential for assessing how long shifts in commodity prices may last and how they can affect the Australian economy.

Changes in commodity prices driven by external demand can result in changes in export volumes, while supply disruptions can lead to temporary price increases.

To illustrate the significance of commodity prices for the Australian economy, let’s take a closer look at some key factors:

Terms of Trade

The terms of trade refer to the ratio of a country’s export prices to its import prices. When commodity prices rise relative to import prices, the terms of trade improve, benefiting the exporting country.

Export Volumes

Commodity prices directly impact the volume of exports. Higher prices can incentivize increased production and exports, leading to economic growth. Conversely, lower prices can result in reduced export volumes, potentially affecting employment and income levels in resource-rich regions.

Australian Dollar

The Australian dollar is strongly influenced by commodity prices. As commodity prices rise, demand for the Australian dollar often increases, leading to currency appreciation. Conversely, a decline in commodity prices can put downward pressure on the Australian dollar.

National Income

Commodity export revenues significantly contribute to Australia’s national income. Changes in commodity prices directly affect the income generated from exports, which, in turn, impacts the overall economic performance of the country.

Aggregate Demand

Commodity prices can have a substantial impact on aggregate demand, influencing consumer spending, business investment, and government fiscal policies. Changes in commodity prices can create either positive or negative wealth effects, influencing consumer confidence and spending behavior.

Overall, fluctuations in commodity prices can have far-reaching effects on the Australian economy, influencing the country’s terms of trade, export volumes, currency value, national income, and aggregate demand.

| Key Factors | Impact on Australian Economy |

|---|---|

| Terms of Trade | Affects export competitiveness and profitability |

| Export Volumes | Influences employment, income, and economic growth |

| Australian Dollar | Affects trade balance and international competitiveness |

| National Income | Contributes significantly to overall economic performance |

| Aggregate Demand | Influences consumer spending, business investment, and government policies |

A Dynamic Factor Model of Commodity Prices

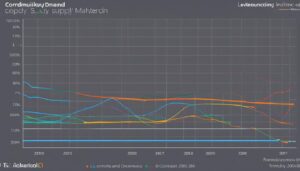

In order to understand the supply and demand dynamics in commodity markets, a dynamic factor model is used to analyze commodity prices. This model decomposes changes in commodity prices into factors that can be interpreted as supply and/or demand developments. These factors capture the common variation between different commodity prices and help to interpret price movements.

By utilizing a dynamic factor model, analysts can gain insights into how changes in supply and demand can impact commodity prices. This provides a framework for understanding the underlying drivers of price fluctuations and forecasting future trends. The dynamic factor model can also be used to analyze various episodes of commodity price movements, allowing for a more nuanced interpretation of market dynamics.

With the ability to break down commodity price changes into their constituent factors, the dynamic factor model offers a powerful tool for market participants and policymakers. It helps to identify patterns, correlations, and trends that may not be immediately apparent from raw price data. By analyzing these factors, it is possible to gain a deeper understanding of the dynamics driving commodity markets and make more informed decisions.

Interpreting Price Movements

The interpretation of price movements using a dynamic factor model involves analyzing the relationship between the identified factors and specific market conditions or events. For example, if an increase in commodity prices is primarily driven by a supply factor, it suggests that there may be a shortage of the commodity in the market. On the other hand, if an increase in prices is primarily driven by a demand factor, it suggests increased consumer demand for the commodity.

Using a dynamic factor model allows us to peel back the layers of complex commodity markets and gain insights into the factors driving price movements. By understanding the relative importance of supply and demand developments, we can make more informed decisions and better navigate the uncertainties of commodity markets.

Enhancing Forecasting and Risk Management

The dynamic factor model can also be used to enhance forecasting and risk management strategies. By identifying the key drivers of commodity price fluctuations, analysts can develop more accurate models for predicting future price movements. This can help market participants, such as traders and investors, make more informed decisions and manage their exposure to price volatility.

Furthermore, the interpretation of factors can provide valuable insights into potential risks and vulnerabilities within commodity markets. For example, if a specific factor is found to have a significant impact on price movements, market participants can monitor and assess the associated risks. This allows for proactive risk management and the development of strategies to mitigate potential adverse effects.

| Advantages of a Dynamic Factor Model in Commodity Price Analysis |

|---|

| Provides insights into the underlying drivers of commodity price changes |

| Helps to identify patterns, correlations, and trends in commodity markets |

| Enhances forecasting accuracy and risk management strategies |

| Facilitates a deeper understanding of market dynamics for informed decision-making |

With the dynamic factor model, market participants and policymakers can gain a more comprehensive understanding of commodity supply and demand dynamics. This knowledge is essential for navigating the complexities of commodity markets, managing risks, and making informed decisions.

The Law of Supply and Demand

The law of supply and demand is a fundamental principle of economics that explains the relationship between price and the quantity of a resource, commodity, or product that is available in the market.

According to this law, as the price of a product increases, the quantity supplied by producers also increases, while the quantity demanded by consumers decreases. Conversely, as the price decreases, the quantity supplied decreases, and the quantity demanded increases.

This relationship between price and quantity is graphically represented by plotting the supply and demand curves on a graph. The supply curve shows the quantity of a product that producers are willing and able to sell at various prices, while the demand curve represents the quantity of the product that consumers are willing and able to buy at different prices.

The point at which the supply and demand curves intersect indicates the equilibrium or market-clearing price, at which the quantity demanded equals the quantity supplied. At this price, there is no shortage or surplus in the market, and the market reaches a state of balance.

For example, let’s consider the market for smartphones. As the price of smartphones increases, suppliers are motivated to produce more smartphones. At the same time, consumers may choose to buy fewer smartphones or seek alternative, cheaper options. This dynamic creates a downward-sloping demand curve and an upward-sloping supply curve.

“The law of supply and demand is the foundation of market economics. It helps explain the forces that drive price movements and the allocation of resources in a market economy.”

The Demand Curve

The demand curve represents the relationship between the price of a product and the quantity that consumers are willing and able to buy. It slopes downward from left to right because as the price decreases, more consumers are willing to purchase the product.

Factors that affect demand and shift the demand curve include changes in consumer income, preferences, population size, and the availability of substitute products.

The Supply Curve

The supply curve represents the relationship between the price of a product and the quantity that suppliers are willing and able to produce. It slopes upward from left to right because as the price increases, suppliers are motivated to produce more of the product.

Factors that affect supply and shift the supply curve include changes in production costs, technology, government regulations, and the availability of inputs or raw materials.

Equilibrium and Market-Clearing Price

The equilibrium price, also known as the market-clearing price, is the price at which the quantity demanded equals the quantity supplied. It is determined by the intersection of the supply and demand curves on the graph.

At prices below the equilibrium, there is excess demand, also known as a shortage, because the quantity demanded exceeds the quantity supplied. This shortage creates upward pressure on prices.

At prices above the equilibrium, there is excess supply, also known as a surplus, because the quantity supplied exceeds the quantity demanded. This surplus creates downward pressure on prices as suppliers compete to sell their excess inventory.

Market forces, such as competition and the pursuit of profit, work to bring the market back to the equilibrium price, where supply and demand are in balance.

| Price | Quantity Demanded | Quantity Supplied |

|---|---|---|

| $10 | 100 | 50 |

| $15 | 80 | 80 |

| $20 | 60 | 110 |

| $25 | 40 | 140 |

This table and graph illustrate the relationship between price, quantity demanded, and quantity supplied for a hypothetical product. At a price of $15, the quantity demanded and supplied are equal, resulting in the equilibrium or market-clearing price.

Understanding the law of supply and demand is crucial for businesses, policymakers, and individuals involved in the commodity markets. It provides insights into price movements, the allocation of resources, and the dynamics of supply and demand in the market.

Speculation and the Impact on Commodity Markets

Speculation plays a significant role in commodity markets, influencing price movements and supply and demand dynamics. When traders buy and sell commodities with the aim of profiting from price fluctuations, it introduces a level of uncertainty and volatility into the market.

One way speculation affects commodity markets is through its impact on supply and demand. For instance, if a speculator purchases a large quantity of a specific commodity, it can create a shortage of supply. As a result, the price of that commodity increases as demand outpaces supply. On the other hand, when speculators offload a significant amount of a commodity, it can lead to an oversupply, causing prices to decrease.

Speculation can create price movements that are not entirely based on the underlying fundamentals of supply and demand. This can sometimes lead to market distortions and make it challenging for market participants to accurately predict and respond to price changes. Additionally, excessive speculation can amplify price volatility, making it difficult for businesses and consumers to plan and budget effectively.

Understanding the impact of speculation on commodity markets is crucial for market participants and policymakers alike. It requires a comprehensive analysis of not only supply and demand dynamics but also the behavior and motivations of speculators in the market. By gaining insights into the role of speculation, stakeholders can make informed decisions and develop strategies to mitigate risks associated with price fluctuations.

“Speculation is a double-edged sword in commodity markets. While it can provide liquidity and opportunities for profit, it can also introduce uncertainty and distortions that may not accurately reflect true market fundamentals.”

To illustrate the impact of speculation on commodity markets, consider the following hypothetical scenario:

| Commodity | Speculator Activity | Supply and Demand Dynamics | Price Movement |

|---|---|---|---|

| Crude Oil | Speculators buy contracts anticipating increasing oil prices | Supply and demand remain relatively stable | Oil prices increase due to increased speculative demand |

| Gold | Speculators sell contracts expecting declining gold prices | Supply and demand remain balanced | Gold prices decline due to increased speculative supply |

| Wheat | Speculators buy contracts based on speculation of poor harvest | Actual harvest yields higher than anticipated | Wheat prices decrease due to oversupply caused by speculative behavior |

This example demonstrates how speculation can influence price movements even when the underlying supply and demand dynamics may not have changed significantly. It highlights the importance of understanding and monitoring speculative activity in commodity markets.

Commodity Prices and Inflation

Commodity prices and inflation are closely intertwined. Fluctuations in commodity prices have a significant impact on production costs, which, in turn, can be passed on to consumers through higher prices. This relationship highlights the importance of understanding the concept of price elasticity, which measures the degree to which changes in price affect the demand and supply of a product.

Commodity prices serve as a leading indicator of inflation due to their significant role as inputs in the production of goods and services. When commodity prices rise, businesses may face higher costs, leading to increased prices for consumers. Conversely, when commodity prices decline, businesses may experience cost savings that could be passed on to consumers through lower prices.

By analyzing the correlation between commodity prices and inflation, economists and policymakers can gain valuable insights into overall economic conditions and make informed decisions. Understanding the dynamics between supply and demand, as well as the key factors influencing commodity prices, is crucial for managing inflationary pressures and ensuring economic stability.

Furthermore, the relationship between commodity prices and inflation can have broader implications for monetary policy, fiscal planning, and consumer behavior. Central banks often monitor commodity prices as part of their inflation targeting frameworks, as changes in these prices can have implications for monetary policy decisions.

Commodity prices and inflation are intertwined, with changes in commodity prices impacting production costs and consumer prices. Understanding the relationship is crucial for assessing economic conditions and making informed decisions.

The Product’s Price Elasticity

The concept of price elasticity is key to understanding how changes in commodity prices affect supply and demand. Products with a high price elasticity are more sensitive to price changes, meaning that small price movements can result in significant shifts in demand and supply. For example, products with readily available substitutes, such as generic brands, tend to have higher price elasticity as consumers can easily switch to alternative options when prices change.

On the other hand, products with low price elasticity are less sensitive to price changes, indicating that demand and supply are relatively stable even with significant price movements. Luxury goods and niche products often exhibit lower price elasticity as consumers are less likely to modify their consumption patterns in response to price fluctuations.

Price elasticity is an important consideration for businesses and policymakers when assessing the impact of commodity prices on inflation. A comprehensive understanding of the price elasticity of different products can inform pricing strategies, supply chain management, and policy interventions aimed at stabilizing inflation rates.

Comparison of Price Elasticity for Different Products

| Product | Price Elasticity |

|---|---|

| Generic Brand | High |

| Luxury Goods | Low |

| Commodities | Varies |

Conclusion

Understanding the dynamics of supply and demand in commodity markets is crucial for investors, traders, and policymakers. The prices of commodities are influenced by various factors, including supply disruptions, demand fluctuations, speculation, and government policies. These factors have a significant impact on the global economy, especially in countries heavily reliant on commodity exports.

By analyzing the supply and demand dynamics, market participants can make informed decisions and navigate the complexities of commodity markets. It is essential to monitor supply disruptions, such as natural disasters or geopolitical events, as they can significantly affect commodity prices. Similarly, changes in global economic activity and consumer preferences can impact demand and subsequently influence prices. Understanding these supply and demand dynamics can help market participants anticipate price movements and manage risk.

Government policies also play a vital role in shaping commodity markets. Subsidies, tariffs, and regulations imposed by governments can impact both supply and demand. For example, government subsidies can incentivize producers to increase their supply, while tariffs can restrict imports and affect demand. Policymakers need to carefully consider the potential consequences of these policies on commodity markets and the overall economy.

In conclusion, a comprehensive understanding of commodity supply and demand dynamics is essential for anyone involved in the commodity markets. By staying informed and analyzing the various factors that influence prices, market participants can navigate the volatility and uncertainty of commodity markets effectively. Furthermore, policymakers must consider the potential impacts of their decisions on commodity markets and ensure they promote stability and growth in the global economy.

FAQ

What is the importance of understanding commodity supply and demand dynamics?

Understanding commodity supply and demand dynamics is crucial for assessing how changes in commodity prices can impact the Australian economy, including exports, business investment, and the exchange rate. Commodity prices account for two-thirds of Australia’s export value and play a significant role in determining the terms of trade, Australian dollar, national income, and aggregate demand.

How do commodity prices affect the Australian economy?

Commodity prices have a direct impact on the Australian economy by influencing the terms of trade, export volumes, national income, and aggregate demand. As commodities account for two-thirds of Australia’s export value, changes in commodity prices can lead to shifts in the country’s economic performance and overall prosperity.

How can a dynamic factor model analyze commodity prices?

A dynamic factor model is used to analyze commodity prices by decomposing changes into factors that represent supply and/or demand developments. These factors capture the common variation between different commodity prices and provide insights into how changes in supply and demand can impact commodity prices.

What is the law of supply and demand?

The law of supply and demand describes how changes in price affect the supply and demand of a resource, commodity, or product. As the price increases, supply rises while demand declines, and vice versa. The intersection of the supply and demand curves represents the equilibrium or market-clearing price.

How does speculation impact commodity markets?

Speculation in commodity markets involves buying and selling commodities with the aim of profiting from price movements. Speculators can impact supply and demand dynamics by causing shortages or oversupply in the market. These actions can introduce volatility and uncertainty into commodity markets.

What is the relationship between commodity prices and inflation?

Changes in commodity prices can impact production costs, which can then be passed on to consumers as higher prices. The degree to which price changes affect demand and supply is known as the product’s price elasticity. Commodity prices can also serve as leading indicators of inflation, as they are crucial inputs in the production of goods and services.

How can understanding supply and demand dynamics in commodity markets benefit investors, traders, and policymakers?

Understanding supply and demand dynamics in commodity markets is essential for making informed decisions. Commodity prices are influenced by various factors such as supply disruptions, demand fluctuations, speculation, and government policies. By analyzing these dynamics, market participants can navigate the complexities of commodity markets and policymakers can shape effective strategies.

Source Links

- https://www.investopedia.com/terms/l/law-of-supply-demand.asp

- https://medium.com/@tickerofficial/understanding-the-supply-and-demand-drivers-in-commodities-markets-86516976e0e

- https://www.rba.gov.au/publications/bulletin/2019/jun/exploring-the-supply-and-demand-drivers-of-commodity-prices.html

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.