Looking ahead to 2023 – 2024, investors are keen to predict the future of precious metals such as gold. After a volatile 2022 with plenty of uncertainty surrounding the direction of gold prices, the forecast for gold prices in 2023 – 2024 remains uncertain.

The year 2022 may have started with a glimmer of hope for economic recovery, but the relaxation of pandemic restrictions worldwide has led to the inevitable consequences of supporting the global economy during the pandemic. As predicted, rising inflation has caused a significant surge in prices, putting a considerable strain on the finances of many individuals.

Once, it was hard to believe that Russia would invade Ukraine, but now an energy crisis has been added to the mix. To address inflation, interest rates have been raised aggressively, though some feel it may be too little, too late.

Is there a possibility for the Gold price to skyrocket to $3,000 or even $4,000 per ounce in 2023?

According to Ole Hansen, a well-regarded commodity strategist at Saxo Bank in Denmark, there is a chance that the markets will eventually realize that global inflation will continue to remain high despite monetary tightening. “As I have previously mentioned, it is my belief that gold has the potential to reach a peak of $4,000”.

Investors should keep a watch on several events that might cause the price of gold to increase. Observe the following significant examples:

1. An increase in the “war economy mentality” may deter central banks from maintaining foreign exchange reserves with the goal of self-sufficiency, which would be beneficial for gold.

2. Government expenditure on deficits is anticipated to rise as a result of the commitment to ambitious initiatives like energy transformation.

3. If there is a worldwide recession in 2023, central banks could release money.

4. The U.S. dollar’s strength.

5. Tensions in Geopolitics.

The U.S. dollar’s strength –

The value of gold and other global currencies has been impacted by the dollar’s remarkable rise in 2022. Given that the dollar index, which measures the value of the dollar to other significant foreign currencies, has risen to a 20-year high, the dollar is a pretty secure choice for investors wanting to protect their money.

Despite high inflation, the US economy has remained strong this year, resulting in low unemployment rates. As a result, the Federal Reserve has been able to aggressively increase interest rates, which currently sit at 5.25%.

The value of the dollar has a direct impact on gold’s price. The current strength of the dollar has led to a drop in gold prices. The dollar is anticipated to stay strong, maintaining low gold prices through 2023–2024 if the Federal Reserve keeps up its aggressive rate rises and the US economy avoids a recession. High-interest rates, however, have the potential to stifle expansion and trigger a recession, even in a robust economy like the U.S. Should this take place, it may result in a decline in the value of the dollar, which would eventually drive up the price of gold.

Foreign investors need to be aware that the price of gold may fluctuate due to changes in currency rates. Depending on how strong or weak the dollar is in contrast to other currencies, the price of gold on the domestic market may increase or decrease.

Inflation and Interest Rates –

The value of the dollar is closely tied to inflation and interest rates. Unfortunately, many countries experienced high inflation in 2022, prompting central banks like the Fed, ECB, and BoE to raise interest rates. However, this has had limited success so far. As long as inflation remains high, interest rates will continue to rise. This is typically bad news for gold, which is a non-yielding asset. That said, gold is traditionally seen as a good hedge against inflation, so high inflation is generally viewed as a positive for gold.

Currently, inflation and interest rates are working against gold prices. While inflation is driving prices up, interest rates are pushing them down. The future price of gold in 2023-2024 will depend on what central banks do next. If they continue to raise interest rates and inflation drops, the price of gold may decrease further. However, if inflation persists, it could offset the negative impact of high-interest rates.

Central Banks on a gold buying spree –

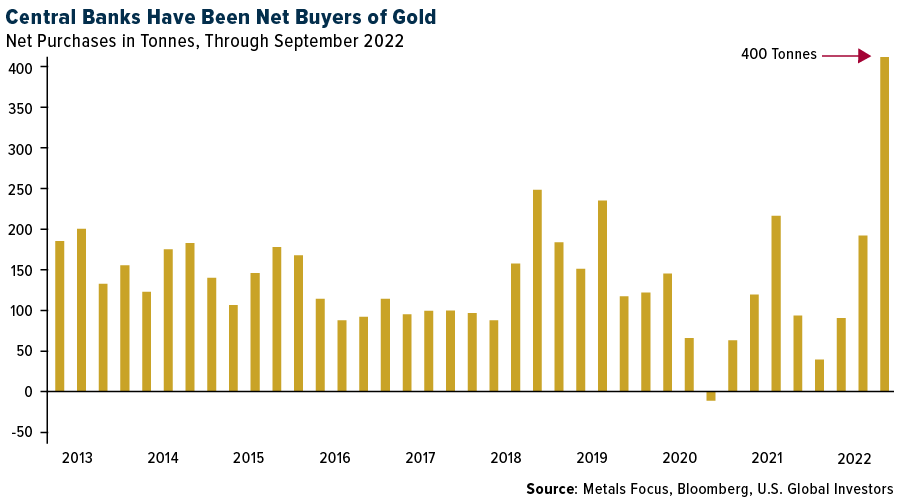

It’s noteworthy that central banks have been increasingly interested in gold as a reserve asset, as pointed out by Hansen. Despite their focus on fiat currency, central bankers and finance ministers have been quietly purchasing the precious metal at an unprecedented rate. Official net gold purchases in the third quarter totaled around $20 billion, or approximately 400 tons, marking the highest level seen in more than 50 years. According to UBS estimates, central banks are projected to purchase 700 metric tons of gold this year based on the first-quarter figures. This number is lower than that of the previous year but still exceeds the average of 500 metric tons observed since 2010.

According to UBS, the demand for gold among global central banks is expected to remain robust, even after a record-breaking year of purchases. In 2022, central banks bought 1,078 metric tons of gold, which is the highest annual demand for the precious metal since records began in 1950. This amount is more than double the 450 metric tons acquired in 2021. UBS strategists noted that, based on Q1 figures, central banks are on track to buy 700 metric tons of gold this year, which is slightly lower than in 2022 but still higher than the average of 500 metric tons since 2010.

It was revealed that Turkey emerged as the largest gold purchaser during the third quarter, followed by Uzbekistan and India. In the meantime, China’s central bank has announced its first gold purchase since 2019. The country disclosed that it had recently added 32 tons, worth $1.8 billion, to its reserves, bringing the total to 1,980 tons. Although China is the sixth-largest holder of gold globally, excluding the International Monetary Fund (IMF), it still has a long way to go in diversifying away from the U.S. dollar. According to the World Gold Council (WGC), gold only represents 3.2% of China’s total reserves. In comparison, the U.S., the world’s largest holder with over 8,133 tons, has 65.9% of its reserves in the precious metal.

Over-tightening risk and recession watch –

It seems likely that a small to moderate recession will occur this year due to the persistence of inflation. There is a concern that the Federal Reserve may tighten monetary policy too much, which would have significant effects on gold from a macroeconomic standpoint.

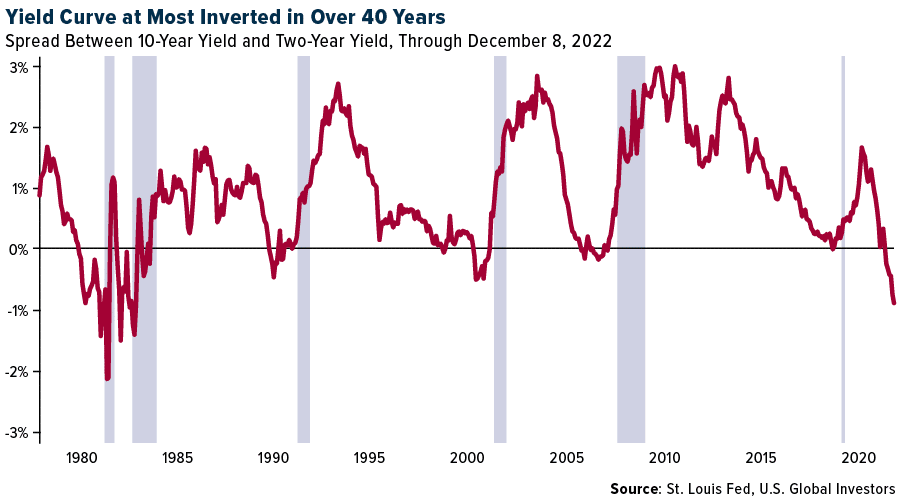

One of the indicators you should monitor is the difference between the 10-year and 2-year Treasury yields. For at least the past 40 years, every recession has been preceded by an inversion of the yield curve. Currently, the yield curve is more inverted than it has been in over four decades, strongly suggesting that a recession is practically inevitable. The only question is when it will occur.

Many banks and ratings agencies have reduced their global growth projections for 2023-2024 due to expectations of ongoing high consumer prices and swift monetary tightening. Investing in gold now may prove to be a wise decision. According to the WGC, gold has provided investors with some protection, delivering positive returns in five out of the last seven recessions.

De-Dollarization –

Recent reports show a surge in demand for gold, with central banks accounting for a record 33% of monthly global demand. This trend is seen as a sign of de-dollarization, with countries such as China, Russia, and India seeking to displace the US dollar’s dominance in global finance and circumvent Western currency sanctions. Nine of the top 10 central banks buying gold are in developing countries. These countries, along with Brazil and South Africa, are also working to create a new currency that is separate from the dollar.

According to UBS, this sustained high demand from central banks is one of the reasons gold is expected to climb to $2,100 per ounce by year-end and $2,200 by March 2024. Gold is now viewed as a Safe-Haven asset, even more so than the US dollar. During the short banking crisis in March, gold continued to rise while the dollar drifted down. This trend is attributed to the increasing use of financial sanctions by the US and its allies, which have affected up to 30% of nations worldwide.

Tensions in Geopolitics –

In 2022, the world was rocked by a Major geopolitical event when Russia invaded Ukraine. The resulting sanctions have strained the global economy, leading to soaring gas prices and a Difficult winter ahead for Europe, potentially damaging industrial output in countries like Germany.

The conflict has been ongoing for Eighteen months with no end in sight. There are concerns that any further escalation could lead to a more serious war beyond economic sanctions. The invasion has also impacted the price of gold, which saw a significant increase in 2022 and will continue to be affected in 2023.

China is another Major geopolitical concern the world is watching closely. The invasion of Ukraine has prompted comparisons with the situation in Taiwan. With tensions escalating, there are fears of military action from China; and the response of other countries like the US. Investors will be closely monitoring these situations and their potential impact on the gold price in 2023.

Gold Long (Buy)

Enter At: 2084.22

T.P_1: 2495.41

T.P_2: 2643.09

T.P_3: 2761.13

T.P_4: 3000.00

T.P_5: 3213.32

T.P_6: 3360.11

T.P_7: 3496.68

T.P_8: 3687.57

T.P_9: 3851.30

T.P_10: 4000.00

S.L: 1611.33

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.