I am excited to delve into the topic of the global economy’s resilience in the face of financial crises. It is fascinating to witness how the economy can adapt and recover despite the challenges it faces. Throughout this article, we will explore the impacts of financial crises on the global economy and how they shape international markets and fiscal stability.

Key Takeaways:

- Financial crises have a significant impact on the global economy.

- The global economy has shown resilience in recovering from financial crises.

- Financial crises can ripple through international markets and affect global trade.

- Fiscal stability and effective government policies are crucial in mitigating the impacts of financial crises.

- Recovering from a financial crisis requires long-term planning and structural reforms.

Understanding Financial Crises and Their Causes

Financial crises are characterized by severe disruptions in the financial system, resulting in economic instability. These crises can have far-reaching impacts on economies worldwide, leading to recessions, bankruptcies, and widespread financial distress. To effectively address and mitigate the effects of financial crises, it is essential to understand their causes and underlying factors.

Causes of Financial Crises

Financial crises can stem from various factors, each contributing to the overall instability of the economy. Some common causes include:

- Banking failures: When banks experience insolvency or encounter liquidity problems, it can trigger a chain reaction that affects the entire financial system.

- Excessive debt: High levels of debt, whether it be on an individual, corporate, or national level, can lead to financial vulnerabilities and instability.

- Stock market crashes: Sharp declines in stock prices can erode investor confidence, leading to panic selling and market instability.

- Speculative bubbles: When asset prices become disconnected from their intrinsic values, speculative bubbles form. When these bubbles burst, it can cause significant disruptions to the financial system.

- Government policy failures: Inadequate regulations, poor oversight, and ineffective policy responses can amplify the impact of financial crises.

Understanding these causes helps economists, policymakers, and financial institutions identify warning signs and implement preventive measures to mitigate the risk of future financial crises.

“The causes of financial crises are often complex and interconnected. Identifying and addressing these causes requires a comprehensive understanding of the financial system and its vulnerabilities.” – Economist, Financial Institute

The Impact of Financial Crises on Economic Stability

Financial crises have significant implications for economic stability. When a crisis occurs, it can lead to:

- Recession: Financial crises often coincide with a contraction in economic activity, leading to a recession. This is characterized by a decline in GDP, rising unemployment rates, and stagnant wages.

- Asset devaluation: During a financial crisis, the value of assets such as real estate, stocks, and bonds can plummet, eroding the wealth and financial security of individuals and institutions.

- Banking sector instability: Financial crises can severely impact banks, resulting in bank failures, liquidity shortages, and a loss of trust in the banking system.

- Economic inequality: Financial crises can exacerbate income inequality as the most vulnerable individuals and households bear the brunt of the crisis, while the wealthiest may have the resources to weather the storm.

These destabilizing effects highlight the importance of implementing effective risk management strategies and policies that promote financial stability.

By understanding the causes of financial crises, policymakers, financial institutions, and individuals can take proactive measures to prevent and mitigate their impacts on the global economy. Regulatory reforms, risk assessment, and improved financial education are crucial in building a more resilient and stable financial system.

The Ripple Effect on International Markets

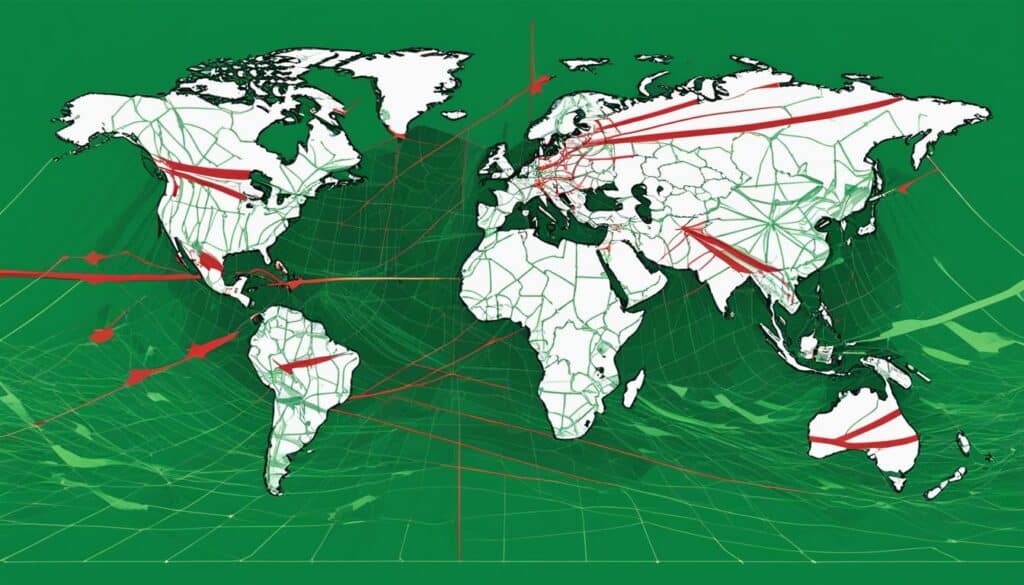

Financial crises have a significant impact on international markets, causing a ripple effect that spreads across economies. When a single country experiences a crisis, it can quickly contagion to other nations, creating a domino effect of financial instability and uncertainty.

The consequences of this contagion effect are felt in various aspects of international markets. Firstly, global trade is heavily affected as the crisis disrupts supply chains, causes a decrease in demand, and hinders cross-border transactions. Companies that rely on international trade may face challenges in sourcing raw materials, exporting goods, and accessing foreign markets.

Furthermore, investor confidence is shaken during such crises, leading to increased volatility in stock markets and investments. The uncertainty surrounding the affected country’s economy can cause investors to withdraw or reallocate their funds, exacerbating the crisis and potentially impacting other markets as well.

The exchange rates between currencies also experience fluctuations due to the contagion effect. As investors seek safer havens for their investments, currencies may appreciate or depreciate rapidly, affecting international trade and further contributing to market instability.

“The ripple effect of financial crises on international markets is a stark reminder of the interconnectedness of the global economy. A crisis in one part of the world can reverberate across continents, highlighting the importance of strong financial systems and robust risk management.”

The impact of this contagion effect can be seen in historical financial crises. For example, the 2008 global financial crisis, which originated in the United States, quickly spread to other countries, causing a deep recession and affecting international markets for years. Similarly, the Asian financial crisis of 1997 had far-reaching consequences on economies beyond Asia, demonstrating the interconnected nature of the global financial system.

To illustrate the contagion effect further, consider the following table:

| Country | Initial Crisis | Contagion |

|---|---|---|

| United States | Subprime mortgage crisis | Global financial crisis |

| Thailand | Weak financial institutions | Asian financial crisis |

| Argentina | Debt default | Contagion to other emerging markets |

This table demonstrates how financial crises in one country can lead to contagion and impact other economies, ultimately affecting international markets. It underscores the importance of monitoring and addressing vulnerabilities within the global financial system to minimize the likelihood and severity of future contagion events.

By understanding the ripple effect that financial crises have on international markets, policymakers and businesses can better prepare for potential challenges, establish risk management frameworks, and foster stronger international cooperation to mitigate the impacts of contagion.

Fiscal Stability and Government Policies

Financial crises serve as a stark reminder of the critical role fiscal stability and effective government policies play in safeguarding the economy. During times of crisis, governments must take swift and decisive action to restore confidence, mitigate risks, and prevent future crises. This section explores the key aspects of fiscal stability and government policies in promoting economic resilience and stability.

The Importance of Financial Regulation

Financial regulation is a crucial component of maintaining fiscal stability. By implementing and enforcing robust regulatory frameworks, governments can mitigate the risks associated with a volatile financial system. Regulations such as capital requirements, risk assessment mechanisms, and transparency measures help prevent reckless behavior and promote a sound and stable financial environment.

Monetary Policy and Its Impact

Monetary policy, implemented by central banks, plays a pivotal role in stabilizing the economy during and after a financial crisis. Through tools such as interest rate adjustments, open market operations, and reserve requirements, central banks can influence borrowing costs, control inflation, and stimulate economic growth. A well-executed monetary policy can instill confidence, encourage investment, and facilitate recovery.

Fiscal Stimulus and Government Intervention

During financial crises, governments often employ fiscal stimulus measures to support economic recovery. This can involve increased government spending, tax cuts, or targeted subsidies to boost aggregate demand and stimulate economic activity. By taking an active role in the economy, governments can mitigate the negative impacts of a crisis and spur growth in key sectors.

“Fiscal stability is the backbone of a resilient economy. It fuels investor confidence, ensures sustainable growth, and provides a solid foundation for prosperity.” – [Insert Expert Name]

Preventing Future Crises through Regulation

Effective regulation serves as a proactive measure to prevent future financial crises. Governments continuously assess and enhance regulations to address emerging risks and vulnerabilities within the financial system. By monitoring and regulating areas such as banking practices, corporate governance, and financial products, regulators can minimize the likelihood of another crisis and protect the overall stability of the economy.

Fostering Collaboration and International Cooperation

As financial crises can have international implications, fostering collaboration and international cooperation is crucial. Governments need to work together to develop globally harmonized regulatory standards, share information on systemic risks, and coordinate crisis response measures. By aligning their efforts, countries can enhance the resilience of the global financial system and minimize the spillover effects of a crisis.

As the next section explores, the effectiveness of fiscal stability measures and government policies becomes particularly evident in the context of economic recovery and long-term impacts.

Economic Recovery and Long-Term Impacts

Recovering from a financial crisis takes time and effort. It is not a quick fix but a journey towards stability and growth. The long-term impacts of a crisis can be significant, shaping the trajectory of an economy for years to come. To ensure sustainable economic growth, countries must go beyond initial recovery efforts and focus on implementing crucial measures.

Structural reforms play a vital role in rebuilding and strengthening the economy after a crisis. These reforms address underlying issues that led to the crisis and promote stability and resilience. By restructuring financial systems, improving regulatory frameworks, and enhancing transparency, countries can create a more robust foundation for future growth.

Investment in infrastructure is another key factor in the long-term recovery and growth of an economy. Building and upgrading infrastructure not only create jobs but also enhance productivity, attract investments, and improve the overall business environment. It is a catalyst for economic development and facilitates trade, innovation, and connectivity.

Diversification of industries is essential to reduce dependence on a single sector and enhance economic resilience. By promoting a diversified economy, countries can mitigate the risks associated with fluctuations in global markets. This diversification can be achieved through encouraging innovation, supporting entrepreneurship, and investing in emerging sectors.

Managing the recovery process effectively is crucial for achieving sustained economic growth. It requires coordinated efforts from governments, businesses, and the society as a whole. Collaboration and cooperation among stakeholders are key to navigating the challenges and seizing the opportunities that arise during the recovery phase.

“Recovery is not just about bouncing back; it’s about building a stronger and more inclusive economy.”

By focusing on long-term strategies, countries can not only recover from a financial crisis but also emerge stronger and more resilient. The measures taken during the recovery period set the stage for sustainable economic growth and a brighter future.

The Path to Economic Growth

Recovering from a financial crisis is a complex process that requires careful planning and execution. The path to economic growth entails:

- Implementing structural reforms to address underlying issues and improve stability.

- Investing in infrastructure to create a solid foundation for future development.

- Promoting diversification of industries to reduce reliance on a single sector.

- Facilitating collaboration and cooperation among stakeholders for effective recovery management.

These steps, when taken with foresight and determination, can pave the way for sustained economic growth and prosperity.

Lessons Learned and Future Preparedness

Financial crises have taught us valuable lessons in risk management, future preparedness, and the need for prudent financial practices. By learning from past events, we can equip policymakers, businesses, and individuals with the knowledge and tools necessary to navigate similar challenges effectively.

“In the wake of a financial crisis, it becomes clear that failing to assess and manage risks can have far-reaching consequences. It is crucial for all stakeholders to recognize the importance of proactively identifying and mitigating risks.”

One of the key lessons learned is the significance of risk management. This involves identifying potential risks, assessing their impact, and implementing strategies to mitigate them. By understanding the vulnerabilities within the financial system, we can develop comprehensive risk management frameworks that promote stability and resilience.

Diversification of investments is another critical lesson. The interconnected nature of global markets means that a crisis in one sector or region can have cascading effects. By diversifying investments across different asset classes and geographic regions, individuals and businesses can minimize their exposure to specific risks and enhance their ability to withstand turbulence.

The importance of prudent financial practices cannot be overstated. Sound financial planning, responsible borrowing, and adequate savings are essential for weathering financial crises. Individuals and businesses alike must prioritize building resilient financial foundations that can withstand unexpected shocks.

Looking ahead, future preparedness plays a crucial role in minimizing the impacts of financial crises. By incorporating the lessons learned from past events into policies and practices, we can enhance our ability to prevent and mitigate future crises. This requires a proactive approach that includes robust regulatory frameworks, comprehensive stress testing, and effective early warning systems.

“By applying lessons learned from previous financial crises, we can develop resilience and fortify our economies, ensuring a more stable and prosperous future for all.”

To summarize, financial crises have provided invaluable insights into risk management, future preparedness, and the importance of prudent financial practices. As we continue to navigate a complex and interconnected global economy, it is imperative that we apply these lessons to build resilience, foster sustainable growth, and minimize the impacts of similar events in the future.

| Lesson | Description |

|---|---|

| Risk Management | Identifying and mitigating potential risks within the financial system. |

| Diversification of Investments | Spreading investments across different sectors and regions to minimize exposure to specific risks. |

| Prudent Financial Practices | Promoting responsible borrowing, sound financial planning, and adequate savings. |

| Future Preparedness | Incorporating lessons learned into policies and practices to prevent and mitigate future crises. |

Regional Perspectives on Financial Crises

Financial crises have a profound impact on the global economy, but their effects can vary significantly across different regions of the world. Regional perspectives provide valuable insights into the diverse ways in which financial crises affect economies and shape their response strategies.

Regional Economies: Vulnerabilities and Resilience

Developing economies often exhibit higher vulnerability to external shocks due to factors such as weaker financial systems, limited access to capital, and higher dependence on global trade. When a financial crisis hits, these economies may experience more severe disruptions in their regional economies and struggle to recover.

On the other hand, advanced economies with stronger financial systems and more diversified regional economies are often better equipped to weather financial storms. Measures such as robust regulatory frameworks, effective risk management systems, and diversified industries can contribute to their resilience and ability to recover more swiftly from financial crises.

“While developing economies may be more susceptible to the initial shockwaves of a financial crisis, their resilience and potential for growth should not be underestimated. By implementing sound policies and leveraging regional strengths, these economies can overcome adversity and emerge stronger.”

Crisis Response: Government Policies and Regional Cooperation

Regional perspectives shed light on the importance of government policies and regional cooperation in responding to financial crises. Governments play a significant role in stabilizing regional economies through fiscal stimulus, monetary policy adjustments, and regulatory interventions.

Regional cooperation among countries can also contribute to crisis response efforts and mitigate the adverse effects of financial turmoil. Collaborative initiatives such as coordinated monetary policies, regional financial safety nets, and knowledge-sharing platforms can enhance the collective resilience of regional economies.

“In the face of financial crises, cohesive regional strategies and collaborative approaches can amplify crisis response measures and facilitate faster recovery. By working together, regions can minimize the negative impacts of financial crises and create a more stable economic environment.”

Unlocking Opportunities: Regional Integration and Market Potential

Financial crises can create opportunities for regional economies to unlock their market potential and foster deeper regional integration. In times of crisis, regional cooperation and integration can help diversify trade opportunities, strengthen supply chains, and reduce reliance on external markets.

Exploring niche regional industries, developing regional value chains, and leveraging regional strengths can enable economies to tap into new growth drivers and enhance their long-term economic prospects.

“Regional economies can turn financial crises into catalysts for market-driven structural transformations. By harnessing their collective potential and focusing on regional integration, economies can build more resilient and globally competitive industries.”

| Region | Impact of Financial Crisis | Response Strategies |

|---|---|---|

| Asia-Pacific | High initial disruptions followed by robust recovery | Strengthening financial regulation, diversifying export markets, promoting regional cooperation |

| Europe | Varying impacts across countries, regional integration challenges | Enhancing fiscal coordination, strengthening banking systems, promoting intra-regional trade |

| Africa | Weak financial systems, significant impact on vulnerable sectors | Developing resilient financial markets, promoting investment in infrastructure, enhancing regional trade |

| Americas | Varied impact based on regional economic integration and policy responses | Strengthening financial oversight, diversifying economies, enhancing regional cooperation |

Conclusion

Financial crises have a profound impact on the global economy, creating ripple effects that are felt far and wide. These crises disrupt international markets, challenge fiscal stability, impede economic growth, and require government policies to adapt. However, the global economy has proven its resilience time and time again, bouncing back from these challenges and finding ways to recover and thrive.

Learning from past crises is key to mitigating the impacts of future financial turmoil. By analyzing the causes and consequences of these crises, countries and businesses can implement effective measures to prevent and minimize future disruptions. This could include better risk management, strengthening financial regulations, diversifying investments, and fostering a culture of prudent financial practices.

Despite the severity of financial crises, they also serve as catalysts for change and innovation. The lessons learned from these tumultuous times can shape the way we approach economic policies, investments, and risk management strategies in the future. By leveraging these lessons, we can build a more resilient global economy that is better equipped to withstand and recover from financial crises.

In conclusion, financial crises have a significant impact on the global economy, but they are not insurmountable. The resilience demonstrated by the global economy, combined with effective measures and the lessons learned from past crises, can help us navigate and mitigate the impacts of future financial turmoil. With strategic planning, risk management, and a commitment to sustainable economic growth, we can build a stronger, more resilient global economy that withstands the challenges and fosters prosperity for all.

FAQ

What is a financial crisis?

A financial crisis is characterized by severe disruptions in the financial system, leading to economic instability. It can be triggered by factors such as banking failures, stock market crashes, or excessive debt.

How do financial crises impact international markets?

Financial crises have a ripple effect on international markets. When one country experiences a crisis, it can quickly spread to other economies through contagion. This contagion effect can impact global trade, investor confidence, and exchange rates, leading to volatility and uncertainty in international markets.

What role do governments play in mitigating the impacts of financial crises?

Governments play a crucial role in stabilizing the economy during a financial crisis. They implement measures such as financial regulation, monetary policy, and fiscal stimulus to restore confidence, mitigate risks, and prevent future crises.

How long does it take to recover from a financial crisis?

Recovering from a financial crisis takes time, and the long-term impacts can be significant. While initial recovery efforts focus on stabilizing the economy, sustained economic growth requires structural reforms, infrastructure investment, and industry diversification.

What can be learned from past financial crises?

Past financial crises provide valuable lessons for policymakers, businesses, and individuals. They highlight the importance of risk management, diversification of investments, and prudent financial practices. Learning from these events can help in future preparedness and minimizing the impacts of similar events.

Do financial crises affect all regions of the world equally?

Financial crises can have varying impacts on different regions of the world. Developing economies may be more vulnerable to external shocks, while advanced economies may have better mechanisms in place to respond to crises. Examining regional perspectives provides insight into the diverse ways in which financial crises affect economies.

What are the profound impacts of financial crises on the global economy?

Financial crises have profound impacts on the global economy, affecting international markets, fiscal stability, economic growth, and government policies. However, the resilience of the global economy has demonstrated its ability to recover and adapt.

Source Links

- https://www.arabnews.com/node/2440041

- https://economictimes.com/news/international/world-news/global-economy-poised-for-a-soft-landing-imf/articleshow/106738051.cms

- https://www.bnnbloomberg.ca/nyc-s-back-to-back-train-derailments-threaten-subway-s-comeback-1.2020845

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.