The euro is being abandoned by traders at a rapid pace due to concerns that the European Central Bank (ECB) will struggle to tighten monetary policy further, despite inflation running far above target. Although data this week showed that consumer-price growth had re-accelerated in Spain and France in August, the market believes that the ECB’s cycle of interest-rate hikes is as good as over. After a string of poor economic figures and comments from ECB member Isabel Schnabel on the dire outlook, there are now doubts about whether there will be a pause at the next meeting.

Many bulls are worried that Europe is facing stagflation, which is a combination of weak economic activity and high inflation, and as a result, they are capitulating, dragging the euro lower. The euro fell as much as 0.4% to $1.0885 on Thursday, taking losses from a peak in July to more than 3%.

Analysts have cut their median forecast for the currency for the first time in six months. Firms such as Bank of America Corp. and JPMorgan Chase & Co. see it falling towards $1.05, a level last seen during the banking crisis in March. BNP Paribas Asset Management says it could reach $1.02.

“The economy is weakening, but core inflation remains stuck. If the weakness we have seen so far is not enough to bring inflation down, the economy needs to weaken even more,” said Athanasios Vamvakidis, head of G-10 FX strategy at Bank of America. “That’s the main concern for the euro.”

Back in January, when inflation had just peaked at double digits and the ECB hiking cycle was in full swing, several analysts were bullish. Both leveraged funds and institutional investors have held a net long position on the euro for nearly a year, helping the currency steadily recover from a two-decade low reached in late 2022.

The economic outlook for Europe is uncertain at the moment.

Although consumer-price growth has decreased significantly, it is expected that inflation is still higher than desired. Moreover, the recent weak PMI data suggests that the impact of rate increases is starting to show.

According to Jane Foley, head of currency strategy at Rabobank, the market should question if it remains too long for the euro under these circumstances.

As per money markets, policymakers will conclude the tightening cycle with a final quarter-point hike to 4% later this year but will opt for a pause in September.

Analysts have adjusted their expectations as well. The median forecast in a Bloomberg survey has now dipped to $1.10 by the end of the year, from $1.12 last week.

On the technical side, momentum indicators have weakened, with a break of the euro-dollar 200-day moving average clearing the way for more losses. Options markets indicate that traders are becoming bearish, with the premium-to-own downside exposure widening lately.

The euro area is also under pressure due to a growing economic crisis in China, which is a bigger trading partner for the bloc than the US. This could impact exports from Germany and other countries in the region.

Nomura’s currency strategist Jordan Rochester wrote in a note that the market narrative has shifted from a ‘soft landing’ US disinflation theme to the risk of a slowdown in China and Europe developing as the new narrative.

Even HSBC Holdings Plc’s Dominic Bunning, who has one of the highest forecasts for the euro by the end of the year at $1.15, said it is becoming “harder and harder” to stay bullish as the data downturn in recent weeks signals a “cyclical challenge.”

Given the divergence in the economic outlook for Europe and the US, Peter Vassallo, a portfolio manager at BNP Paribas Asset Management, said the euro should be trading close to $1.02 — not far off the lowest level against the dollar in two decades reached last year.

“I’m surprised the selloff in recent weeks has not been more dramatic,” he said. “When we talk about the resilience of global growth and the resilience of the world economy, really what it is is US resilience.”

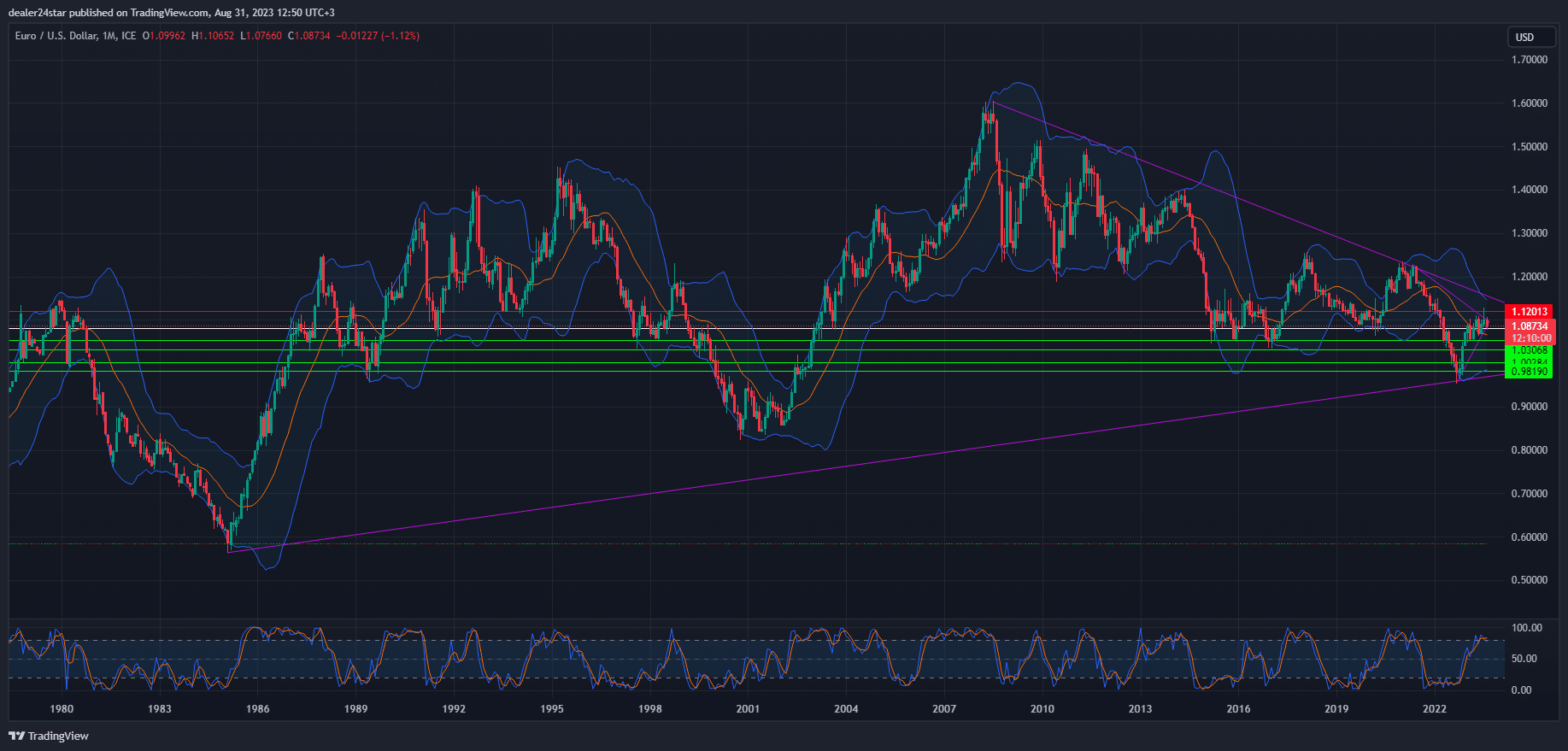

EUR/USD Short (Sell)

Enter at: 1.08072

T.P_1: 1.05365

T.P_2: 1.03068

T.P_3: 1.00284

T.P_4: 0.98190

S.L: 1.12013

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.