The foreign currency issuer default rating of the United States was downgraded from AAA to AA+ by Fitch Ratings on Tuesday.

Although the new rating is still considered investment grade, the downgrade was due to anticipated fiscal decline within the next three years, a decrease in governance, and an increase in overall debt.

Fitch expressed concern over repeated political disputes over the debt limit and last-minute solutions which have eroded confidence in fiscal management. This decision highlights the potential consequences of political polarization and Washington standoffs on the U.S. taxpayers as a lower credit rating could lead to higher borrowing costs for the government.

This is only the second time in history that the nation’s credit rating has been lowered, with the first being in 2011 when Standard & Poor’s removed the U.S. from its AAA rating after a prolonged argument over the government’s borrowing limit.

In 2012, the Government Accountability Office estimated that the 2011 budget standoff had increased Treasury’s borrowing costs by $1.3 billion.

Despite the large size of the United States economy and the stability of the federal government, its borrowing costs have remained low. During times of economic turbulence, global investors often turn to U.S. Treasury securities, which results in a decrease in interest rates paid by the government.

In May, the AAA rating of the nation was put on negative watch by the agency due to the debt ceiling dispute. At the time, lawmakers in Washington were in disagreement over an agreement to prevent the federal government from running out of money. The debt ceiling bill was signed by President Joe Biden on June 2, just before the “X-date” on June 5.

The debt limit disagreement was mentioned again in the recent downgrade by Fitch.

Fitch also pointed out the increasing general government deficit, which is expected to increase to 6.3% of the gross domestic product in 2023 from 3.7% in 2022. Fitch stated that “cuts to non-defense discretionary spending (15% of total federal spending) as agreed in the Fiscal Responsibility Act offer only a modest improvement to the medium-term fiscal outlook.”

According to a person familiar with the discussions between the administration and the rating agency, Fitch informed Biden administration officials that the Jan. 6, 2021 insurrection was a factor in its decision to downgrade due to the instability it indicated in the government. The person stated that Fitch produced a report last year showing that government stability declined from 2018 to 2021 but increased since Biden became president.

Fitch’s decision was also influenced by its expectation that the U.S. economy will experience a “mild recession” in the final three months of this year and early next year. While economists at the Federal Reserve made a similar prediction in the spring, they reversed it in July and stated that growth would slow down but that a recession would most likely be avoided.

The White House disagreed with Fitch’s downgrade, with press secretary Karine Jean-Pierre stating that “it defies reality to downgrade the United States at a moment when President Biden has delivered the strongest recovery of any major economy in the world.”

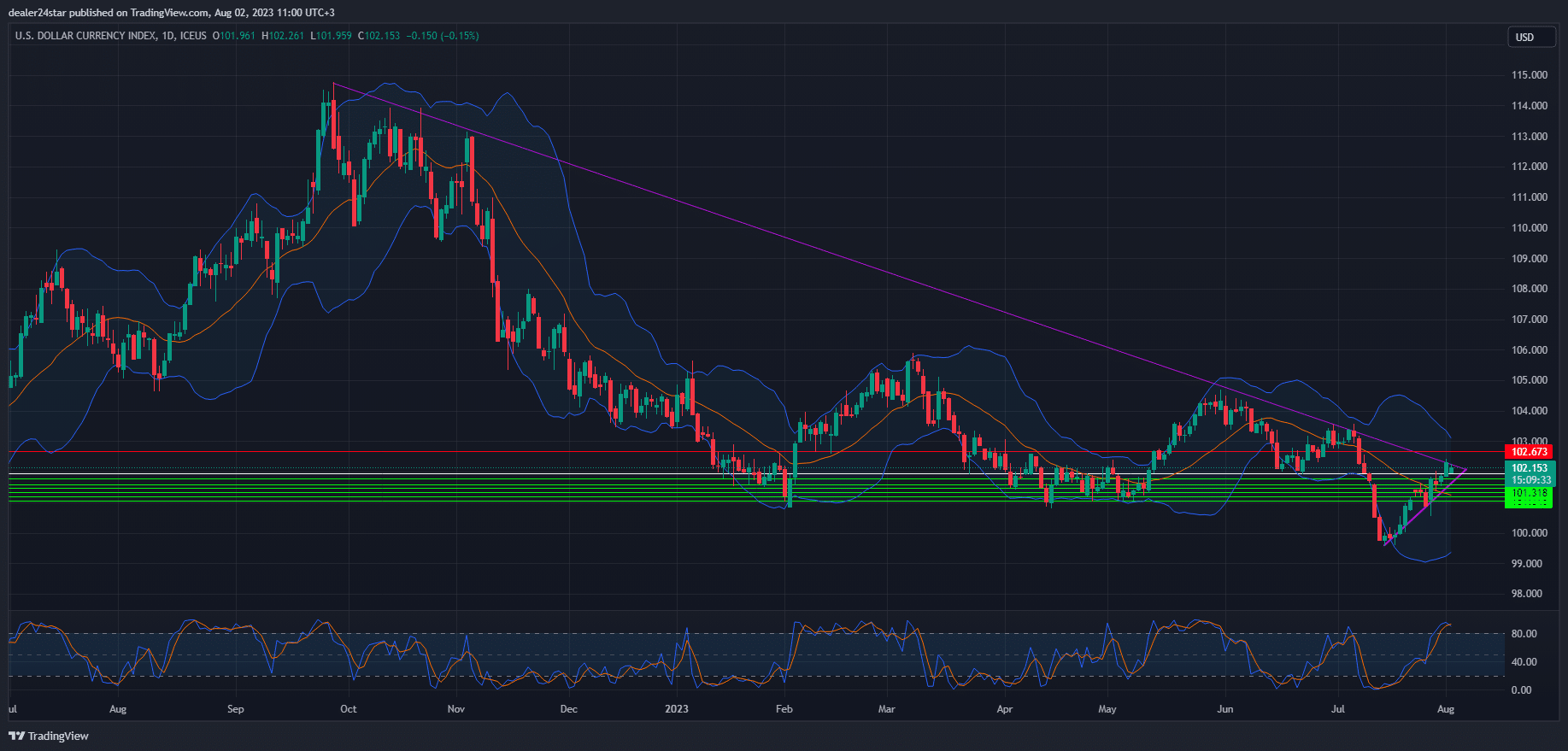

DXY Short (Sell)

Enter At: 101.946

T.P_1: 101.782

T.P_2: 101.591

T.P_3: 101.463

T.P_4: 101.318

T.P_5: 101.190

T.P_6: 101.045

S.L: 102.673

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.