JPMorgan has increased its forecast for corporate high-yield defaults in emerging markets worldwide due to concerns about the potential impact of a default by Country Garden on China’s property sector.

In a note dated August 15th, the US-based investment bank raised its 2023 global forecast from 6% to 9.7%. It also increased its forecast for Asia’s high-yield default rate from 4.1% to 10%. However, if China’s property sector is excluded, that figure drops to just 1%.

JPMorgan predicts that China’s property sector will account for almost 40% of all default volumes in 2023.

These changes come amid fears of contagion in the Chinese economy, which could experience a collapse in the property sector following a request by Country Garden, China’s largest private real estate developer, to delay payment on the private bond.

The largest private real estate developer in China has decided to postpone the payment of the private bond. This move has raised concerns about the potential ripple effect of a default by Country Garden on the Chinese property sector and the wider economy. The fact that JPMorgan’s risk assessment has been significantly increased highlights these worries. Country Garden has a much larger and more diverse range of developments compared to the China Evergrande Group.

The Chinese property sector has been facing challenges since 2020 due to a crackdown by Beijing on the debt levels of mainland property developers. Country Garden, a major player in the industry, defaulted in 2021 and announced an offshore debt restructuring program in March.

The crackdown measures, known as China’s “three red lines” policy, require developers to meet specific balance sheet conditions to take on more debt. These rules are aimed at limiting debt to the company’s cash flow, assets, and capital levels, and have led to a slowdown in the industry’s growth.

According to official data released on Wednesday, China’s new home prices experienced a decline in July. This marks the first time this year that such a fall has occurred. Specifically, prices decreased by 0.2% every month and by 0.1% compared to the same period last year. These figures were calculated by Reuters based on data from the National Bureau of Statistics. This is part of a larger trend of lackluster economic data, prompting calls for policy support to spur growth.

Country Garden, a former major developer in China, has until early September to pay the coupon payments it missed on two dollar notes on August 7th. The company also halted trading on 11 domestic bonds and warned that it may report a half-year annualized loss of up to 55 billion yuan ($7.5 billion).

Furthermore, JPMorgan predicts that if Country Garden defaults, it could add $9.9 billion to the global emerging markets high-yield corporate default tally for the year, resulting in a total default volume of $17 billion for the Chinese property sector in 2023.

JPMorgan estimates that if a Country Garden default were to occur, it could result in losses of $8 billion, leading to $8 billion worth of defaults among smaller Chinese property developers and an additional $2 billion for liability management in other high-yield Chinese sectors.

Over the past two and a half years, over $100 billion of China property bonded debt has defaulted, with $109 billion in defaults already recorded in the Chinese property sector since the start of 2021. This accounts for 94% of all defaults in Asia during that time.

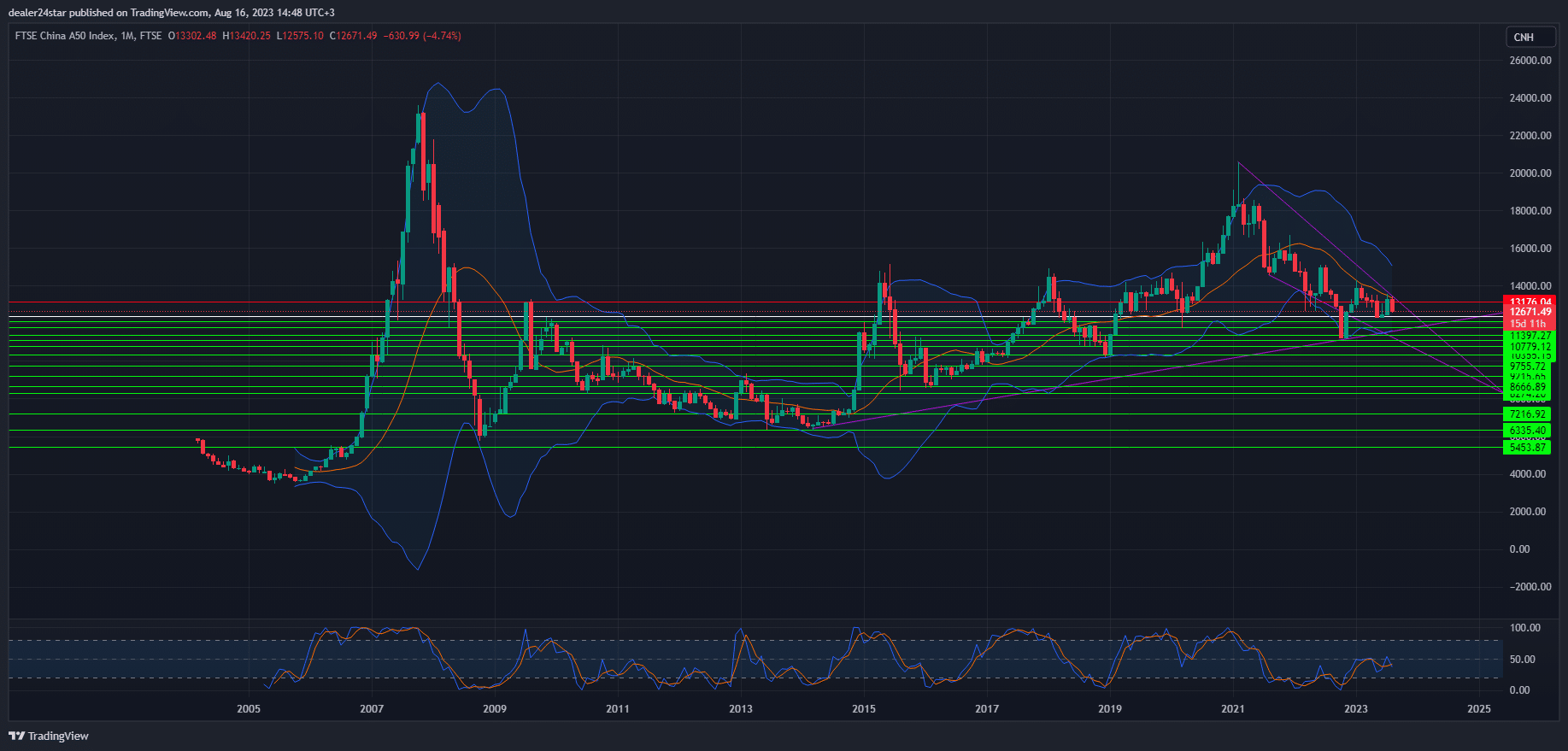

China A50 Short (Sell)

Enter At: 12392.38

T.P_1: 12106.33

T.P_2: 11779.07

T.P_3: 11397.27

T.P_4: 11095.64

T.P_5: 10779.12

T.P_6: 10355.15

T.P_7: 9755.72

T.P_8: 9215.65

T.P_9: 8666.89

T.P_10: 8274.20

T.P_11: 7216.92

T.P_12: 6335.40

T.P_13: 5453.87

S.L: 13176.04

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.