Today, the Bank of Canada (BoC) will announce its monetary policy decisions, and Governor Tiff Macklem will speak about the policy outlook. It is expected that the BoC will raise its policy rate by 25 basis points to 5%. In early European trading, the USD/CAD exchange rate reached its lowest level since late June, trading near 1.3200.

It is not surprising that a currency rises in response to a rate hike. However, in the case of the BoC, investors do not always look beyond the current decision, as the bank has been known to play tricks with the markets. This may lead to a significant reaction, particularly in the USD/CAD exchange rate.

Unlike the U.S. Federal Reserve (Fed) and the European Central Bank (ECB), the BoC does not feel the need to pre-commit its decisions. The larger central banks aim to provide certainty, something that the BoC does not feel restricted by.

In the previous decision in June, the BoC surprised investors by raising rates from 4.50% to 4.75%, after leaving rates unchanged twice in a row and hinting that it was finished increasing borrowing costs. Governor Tiff Macklem and his colleagues indicated that the hike was a one-time reaction to stronger data. However, this decision left markets in disbelief.

In three of its most recent actions, the BoC caught the markets off guard:

source: tradingeconomics.com

Officials have recently commented on the need to fight inflation, and a positive jobs report has raised expectations for another increase in the upcoming meeting. The Federal Reserve’s hawkish stance, projecting two more rate hikes after pausing, has also increased expectations. However, if the BoC decides to hike interest rates, it would be a surprise and could send the USD/CAD tumbling down.

Here are three reasons why a BoC interest rate hike could result in a fall in the USD/CAD:

1) Uncertainty and fear of further increases – the market may remain worried about future moves even if the BoC promises to leave rates unchanged after this hike. This “dovish hike” would be met with skepticism, and markets would await further moves, supporting the Canadian Dollar.

2) Inflation is falling in Canada – the Consumer Price Index (CPI) fell to 3.4% in May, and Core CPI missed estimates, sliding from 4.1% to 3.7%. This is significantly below the U.S’s 5.3% for the same month and substantially below interest rates. If the BoC extends its tightening cycle and pushes borrowing costs to highly restrictive territory, investors would worry that the BoC would not stop until inflation fully returns to the bank’s 2% target. Such hawkishness would give the Canadian Dollar an advantage.

3) Inflation is falling in the U.S.f – a few hours before the BoC announces its decision, Washington’s statistics agencies release a fresh inflation report for June, expected to show a drop in headline inflation to 3.1% YoY and Core CPI to 5%. Investors expect one more hike in the U.S. and are happy to see the end of the tightening cycle. This contrast with a stubborn BoC could send USD/CAD tumbling down.

This is significant as roughly 75% of Canadian exports go south, and both countries have an extensive trade agreement that encourages even closer ties. Therefore, Canada’s smaller northern economy heavily depends on the southern one.

It’s important to consider the possibility of the Bank of Canada leaving interest rates unchanged, despite their tendency to surprise. This decision would be in response to concerns about weaker inflation and a potential U.S. economic slowdown.

However, if the BoC does not raise rates as expected, the Canadian Dollar could experience a significant drop in value, particularly against other currencies.

It’s worth noting that even if the BoC does raise rates, there could still be a downside move in the USD/CAD exchange rate.

Credit Suisse predicts that a 25 basis point hike and hawkish guidance from the BoC could push USD/CAD towards their end-Q3 target of 1.31.

The bank expects the BoC to maintain a hawkish stance, potentially indicating further rate increases in the future. This could lead to an increase in short-term policy tightening expectations and provide positive support for the Canadian Dollar.

Despite this, Credit Suisse remains optimistic about the CAD and maintains its end-Q3 target.

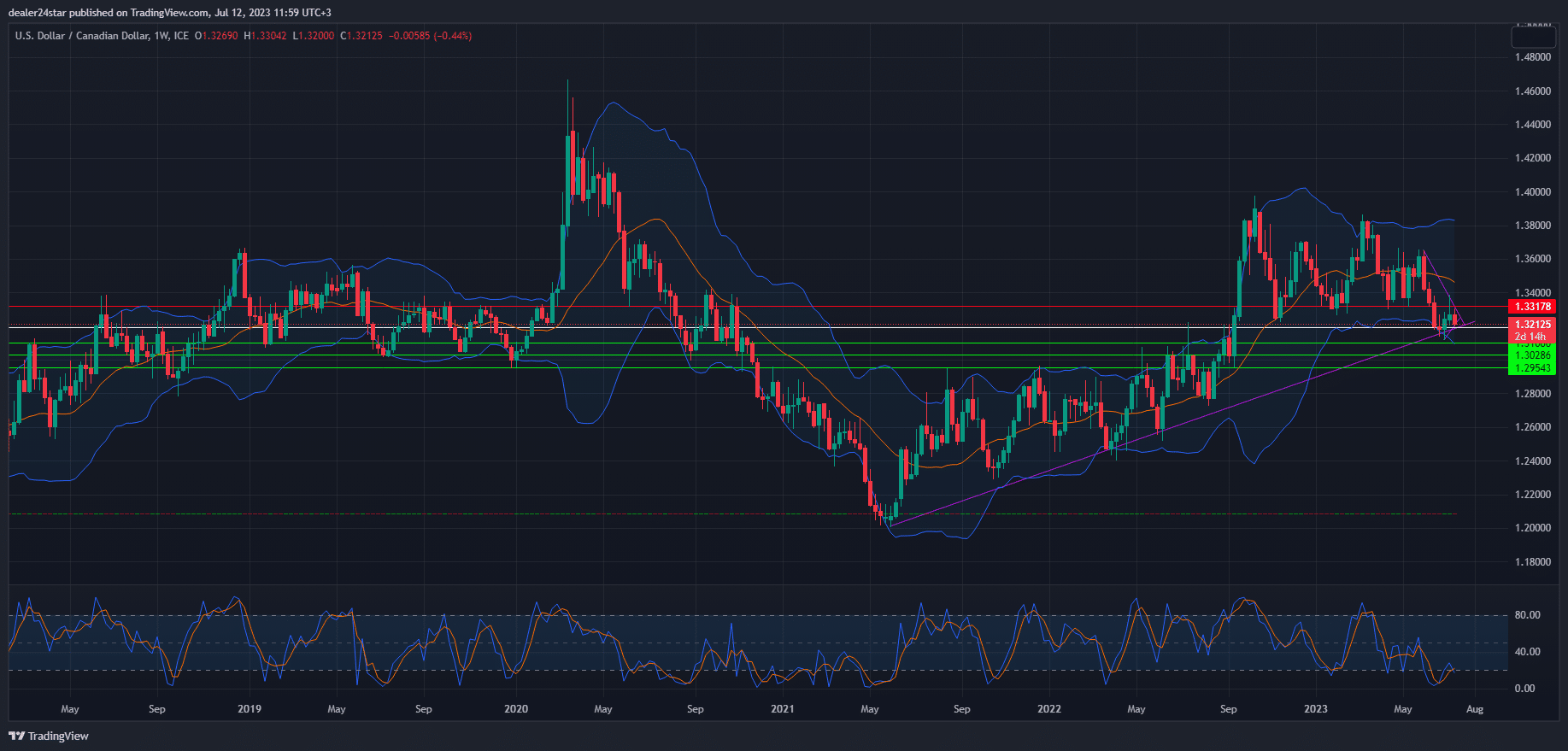

USD/CAD Short (Sell)

Enter At: 1.31938

T.P_1: 1.31000

T.P_2: 1.30286

T.P_3: 1.29543

S.L: 1.33178

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.