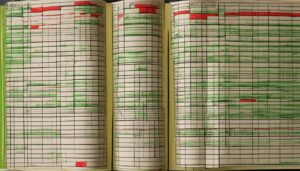

A trading journal is a powerful tool for beginner forex traders looking to improve their trading strategy. It serves as a log of all trading activity, allowing traders to objectively evaluate their performance and make informed decisions. Maintaining a trading journal requires discipline, honesty, and consistency. By documenting trades, emotions, market observations, and performance, beginners can gain valuable insights into their strengths, weaknesses, and the best way for them to trade.

Key Takeaways:

- Maintaining a trading journal is crucial for beginners to improve their trading strategy.

- A trading journal helps traders evaluate their performance objectively.

- The journal consists of entries about trades, emotions, market observations, and performance.

- Recording and analyzing key statistics can lead to better decision-making and strategy refinement.

- A trading journal is a dynamic tool for self-awareness and error elimination.

What to Include in Your Trading Journal

To create a comprehensive trading journal, traders, especially beginners, should include various key elements. These elements include recording their motivations for forex trading, their market views and philosophies, observations of the market, trading mistakes and missed opportunities, and performance statistics. By documenting these details, traders can understand themselves, their trading style, and make informed decisions.

Market observations can help identify patterns and tendencies in the market that traders can take advantage of. Recording mistakes and missed opportunities can lead to better decision-making in the future. Performance statistics such as win rate, loss rate, risk-to-reward ratios, and maximum drawdown provide a realistic picture of trading performance and guide improvements. By including these elements in their trading journal, beginners can develop a better understanding of their trading journey and make data-driven decisions.

Recording Motivations and Market Views

When maintaining a trading journal, it is important to record the motivations behind entering the forex market. This helps traders stay focused and remind themselves of their long-term goals. Additionally, documenting market views and philosophies allows traders to track and evaluate their predictions and opinions about the market. It helps in identifying biases and adjusting strategies accordingly.

Observations of the Market

Traders should record their observations about the market. This can include patterns noticed in price movements, reactions to economic events, and changes in market sentiment. By keeping track of these observations, traders can identify recurring trends and make more informed trading decisions.

Recording Mistakes and Missed Opportunities

Every trader makes mistakes, and acknowledging and learning from them is crucial for growth. Recording mistakes and missed opportunities helps traders analyze their decision-making process and identify areas for improvement. It also serves as a reminder to avoid repeating the same errors in the future.

“Mistakes are the portals of discovery.” – James Joyce

Performance Statistics

Performance statistics provide quantitative insights into trading success. By tracking win rates, loss rates, risk-to-reward ratios, and maximum drawdown, traders can assess the effectiveness of their strategies and make necessary adjustments. These statistics serve as a benchmark for performance evaluation and guide traders towards achieving consistent profitability.

| Performance Statistics | Description |

|---|---|

| Win Rate | The percentage of trades that resulted in a profit. |

| Loss Rate | The percentage of trades that resulted in a loss. |

| Risk-to-Reward Ratio | The ratio between the potential profit and potential loss for each trade. |

| Maximum Drawdown | The largest peak-to-trough decline in capital over a specific period. |

By diligently recording these key elements in a trading journal, beginners can gain valuable insights into their trading journey. It provides a holistic view of their performance, motivations, market knowledge, and areas for improvement. A trading journal is an indispensable tool for any trader looking to continuously evolve their strategies and achieve long-term success in the forex market.

Essential Statistics for Trading Success

The true power of a trading journal lies in the statistics recorded within it. These statistics provide valuable insights that can lead to trading success. By analyzing and understanding these statistics, traders can refine their strategies, identify areas for improvement, and make more informed trading decisions.

Entry and Exit Points

One of the key statistics to include in your trading journal is the entry and exit points for each trade. These points reflect the precision and timing of your trade executions. By analyzing these data points, you can evaluate the effectiveness of your entry and exit strategies and make adjustments accordingly.

Risk-to-Reward Ratios

Calculating risk-to-reward ratios is essential for maintaining a balanced approach between potential gains and losses. This statistic measures the relationship between the amount of risk taken on a trade and the potential reward. By monitoring and optimizing your risk-to-reward ratios, you can ensure that your trades have a favorable return profile.

Win Rate and Loss Rate

Another important set of statistics to track in your trading journal is your win rate and loss rate. These metrics serve as indicators of the overall success of your trading strategy. By analyzing your win rate and loss rate, you can assess the profitability of your trades and identify any patterns or trends that may impact your trading performance.

Maximum Drawdown

Maximum drawdown is a crucial statistic that helps manage potential losses and protect your trading capital. It measures the largest peak-to-trough decline in your trading account. By tracking and minimizing your maximum drawdown, you can safeguard your capital and maintain a more consistent trading performance.

Average Time in Trades

The average time in trades provides insights into your trading style and preferences. It measures the duration of your trades and can help identify whether you are more inclined towards short-term or long-term trading strategies. Understanding your average time in trades can assist you in optimizing your trading approach.

By diligently recording and analyzing these key statistics in your trading journal, you can extract valuable insights that guide your decision-making process. These statistics serve as a compass, pointing you towards areas of improvement and helping you refine your trading strategies for enhanced success.

Turning Data into Wisdom

Simply recording the statistics in a trading journal is not enough; traders need to transform that data into actionable insights. By analyzing the data, traders can understand why their trades performed the way they did and make necessary adaptations and improvements.

For example, a low win rate may indicate that entry points need refinement. Comparing risk-to-reward ratios and win/loss rates can reveal the strengths and weaknesses of a strategy. These insights are invaluable for making data-driven decisions and optimizing trading performance.

Recording and analyzing statistics in a trading journal also allows traders to identify patterns in their trading behavior. By pinpointing recurring trends and tendencies, traders can capitalize on favorable patterns and adjust their approach to minimize negative patterns.

A trading journal is not merely a passive record-keeper, but an active partner in the journey toward trading success. It turns raw data into meaningful insights, empowering traders to make informed decisions based on facts rather than guesswork.

“Analyzing the data in a trading journal is like turning on a light in a dark room. It illuminates the path to success and provides clarity amidst uncertainty.” – John Davis, Professional Trader

Identifying patterns through data analysis

Data analysis plays a crucial role in extracting meaningful patterns from a trading journal. By examining historical data, traders can uncover recurring trends, market cycles, and behavioral patterns. This analysis facilitates a deeper understanding of the market and enhances predictive capabilities.

Additionally, data analysis can reveal specific patterns in the trader’s decision-making process. By examining past trades, traders can identify common mistakes, biases, and emotional triggers. Armed with this knowledge, traders can implement strategies to counteract these patterns and make more rational, disciplined trading decisions.

Implementing data-driven strategies

Insights derived from data analysis can be used to develop and refine data-driven trading strategies. By leveraging historical performance data, traders can identify profitable setups, optimal entry and exit points, and robust risk management techniques.

A data-driven approach helps traders overcome cognitive biases and emotional reactions. Instead of relying on gut feelings or external opinions, traders can make informed decisions anchored in objective data and analysis.

Unlocking the power of a trading journal

A trading journal is more than just a collection of numbers and figures. It is a treasure trove of insights waiting to be discovered. By leveraging data analysis techniques, traders can transform the information in their trading journal into actionable wisdom. This wisdom enables them to make confident decisions, adapt their strategies, and continuously improve their performance.

Conclusion

In conclusion, maintaining a trading journal is crucial for beginners who want to improve their trading strategy and achieve success in the forex market. By recording and analyzing key statistics such as entry and exit points, risk-to-reward ratios, win rate, loss rate, maximum drawdown, and average time in trades, beginners can gain valuable insights into their trading performance and make more informed decisions. A trading journal serves as a dynamic tool for self-awareness, strategy refinement, and error elimination.

By consistently recording and reviewing their trades, beginners can identify patterns and trends in their trading behavior, enabling them to refine their strategies and avoid repeating mistakes. The journal also provides a record of emotional responses to trades, helping beginners understand and manage their trading psychology. It is through this process of self-reflection and analysis that beginners can improve their trading skills and develop a winning strategy.

A trading journal is not just a record of past trades; it is a powerful tool that can optimize trading results. By leveraging the insights gained from analyzing the journal, beginners can make data-driven decisions and adapt their strategies to changing market conditions. With time and practice, beginners can transform their trading journal into a roadmap to success in the forex market.

FAQ

Why is maintaining a trading journal important for beginners?

Maintaining a trading journal is important for beginners because it helps them track their trades, evaluate their trading strategy, and gain valuable insights into their strengths and weaknesses as traders.

What key elements should beginners include in their trading journal?

Beginners should include various key elements in their trading journal, such as their motivations for forex trading, market views and philosophies, observations of the market, trading mistakes and missed opportunities, and performance statistics.

What are some important statistics that should be recorded in a trading journal?

Some important statistics that should be recorded in a trading journal include entry and exit points for each trade, risk-to-reward ratios, win rate, loss rate, maximum drawdown, and average time in trades.

How can traders turn the data in their trading journal into actionable insights?

Traders can turn the data in their trading journal into actionable insights by analyzing the data, understanding why their trades performed the way they did, and making necessary adaptations and improvements to their trading strategy.

Source Links

- https://www.babypips.com/learn/forex/summary-keeping-a-trading-journal

- https://www.babypips.com/learn/forex/what-should-you-record-in-your-journal

- https://www.linkedin.com/pulse/optimize-your-trading-journal-harnessing-key-statistics-success-kyavf

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.