Trading index futures requires effective strategies to enhance market performance and make strategic futures investments. In this article, I will explore proven strategies that can help you maximize your trading performance in the index futures market.

Key Takeaways:

- Developing effective trading strategies is crucial for success in index futures trading.

- Combining technical and fundamental analysis techniques can provide a comprehensive understanding of market trends.

- Continuous refinement and adaptation of strategies are necessary based on market conditions and trading preferences.

- By applying these strategies, you can enhance your market performance and achieve your investment goals.

- Stay informed about the latest market news and economic indicators to make well-informed trading decisions.

Understanding Index Futures Trading

Before diving into the strategies, it is essential to have a solid understanding of index futures trading. Index futures are contracts that allow traders to speculate on the future direction of an underlying stock index. These contracts derive their value from the performance of the index they represent, such as the S&P 500 or Dow Jones Industrial Average. By trading index futures, traders can take positions on the overall market performance rather than individual stocks.

Index futures trading is based on the concept of buying or selling contracts that represent the value of an index at a future date. These contracts are standardized and traded on regulated exchanges, providing traders with the opportunity to profit from market movements without owning the actual underlying assets.

By trading index futures, investors can effectively diversify their portfolios and manage risk exposure. Index futures trading offers flexibility, liquidity, and the potential for significant returns.

One of the key advantages of trading index futures is the ability to speculate on the direction of the market as a whole. Instead of analyzing and trading individual stocks, traders focus on the performance of the broader market represented by the index. This allows for a more streamlined trading approach and reduces the need for in-depth research on individual companies.

To better understand index futures trading, let’s consider an example. Imagine that a trader believes the S&P 500 index will increase in value in the next month. They can buy an index futures contract that represents the value of the S&P 500 index at a specific future date. If the index indeed increases in value, the trader can sell the contract at a higher price, profiting from the price difference.

Trading index futures requires knowledge of market dynamics, technical analysis, and risk management strategies. By understanding the basics of index futures trading, traders can make informed decisions and adapt their strategies to the ever-changing market conditions.

Benefits of Index Futures Trading

Index futures trading offers several benefits for traders:

- Leverage: Traders can control a large contract value with a relatively small initial investment, allowing for greater potential returns.

- Diversification: Index futures enable traders to gain exposure to a broader market without needing to own individual stocks.

- Liquidity: The index futures market is highly liquid, providing ample opportunities for buying and selling contracts.

- Hedging: Traders can use index futures contracts to hedge their existing positions and manage risks.

With these advantages, index futures trading has become a popular choice among investors and speculators looking to participate in the global financial markets. Whether you are a seasoned trader or just starting, understanding the basics of index futures trading is essential for long-term success.

Technical Analysis Strategies for Index Futures Trading

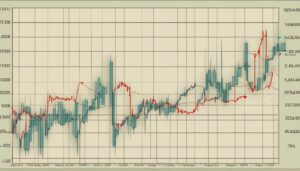

Technical analysis is a critical component of successful index futures trading strategies. By utilizing various technical indicators and conducting trend analysis, traders can make informed decisions and enhance their trading performance. In this section, we will explore some popular technical analysis strategies employed by traders in index futures trading.

Moving Average Crossovers

One common technical analysis technique is using moving average crossovers. Traders observe the intersection of different moving averages, such as the 50-day and 200-day moving averages, to identify potential changes in trend direction. A bullish crossover occurs when a shorter-term moving average crosses above a longer-term moving average, signaling a potential buying opportunity. Conversely, a bearish crossover happens when a shorter-term moving average crosses below a longer-term moving average, indicating a possible selling opportunity.

Trendline Analysis

Trendline analysis is another valuable tool in technical analysis for index futures trading. Traders draw trendlines on price charts to identify and validate trends. An uptrend is characterized by a series of higher highs and higher lows, while a downtrend consists of lower highs and lower lows. By identifying these trendlines, traders can determine potential support and resistance levels, which can help guide their trading decisions.

Oscillators: RSI and Stochastics

Oscillators, such as the Relative Strength Index (RSI) and Stochastics, are widely used to identify overbought and oversold conditions in the market. The RSI measures the speed and change of price movements and provides traders with a numerical value between 0 and 100. Readings above 70 suggest overbought conditions, signaling a potential price decline, while readings below 30 indicate oversold conditions, indicating a possible price increase. Similarly, Stochastics tracks the closing price relative to the price range over a specific period and generates signals based on overbought and oversold levels. Traders can use these oscillators to determine entry and exit points in their trades.

By incorporating technical analysis strategies like moving average crossovers, trendline analysis, and oscillators into their index futures trading, traders can gain valuable insights into market trends and potential trading opportunities. The use of these tools aids in making informed decisions based on historical price data and market trends.

Fundamental Analysis Strategies for Index Futures Trading

When it comes to trading index futures, utilizing fundamental analysis is essential for making informed decisions and predicting market trends. By analyzing economic indicators, market news, and company fundamentals, traders can assess the future performance of the index and position themselves effectively.

Fundamental analysis involves evaluating various data points such as GDP growth, employment reports, interest rate changes, and earnings announcements. These economic indicators provide valuable insights into the overall health and direction of the market. By understanding the underlying factors that drive market movements, traders can gain a deeper understanding of the index’s performance and make strategic trading decisions.

Market news is another critical aspect of fundamental analysis. Staying updated with the latest news and events can provide valuable context and help traders anticipate market movements. By monitoring news related to industry trends, political developments, and global economic factors, traders can identify potential opportunities and risks in the index futures market.

“Fundamental analysis allows me to make well-informed trading decisions based on a thorough understanding of the market’s underlying factors. By assessing economic indicators and staying updated with market news, I can anticipate market trends and position myself strategically in index futures trading.”

Successful index futures traders combine technical analysis with fundamental analysis to gain a comprehensive understanding of market trends and make more accurate predictions. By considering both the historical price data and the fundamental factors that influence market movements, traders can enhance their trading strategies and maximize their profits.

To further illustrate the importance of fundamental analysis in index futures trading, let’s consider an example. Suppose there is a significant increase in the economic indicators, such as GDP growth and consumer spending, indicating strong market performance. Traders who apply fundamental analysis might take this as a positive signal and position themselves for potential long trades.

Through fundamental analysis, traders can gain a deeper understanding of the index futures market and make well-informed trading decisions. By evaluating economic indicators, staying updated with market news, and considering company fundamentals, traders can enhance their strategies and achieve success in index futures trading.

Conclusion

Developing effective trading strategies is crucial for success in index futures trading. By combining technical and fundamental analysis techniques, traders can gain a comprehensive understanding of market trends and make well-informed trading decisions. It is important to continuously refine and adapt these strategies based on market conditions and individual trading preferences.

Technical analysis provides valuable insights by analyzing historical price data and utilizing indicators and chart patterns to identify trends and entry/exit points. On the other hand, fundamental analysis allows traders to assess the underlying factors that drive market movements, such as economic indicators and news events. By incorporating both approaches, traders can make more accurate predictions about market behavior.

As the market constantly evolves, it is essential for traders to stay updated and adjust their strategies accordingly. Regularly monitoring market conditions, staying informed about economic developments, and assessing the impact of external factors can help traders refine their trading strategies for better performance. Additionally, understanding one’s own risk tolerance and trading preferences is crucial in developing a personalized trading approach.

In summary, an effective trading strategy for index futures trading involves a combination of technical and fundamental analysis, continuous refinement, and adaptation to market conditions. By honing these strategies, traders can enhance their market performance and achieve their investment goals in the index futures market.

FAQ

What are index futures?

Index futures are contracts that allow traders to speculate on the future direction of an underlying stock index. These contracts derive their value from the performance of the index they represent, such as the S&P 500 or Dow Jones Industrial Average.

How can index futures trading strategies enhance market performance?

Index futures trading strategies can enhance market performance by providing traders with effective techniques to analyze trends, identify entry and exit points, and make well-informed trading decisions. These strategies combine technical and fundamental analysis methods to gain a comprehensive understanding of market movements.

What role does technical analysis play in index futures trading strategies?

Technical analysis plays a crucial role in index futures trading strategies. Traders use various technical indicators and chart patterns to identify trends, support and resistance levels, and potential entry and exit points. Some popular technical analysis strategies for index futures trading include moving average crossovers, trendline analysis, and oscillators like the Relative Strength Index (RSI) or Stochastics.

How does fundamental analysis contribute to index futures trading strategies?

Fundamental analysis involves analyzing economic indicators, market news, and company fundamentals to assess the future performance of the index and predict market trends. Traders can use various data points such as GDP growth, employment reports, interest rate changes, and earnings announcements to make informed trading decisions. By understanding the underlying factors that drive market movements, traders can position themselves effectively in index futures trading.

Why is it important to continuously refine and adapt index futures trading strategies?

It is important to continuously refine and adapt index futures trading strategies based on market conditions and individual trading preferences. The market is dynamic and constantly changing, and strategies that may have been effective in the past may not work in the current market environment. By continuously refining and adapting strategies, traders can stay ahead of the curve and make more informed trading decisions.

Source Links

- https://www.nasdaq.com/articles/south-african-rand-little-changed-after-us-inflation-data

- https://www.marketscreener.com/quote/index/S-P-500-4985/news/Wall-Street-drops-as-inflation-data-dulls-rate-cut-hopes-45725646/

- https://ca.marketscreener.com/quote/index/DOW-JONES-INDUSTRIAL-4945/news/Wall-Street-in-the-red-as-inflation-reaccelerates-45725337/

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.