The MOEX Russia Index has shown notable resilience, reaching pre-war levels in May 2024 after a significant decline following the onset of the Ukraine conflict.

Several key factors contribute to this resurgence:

- Shifting Investment Landscape: Western sanctions have limited foreign participation in the Russian stock market. This gap has been partially filled by an increase in domestic retail investment and capital inflows from allied nations, providing crucial support for the market’s recovery.

- Robust Corporate Performance: Boosted by the global rise in energy prices, many Russian companies, especially in the energy sector, have reported strong financial results. This financial health, with rising revenue and profitability, has enabled continued investment in operations and dividend distributions, attracting domestic investors seeking promising opportunities.

- Renewed IPO Activity: The Russian IPO market, which experienced a boom in late 2021, was significantly impacted by the war. Nonetheless, there are signs of a cautious revival in domestic IPO activity, indicating a return of investor confidence in the local market.

However, several challenges persist:

Sanctions and Foreign Investment: The full impact of Western sanctions on the Russian economy remains uncertain. Restricted foreign investment continues to limit overall market liquidity, potentially hindering future growth. Additionally, sectors dependent on foreign technology or components may face long-term constraints.

Geopolitical Uncertainty and Military Expenditure: The ongoing war in Ukraine and associated geopolitical uncertainty continue to weigh on the Russian economy. Increased military spending, while benefiting some sectors in the short term, could strain the Russian treasury in the long run.

Turkey’s Potential Role in Sanctions Busting:

The article also highlights a concerning trend: Turkey’s potential role in facilitating the re-export of Russian oil products to Europe. If confirmed, this practice could undermine the effectiveness of sanctions aimed at limiting Russia’s war chest. Further investigation and potential sanctions enforcement actions by the international community may be necessary to address this issue.

In conclusion, the resurgence of Russia’s MOEX index presents a compelling case study. While domestic factors have bolstered the market in the short term, the long-term trajectory remains dependent on the evolving geopolitical landscape, the effectiveness of sanctions, and the overall health of the Russian economy. The situation surrounding Turkey’s potential role in sanctions circumvention adds another layer of complexity to this evolving story.

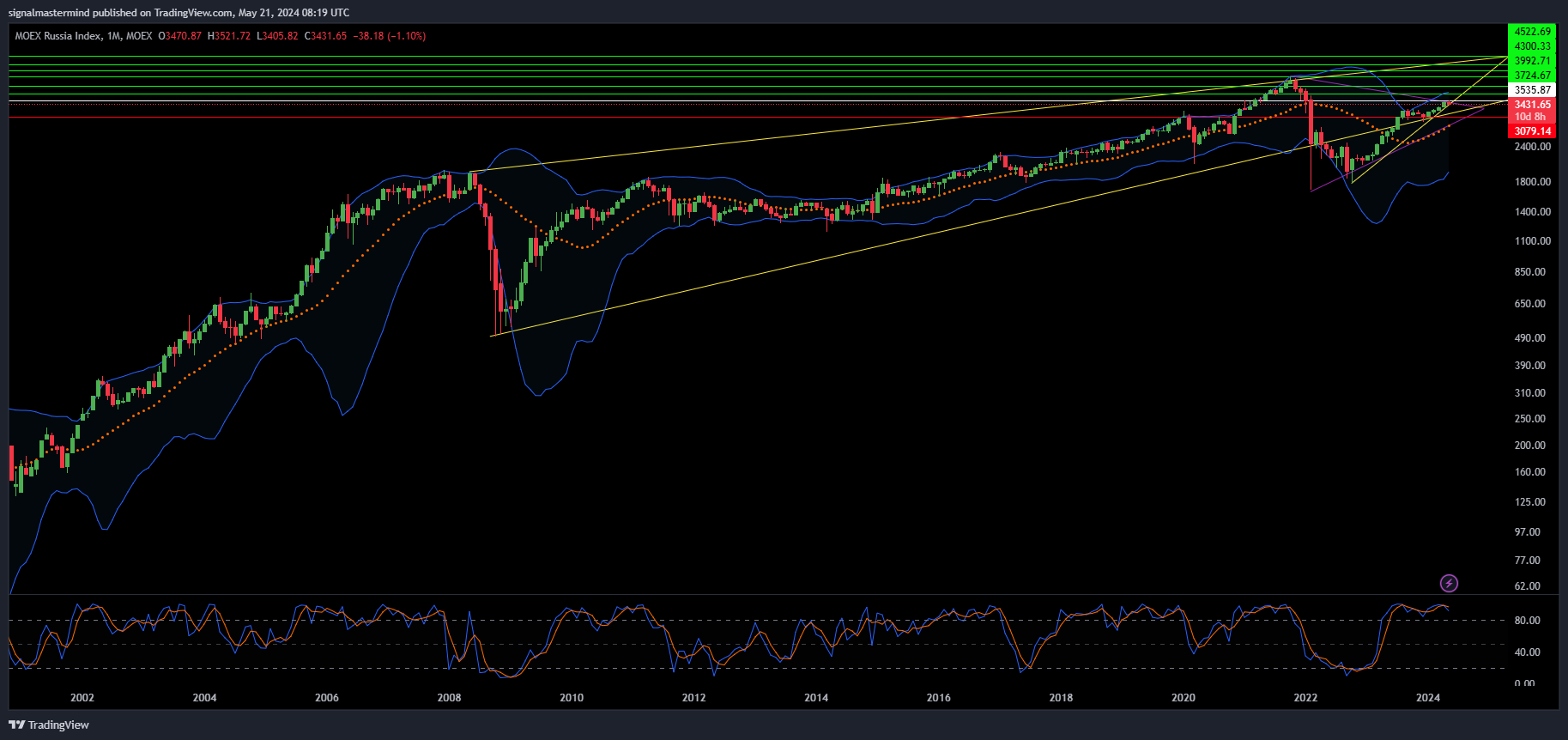

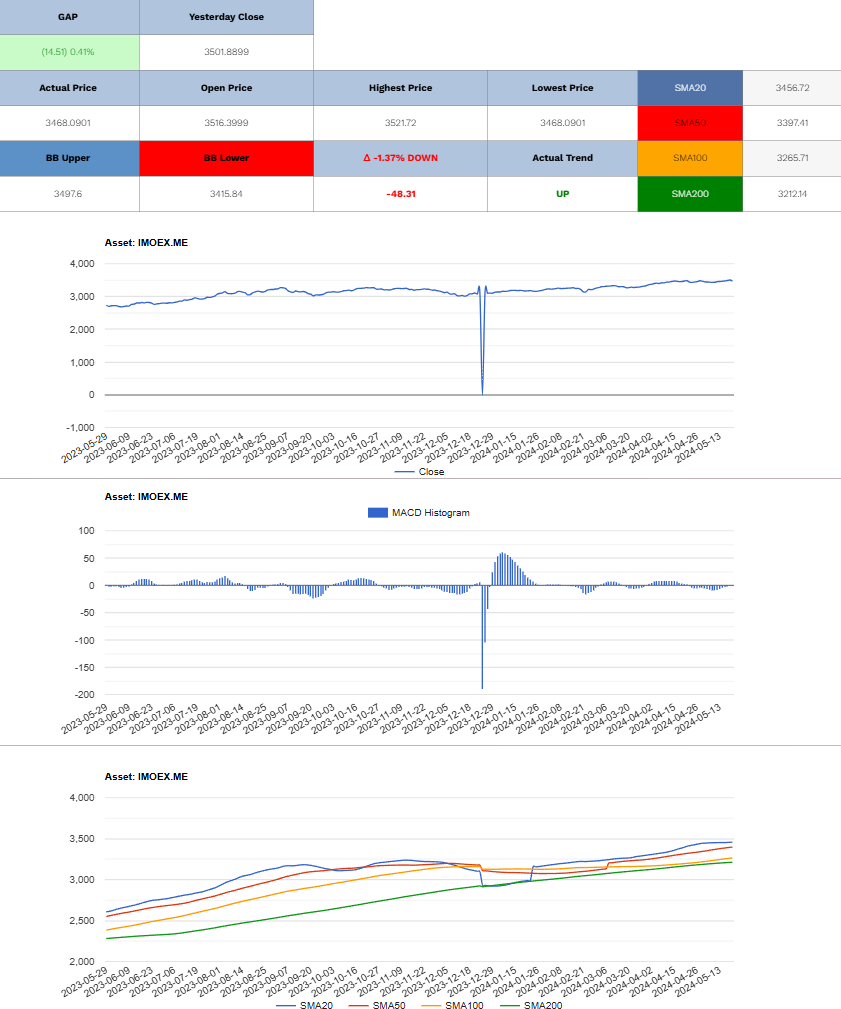

MOEX Long (Buy)

Enter At: 3535.87

T.P_1: 3724.67

T.P_2: 3992.71

T.P_3: 4300.33

T.P_4: 4522.69

T.P_5: 4767.57

T.P_6: 5105.74

S.L: 3079.14

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.