The Russian ruble is undergoing a significant downward trend, with its value reaching 95 rubles against the dollar and 105 against the euro in the current week. This development has sparked discussions among analysts about whether the currency’s decline is a result of economic sanctions or a strategic move by the Central Bank of Russia (CBR) to mitigate a budget deficit that was reached by early March.

Starting from December 2021, the ruble has displayed a continuous decline, occasionally marked by periods of instability. Both the dollar and the euro have demonstrated strength against the ruble, attaining their peak values since March 2022 at 95.6 and 105.6 respectively. While official accounts attribute the ruble’s depreciation to factors like increased imports, sanctions impact, and stabilization of global oil prices, experts such as Chris Weafer, the CEO of Macro Advisory and a former research head at several Moscow-based investment banks, propose that the Central Bank of Russia (CBR) has actively managed the exchange rate to bolster ruble reserves and fortify the budget.

The increase in federal budget revenues was notable in June due to the shift of oil exports from Europe to Asia. This switch reduced the cumulative deficit from RUB3.3 trillion, surpassing the 2% of GDP target in March, to RUB2.5 trillion at present, falling below the 2% target. However, the first half of this year witnessed negative revenues, causing the deficit to expand.

The Russian budget factors in projected revenues from oil export taxes, denominated in dollars but converted into rubles for expenditures. Consequently, the budget benefits from currency devaluation, as it results in more rubles available for spending, despite their diminished value, thereby contributing to deficit reduction.

CBR governor Elvira Nabiullina remains committed to targeting inflation rates and raised interest rates by 100 basis points in July due to mounting inflationary pressures, partly attributed to the depreciating ruble. Nabiullina anticipates inflation to rise from the 3.2% recorded in June to approximately 6% by year-end, yet she envisions a decline to the CBR’s 4% target in the following year.

Simultaneously, the ruble’s depreciation holds real implications for Russians beyond its psychological impact. Accelerated inflation has stemmed from factors like increased budget expenditure, growing domestic demand, and a scarcity of labor. To mitigate pressure on the ruble, the government was compelled to forsake a key budget policy, which involved utilizing windfall profits from oil for current expenditures.

The root cause of the situation lies in Russia’s economic strategies, including ineffective budget policies and monetary approaches, as noted by The Bell. The government’s substantial 20% year-on-year expenditure growth and the Central Bank’s monetary policies have exacerbated the ruble’s decline. Compounded by a mid-July deficit in the current account, these factors have compounded the challenges.

The plummeting ruble has instigated rapid inflation escalation, impacting an overheated economy and a depleted labor market. While the official pace of price escalation has moderated somewhat this week, the underlying rate of inflation remains elevated.

With the dollar approaching the 100-ruble threshold and inflation surging to 10%, expectations have arisen for governmental intervention to address the situation. Reports suggest that the government might temporarily suspend the budgetary rule that allocates oil and gas windfalls into the National Wealth Fund for the remainder of the year. This fiscal rule has been a pivotal aspect of Russia’s financial planning for years.

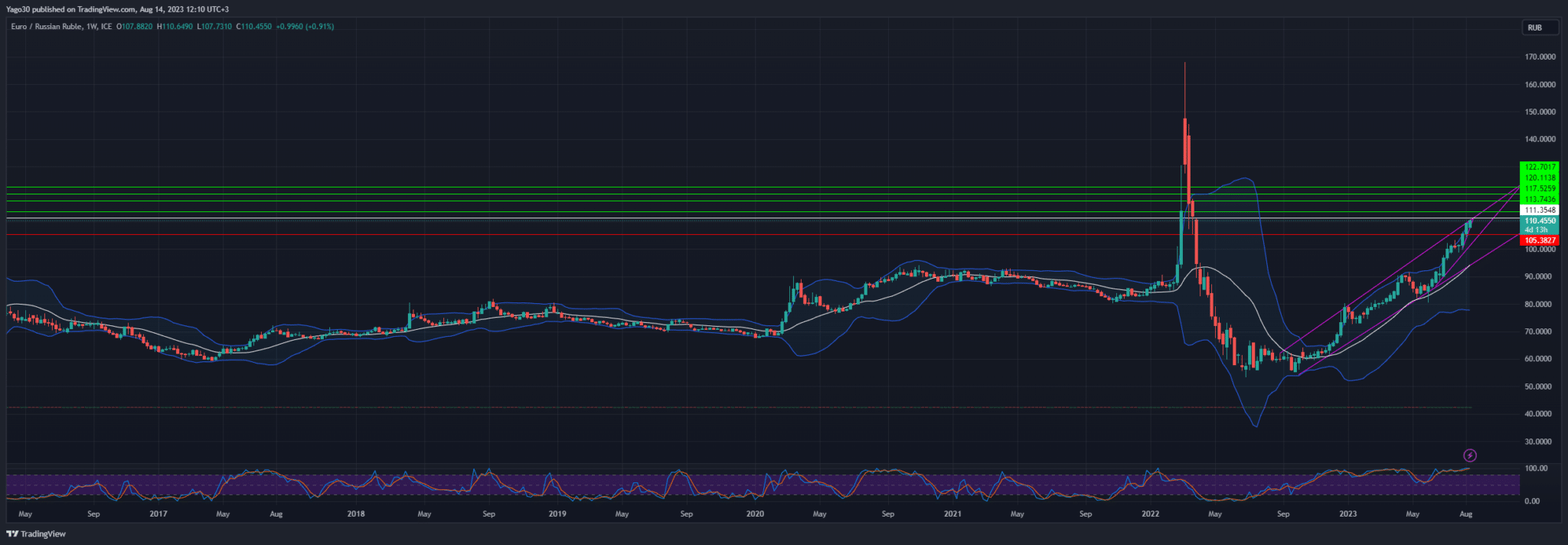

EUR/RUB Long (Buy)

Enter At:111.3548

T.P_1: 113.7436

T.P_2: 117.5259

T.P_3: 120.1138

T.P_4: 122.7017

S.L: 105.3827

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.