On Wednesday, the Russian Rouble remained steady near 90 against the dollar with the help of high oil prices and an upcoming favorable tax period ahead of two OFZ bond auctions by the finance ministry.

Brent crude oil, which is a global benchmark for Russia’s main export, was slightly down at $83.55 a barrel but had hit its strongest point in over three months in the previous session.

The Rouble has been weakening this year as exports fall and imports recover. However, it hit a more than 15-month low in early July following an abortive armed mutiny by the Wagner mercenary group in late June.

Last week, the Bank of Russia’s larger-than-expected 100-basis-point rate hike to 8.5% had a limited immediate impact on the currency, but higher rates should lend the Rouble some support as they make investments in Russian assets more attractive.

Taxes due on July 28, where exporters convert foreign currency revenues to meet local liabilities, could also support the Rouble. Russian stock indexes were down after touching months-long highs.

On the other hand, the Federal Reserve is expected to raise interest rates by a quarter of a percentage point on Wednesday, marking the 11th hike in the US central bank’s past 12 policy meetings and possibly a last move in its aggressive battle to tame inflation.

The increase, anticipated by investors with nearly a 100% probability, would raise the benchmark overnight interest rate to the 5.25%-5.50% range.

There’s little sense that a similar collapse is on the horizon, as the economy is proving more resilient to rising interest rates than expected, with ongoing growth and an unemployment rate that is currently pinned at a low 3.6%.

In assessing where policy may move next, the Fed will be balancing whether the economy remains too strong to return a still-elevated rate of inflation to the central bank’s 2% target against evidence that a process of “disinflation” may be underway that is likely to continue even without any further rate increases.

After a rapid series of rate hikes over the last year, policymakers say they are now making meeting-by-meeting judgments based on incoming data, an approach meant to keep their options open and one likely to be emphasized by Fed Chair Jerome Powell in a press conference.

As the Fed meets this week, policymakers will not provide updated economic and interest rate projections.

However, they will review quarterly bank survey data that has become increasingly important following several regional bank collapses this year.

In June, policymakers projected that the Fed was nearing the end of its hiking cycle, with most only anticipating one more quarter-percentage-point increase beyond the expected hike on Wednesday.

Yet, data since June has dampened expectations for further increases in borrowing costs. Recent headline inflation data was weaker than anticipated, and other indicators of the economy, such as producer prices, suggest that moderation is underway.

On Tuesday, as policymakers began their two-day meeting, the Conference Board reported that U.S. consumers expect inflation to stay low for the next 12 months, reaching the lowest level since November 2020.

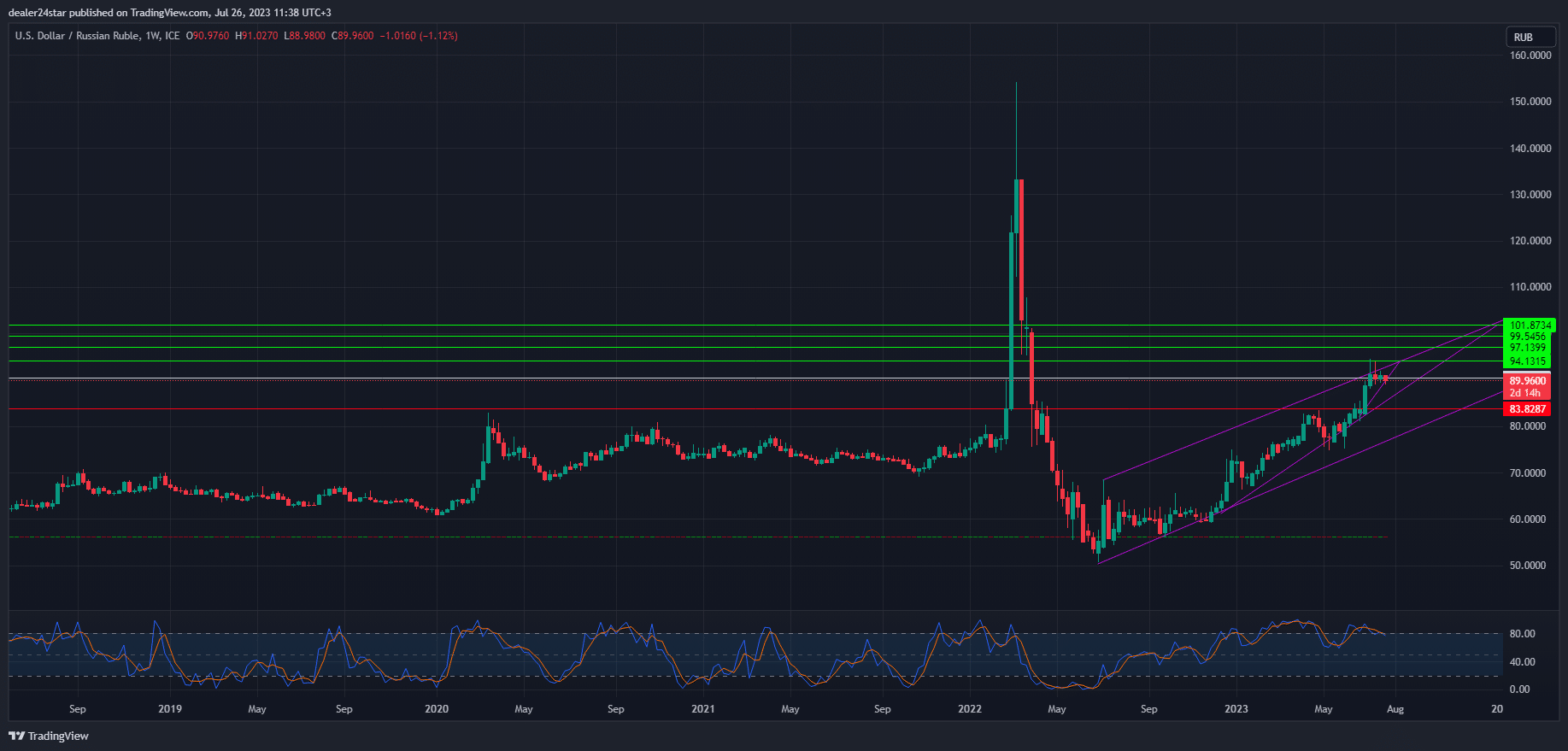

USD/RUB Long (Buy)

Enter At: 90.4931

T.P_1: 94.1315

T.P_2: 97.1399

T.P_3: 99.5456

T.P_4: 101.8734

S.L: 83.8287

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.