After a two-day slump in gains, the euro increased against the dollar in European trade, touching 17-month highs due to expectations for the ECB’s meeting next week.

According to some observers, the European Central Bank will continue to fight EuroZone inflation and continue raising interest rates.

Following a string of dismal US statistics, the dollar dropped once more, supporting the idea that the 0.25% Fed rate hike scheduled for next week will be the final one.

The recent more pessimistic comments made by ECB officials, which raised doubts about the likelihood of a rate hike in September, also impacted the euro.

Klaas Knot, president of De Nederlandsche Bank, stated that to prevent unduly tightening monetary policy, the ECB would closely examine inflation signals in the coming months.

ECB – This week, the European Central Bank will meet to discuss its policies and the most recent developments in the eurozone. The meeting is anticipated to result in a 0.25% ECB rate increase.

Despite recent gloomy comments from some members, the ECB is anticipated to continue its course of tightening policy because inflation is still persistently high.

Recent US retail sales and housing data fueled speculation that the Fed will terminate the current cycle of policy tightening after the July meeting, fueling worries of a recession in the second half of the year.

As it posts its first daily profit in three days going into Thursday’s European session, the EUR/USD currency pair holds onto modest gains around 1.1220. In doing so, the Euro pair applauds the general decline in the US dollar while paying little attention to the conflicting concerns regarding the Eurozone.

However, Reuters’ analysis emphasizes the multi-year high inflation and the war in Ukraine to highlight the deplorable employment situation in the region and spur confidence about the Eurozone. Yannis Stournaras, a member of the ECB Governing Council, said on Wednesday on CGTN Europe that he wasn’t sure if the ECB would raise rates again following a 25 bps increase next week. The policymaker added that further hikes in interest rates could hurt the economy while also arguing that inflation is declining.

It’s important to note that the US economic transition is drawing more skepticism than the Eurozone’s, which keeps the EUR/USD stronger, particularly as Fed bets point to a policy change after July while ECB conversations are marginally less dovish.

To adorn the economic calendar, the preliminary data for the Eurozone’s Consumer Confidence for July will come before the US Initial Jobless Claims and Existing Home Sales. For obvious instructions, the risk catalysts should receive the majority of focus. If the anticipated EU readings are stronger than expected, the EUR/USD might break over the crucial 1.1280 barriers amid widespread US Dollar weakness; however, if the US data and attitude are less than expected, the bears may not be attracted to the situation.

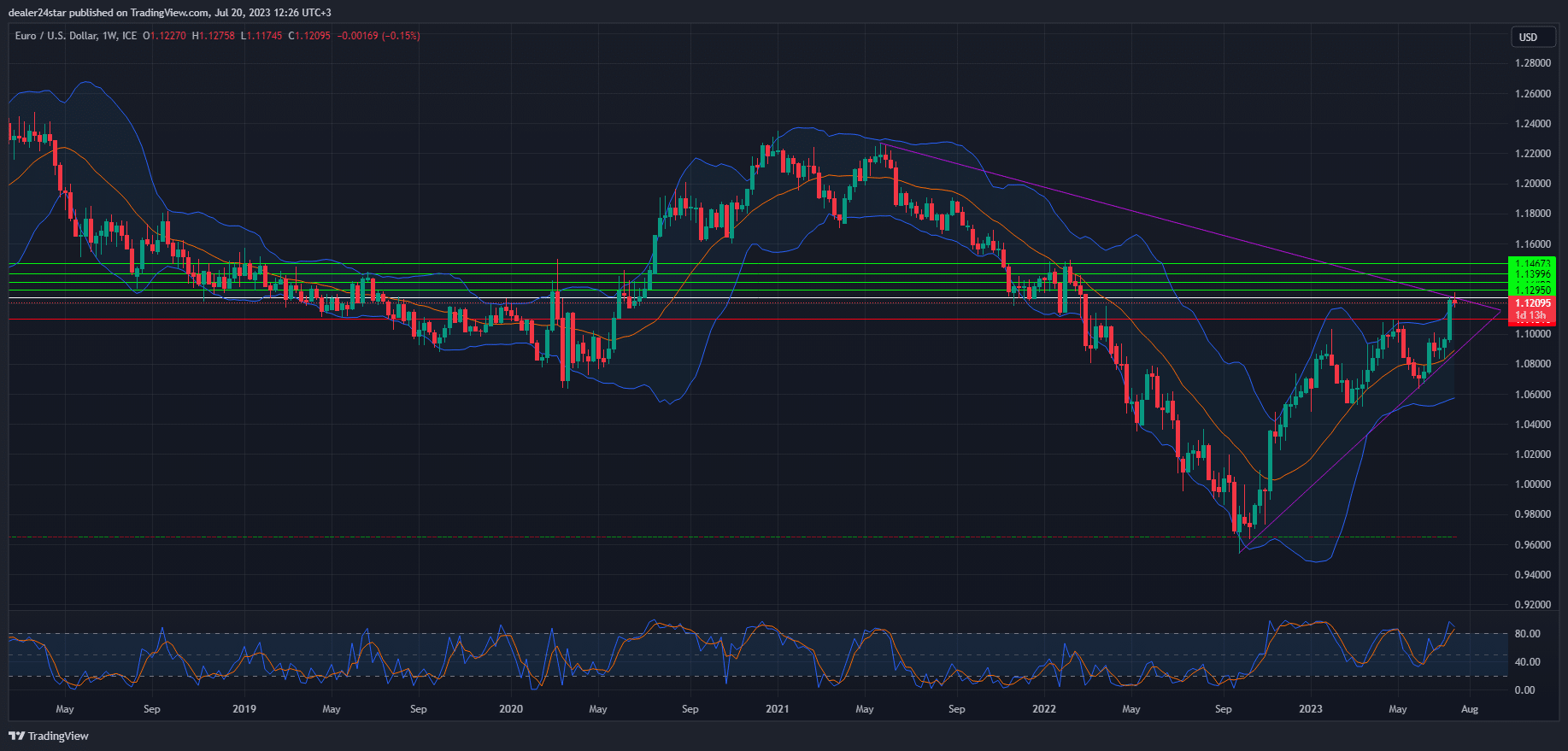

EUR/USD Long (Buy)

Enter At: 1.12437

T.P_1: 1.12950

T.P_2: 1.13465

T.P_3: 1.13996

T.P-4: 1.14673

S.L: 1.11013

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.