On Monday, Netflix’s shares saw an increase in value as analysts raised their expectations for the company’s growth initiatives. This comes ahead of the June quarter earnings report, set to release on Wednesday. Over a year ago, Netflix’s founder, chairman, and former CEO, Reed Hastings, shared plans to launch an ad-supported streaming tier, as well as potentially crack down on password sharing. The company has since progressed on both fronts, and analysts anticipate these measures to have a positive impact on revenue and subscriber growth. The post-earnings analyst call is expected to include in-depth discussions on the effects of current labor actions on film and TV production. Hollywood’s actor’s union went on strike last week, joining screenwriters on the picket line.

Netflix expects to generate $8.2 billion in revenue this quarter, up by 3.4% from last year. Their projected profit is $2.84 a share, a decrease from $3.20 a year ago, and subscriber growth is expected to be in line with the 1.75 million added in the first quarter. Nevertheless, the expectations for subscriber growth are increasing.

Deutsche Bank analyst, Bryan Kraft, reiterated his buy rating on Netflix shares and raised his target price on the stock to $475 from $410. He is optimistic about the new ad-supported subscription tier, priced at $6.99 a month, and the company’s efforts to reduce password sharing. Kraft predicts that advertising will add $400 million in revenue this year, $1.3 billion next year, and $2.3 billion in 2025, jumping to $6 billion by 2030. He also believes that the password crackdown will add $900 million in revenue this year, $3.4 billion next year, and $4.5 billion in 2025.

Although the valuation case for Netflix shares has become more challenging with a 53% increase in stock value for the year to date, Kraft recognizes Netflix as one of the few media and communications companies with solid earnings and free cash flow growth stories.

Alan Gould, an analyst at Loop Capital, has also raised his target price to $425 from $330 while maintaining a Hold rating. Gould believes that the labor issues in Hollywood will benefit Netflix’s competitive position, thanks to its vast collection of unreleased content and global production capabilities.

However, with the stock up by over 30% since the last earnings report, he sees the risks and rewards as evenly balanced heading into the quarter.

Mark Mahaney, an analyst at Evercore ISI, maintains an Outperform rating and $400 target price on Netflix shares but has made a “tactical underperform” call on the stock. Mahaney believes that subscriber growth expectations for Q2 and Q3 have reached an elevated range of four to five million and five to seven million, respectively, increasing the likelihood of a negative Q2 surprise.

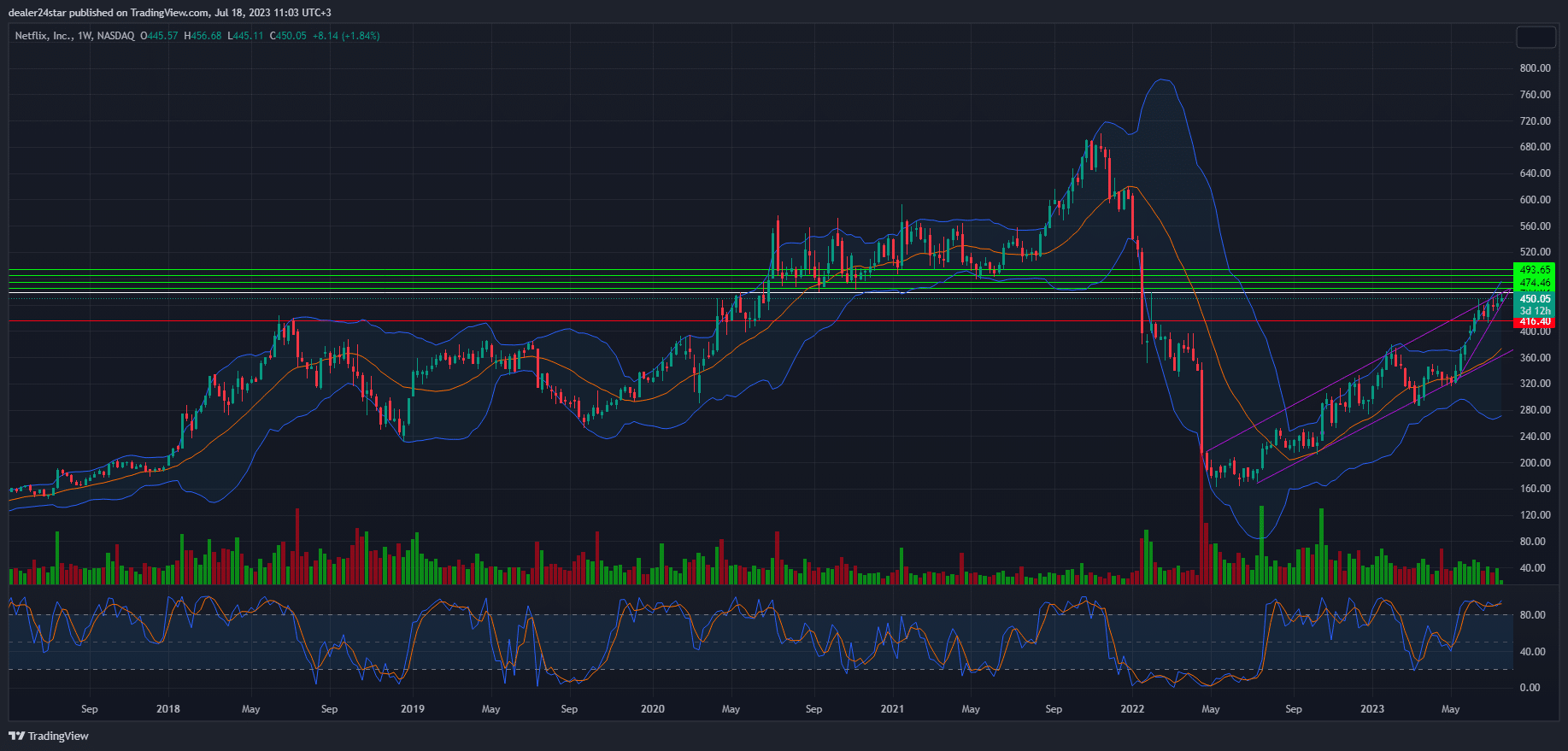

Netflix Long (Buy)

Enter At: 458.45

T.P_1: 465.09

T.P_2: 474.46

T.P_3: 484.47

T.P_4: 493.65

S.L: 416.40

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.