The resurgence of the El Nino weather phenomenon is expected to boost soybean production in South America, providing much-needed relief from this season’s severe drought in the lower latitudes of the continent. Meteorologists and grain analysts predict that the mild to moderate El Nino pattern, characterized by elevated temperatures in the Pacific Ocean’s surface waters, would have a positive impact on farmers’ prospects in Brazil’s Rio Grande do Sul state and neighboring Argentina.

This forecast has far-reaching implications for the global soybean market. While Brazil has the potential to achieve a record soybean production of around 160 million metric tons in the 2023/24 cycle, Argentina’s soy output could nearly double, as projected by analysts.

According to Safras & Mercado analyst Luiz Roque, this El Nino pattern is exhibiting a typical behavior, resulting in above-average rainfall in Southern Brazil and below-average rainfall in the North and Northeast. As Argentina receives much-needed rainfall, Roque anticipates soy output to reach 45-48 million tons, compared to 25 million tons in the preceding year.

Should favorable weather conditions persist, Brazil, Argentina, and Paraguay are poised to dominate global export markets, projected to account for nearly a third of the world’s supplies in 2023/24, estimated at 169 million tons by the USDA.

However, there are regional variations in the impact of El Nino. Safras & Mercado’s Roque suggests that although Brazil’s soybean production could Potentially reach 163 million tons in the upcoming season, this projection may be revised downwards. Indications suggest that the northern half of Brazil, including the Centerwest and Southeast regions, may experience below-average rainfall starting in November. While not indicating crop failure, this shift in weather patterns raises concerns.

The anticipation of another prosperous year could keep soybean prices subdued, potentially discouraging the expansion of soybean cultivation. The President of Aprosoja Brasil, Antonio Galvan, highlights that low prices may dissuade growers from increasing their plantings as in previous years. Additionally, the prospect of reduced rainfall in northern Brazil could impact overall output.

According to meteorologist Desiree Brandt, Brazil’s northeast, which includes the Matopiba agricultural border, is frequently hit by unpredictable weather. Despite not being optimal for crops, this season’s weather is predicted to be better than the severe crop losses incurred during the 2015–16 drought.

El Nino’s influence extends to spring rains in the Centerwest region, coinciding with the onset of soy planting. Meteorologist Marco Antonio dos Santos warns that these rains could Potentially delay sowing activities.

As the situation unfolds, the ramifications of El Nino on South American soy production will reverberate through global grain markets, influencing supply, prices, and trade dynamics.

On a global scale, Chicago soybean prices have surged to a one-month high, while corn has also seen an increase, driven by the impact of hot and dry weather conditions on crops. The United States, a major soybean producer, is experiencing stress on its crops due to extreme temperatures. This situation has led to reduced production estimates by advisory service Pro Farmer, forecasting soybean and corn production below the USDA’s projections.

While U.S. soybean output may decline, China’s strong demand for soybeans is confirmed by private sales of 120,000 metric tons of U.S. soybeans for delivery to China. This robust demand is contributing to the upward momentum of soybean prices.

However, the El Nino phenomenon is expected to have contrasting effects on northern Brazil, where below-average rainfall could impact crop yields. The return of El Nino has also spurred discussions on the boost to South American soybean production, with Brazil and Argentina poised to become dominant players in the global export market.

The global grain market landscape remains intricate and sensitive to climatic conditions. As El Nino’s impact continues to unfold, stakeholders in the agricultural and trading sectors are keeping a vigilant eye on crop prospects, supply dynamics, and market trends.

Soybean Production and the Climate Challenge:

Soybean, a vital agricultural commodity with applications ranging from vegetable oil to tofu, holds a global presence in various regions. The worldwide production of soybeans is projected to surge to 410.6 million metric tons in 2023/24, marking a substantial increase of 40.2 million metric tons from the preceding year. This growth is attributed to escalating demand for soybean-based products, coupled with favorable weather conditions in major production hubs.

The intricate relationship between soybean production and global warming underscores the critical role climate plays in shaping agricultural landscapes. The anticipated impacts of global warming, characterized by elevated temperatures and shifting precipitation patterns, are poised to alter the suitability of land for soy cultivation.

For instance, a study by the International Food Policy Research Institute underscores the potential for global warming to slash soybean yields by up to 10% by 2050. The study also underscores the unevenness of this impact, with certain regions facing more severe repercussions than others.

The ramifications of global warming on soybean production necessitate proactive adaptation strategies to mitigate its effects. Some additional insights to consider include:

1. Brazil, the United States, Argentina, India, and China stand as the top five soybean-producing countries globally.

2. The water-intensive nature of soybean cultivation intersects with projections of increased water stress due to global warming.

3. Soybeans possess nitrogen-fixing properties, benefiting soil fertility. However, the escalating nitrogen losses from soils due to global warming could negatively influence soybean production.

The intricate relationship between global warming and soybean production underscores the complexity of this issue, and substantial knowledge gaps persist. However, harnessing effective adaptation strategies is paramount to counter the implications of climate change on this pivotal crop. The continued evolution of this narrative beckons collaborative efforts to navigate the challenges that lie ahead.

Navigating the Nexus of Climate and Agriculture: Illuminating the Global Food Shortage Challenge

As we stand at the intersection of climate shifts and agricultural landscapes, an unsettling reality looms ahead – a colossal food shortage that threatens to reshape our global sustenance. This impending crisis casts a shadow over the very foundation of food production, challenging our capacity to meet the nourishment needs of billions.

The ramifications are stark: the production of essential agricultural goods, our lifeline to sustenance, faces an unprecedented threat, one that could cascade into a global food shortage of monumental proportions. It’s a scenario that beckons us to ponder the fragility of our intricate agricultural networks, as they brace for the impact of climate-driven disruptions.

This challenge, however, is not borne equally. As the wheels of this scarcity start turning, the first to feel its reverberations will be the nations less equipped to buffer its blows – the impoverished countries scattered across Africa, the Middle East, and Southeast Asia. These regions, already grappling with multifaceted challenges, now stare at the prospect of further adversity, where securing basic nourishment could prove an arduous endeavor.

The timeline of this crisis unfolds with an air of uncertainty. The timeline – a spectrum that stretches from a few months to a year and a half – will bear the weight of the world’s attention as we reckon with its consequences. In the meantime, the implications ripple far beyond the realms of sustenance alone, infiltrating economies, societies, and geopolitics.

Yet, amid this unnerving backdrop, there’s a glimmer of hope – a recognition that this period, while tumultuous, will eventually wane. A collective dedication to adaptation, innovation, and collaboration could guide us through these turbulent waters, steering global food production back to familiar horizons.

As we confront this thought-provoking juncture, we are compelled to reimagine resilience. The impending global food shortage impels us to chart new trajectories that transcend borders and ideologies, forming a united front against a challenge that recognizes no boundaries.

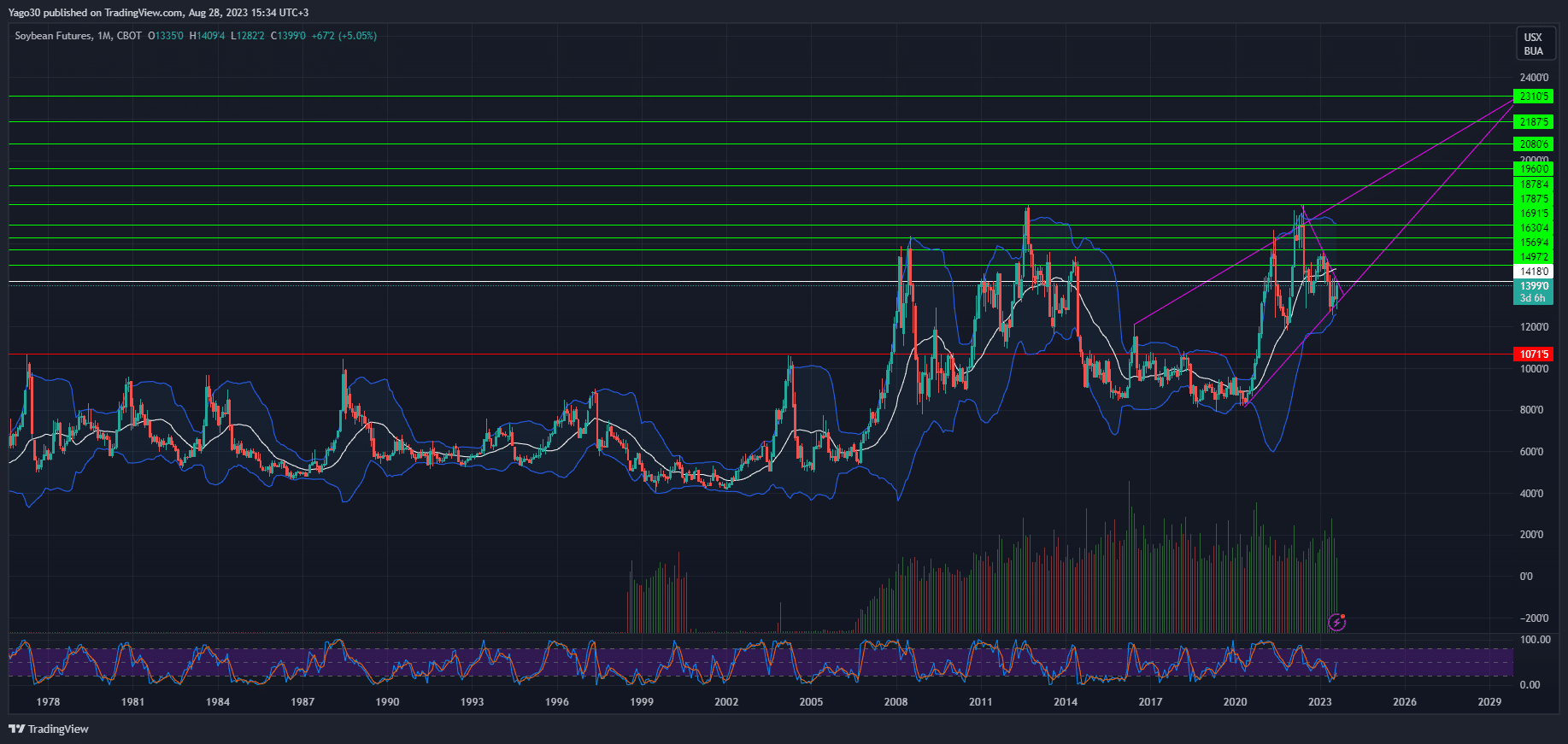

Soybean Long (Buy)

Enter At: 1418.00

T.P_1: 1497.25

T.P_2: 1569.50

T.P-3; 1630.50

T.P_4: 1691.625

T.P_5: 1787.625

T.P-6: 1878.50

T.P_7: 1960.00

T.P_8: 2080.75

T.P_9: 2187.625

T.P-10: 2310.625

S.L: 1071.625

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.