The Nasdaq 100 index is preparing to adjust the weight of its 100 components. Seven of the stocks, including Microsoft, Apple, Nvidia, Tesla, Google parent Alphabet, Meta Platforms, and Amazon, currently hold over half of the index’s weight. Unfortunately, these magnificent seven stocks experienced a decline on Monday, following this information.

To address the over-concentration in the index, a special rebalance will take place before the market opens on Monday, July 24th. The weighting changes will be announced on Friday, July 14th, but no stocks will be added or removed.

To be clear, the Nasdaq 100 is made up of the 100 largest Nasdaq components that are not financial. Although there are safeguards against overconcentration, the index is weighted according to market capitalization.

Nasdaq 100 Weights Of Magnificent Seven

| Company | Ticker | Weight | Market cap, in trillions (as of July 11) |

|---|---|---|---|

| Microsoft | MSFT | 12.9% | $2.459 |

| Apple | AAPL | 12.5% | $2.946 |

| Nvidia | NVDA | 7.0% | $1.042 |

| Amazon | AMZN | 6.9% | $1.322 |

| Tesla | TSLA | 4.5% | $0.849.44 |

| Meta Platforms | META | 4.3% | $0.761.7 |

| Alphabet | GOOGL | 3.7% | $1.491 |

| Alphabet | GOOG | 3.7% |

The Nasdaq 100 index is dominated by the seven largest companies, which account for 55% of the index. However, it is expected that this combined weighting will be reduced soon, and there may be notable shifts within these seven giants.

While market capitalization is the primary factor for determining the weights, it is not the only one. As of July 7, Microsoft stock has the largest weight at 12.9%, followed closely by Apple with a weight of 12.5%, despite having a market cap of $2.999 trillion, compared to Microsoft’s $2.51 trillion.

Google stock has a 7.4% weighting, taking into account the combined share classes of GOOGL and GOOG. Meanwhile, Nvidia stock has a weight of 7% in the Nasdaq 100, thanks to its $1.05 trillion market cap. Surprisingly, this is slightly higher than Amazon stock, which has a market cap of $1.33 trillion, yet a weight of 6.9%.

Tesla stock and Meta Platforms complete the top-seven members, with weights of 4.5% and 4.3%, respectively. For the entire Nasdaq composite, Apple stock has an 11.4% weighting, while Microsoft is at 9.5%. Google stock is at 5.8%, while Amazon and Nvidia are at 5.1% and 4%, respectively. Tesla stock has a 3.3% share, and Meta stock is at 2.8%.

It is expected that there will be some reduction in the weightings of the top five companies (Apple, Microsoft, Google, Amazon, and Nvidia) in the Nasdaq 100 index, as per the methodology.

Their combined weight will be set to 38.5%, which is less than their current combined weight of 46.7%. This also indicates that there may be a slight decrease in the weight of TSLA stock. The official reweightings are expected to be released on Friday, and it may also include an increase in the weightings of other stocks.

The year 2023 has been a great one for the Invesco – QQQ ETF, as it has seen an increase of 37.5% in value through July 7th, tracking the big-cap Nasdaq index. However, the First Trust Nasdaq 100 Equal Weighted Index ETF (QQEW), which gives equal weight to all 100 stocks, has only seen an increase of 18.8%.

This performance gap is mostly caused by the enormous moves made by mega-caps this year. The value of Nvidia stock has nearly quadrupled (191%), META stock has increased 141%, and Tesla stock has increased 123%. In addition, Apple stock has increased by 47%, Microsoft stock has increased by roughly 41%, and Amazon stock has increased by a notable 54.5%. The price of Google stock has also increased by a respectable 35%.

However, there is some concern that this handful of names is distorting the health of the overall stock market, which is likely why a special rebalancing is being planned.

The Nasdaq 100 special rebalancing could cause stock allocation shifts among ETFs such as the QQQ and mutual funds that track the index. Therefore, there could be some one-off gains or losses, possibly as a result of the planned changes that will be announced on July 14th.

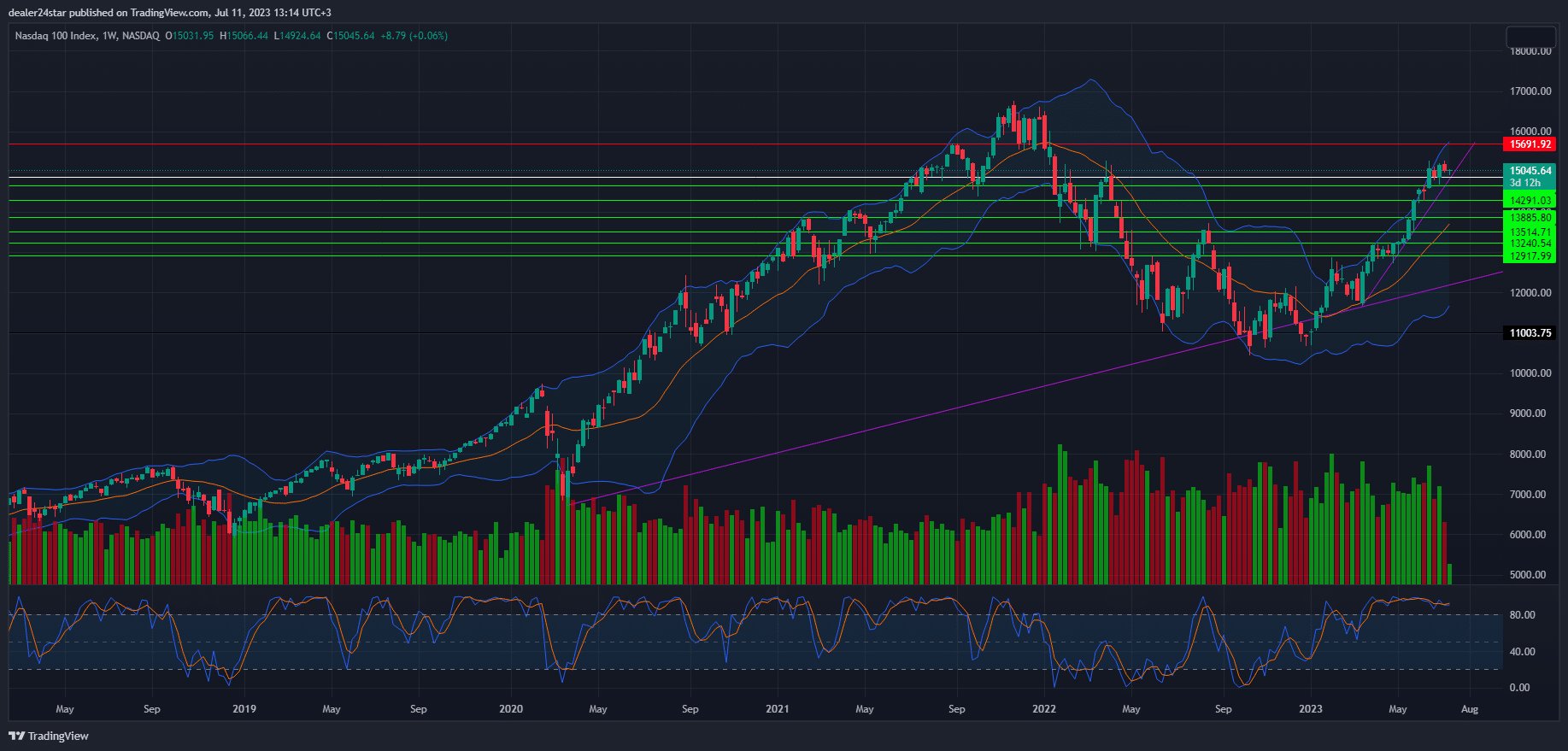

Nasdaq 100 Short (Sell)

Enter At: 14875.71

T.P_1: 14664.04

T.P_2: 14291.03

T.P_3: 13885.80

T.P_4: 13514.71

T.P_5: 13240.54

T.P_6: 12917.99

S.L: 15691.92

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.