As a new investor, understanding stock market analysis techniques is essential for achieving success in your investments. With a wide range of techniques available, it can be overwhelming to know where to start. In this article, I will introduce you to some of the most crucial techniques that can help you evaluate companies, spot trends, predict market behavior, and protect your capital.

Key Takeaways:

- Stock market analysis techniques are crucial for new investors seeking investing success.

- Fundamental analysis evaluates company financials to assess investment potential.

- Technical analysis studies historical price data to spot patterns and trends.

- Trend following strategies help investors ride the wave of market momentum.

- Value investing focuses on finding undervalued stocks for long-term growth.

Fundamental Analysis: Evaluating Company Financials for Stock Selection

Fundamental analysis is a powerful tool that allows investors to evaluate a company’s financial health and determine its investment potential. By examining crucial factors such as revenue, earnings, debt, and market position, investors can gain valuable insights into a company’s stability and growth prospects.

Financial health is a key aspect of fundamental analysis. It helps investors assess the overall strength and viability of a company, enabling them to make informed investment decisions. By analyzing a company’s financial statements, including income statements, balance sheets, and cash flow statements, investors can understand its profitability, liquidity, and solvency.

When evaluating a company’s financial health, investors often rely on fundamental indicators like the price-to-earnings ratio (P/E), earnings per share (EPS), and return on equity (ROE). These indicators provide crucial information about a company’s valuation, profitability, and efficiency.

“Fundamental analysis is like peering into the DNA of a company. It helps me understand the underlying factors that contribute to its success or failure.”

By conducting fundamental analysis, investors can assess a company’s investment potential. They can identify undervalued stocks with promising growth prospects or avoid overvalued stocks that may be at risk of a price correction. Fundamental analysis provides a solid foundation for stock selection, helping investors choose companies with the potential for long-term profitability and capital appreciation.

| Fundamental Analysis | Benefits |

|---|---|

| Evaluates company financial health | Identifies stable and growing companies |

| Assesses investment potential | Helps in stock selection |

| Provides insights into valuation | Leads to long-term profitability |

Understanding the financial health of a company is essential for investors seeking sustainable and profitable investments. With fundamental analysis, investors can make informed decisions based on thorough assessments of a company’s financials, enabling them to navigate the stock market with confidence.

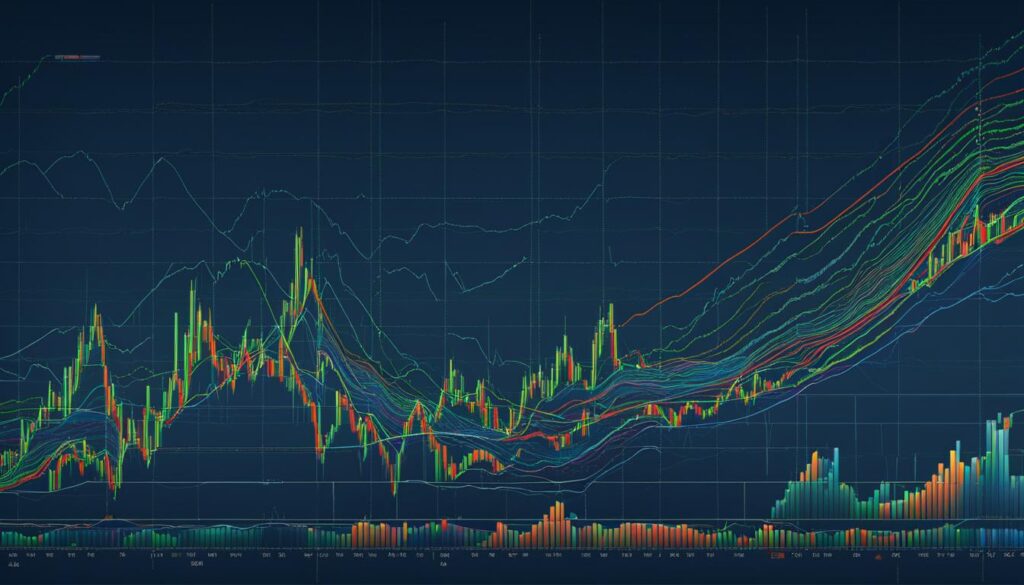

Technical Analysis: Spotting Patterns and Trends in Stock Price Charts

When it comes to analyzing the stock market, technical analysis plays a critical role in identifying patterns and trends in stock price charts. By studying historical price data and using various technical indicators, traders and analysts can gain valuable insights into market sentiment and make informed trading decisions.

Historical price data provides a wealth of information about a stock’s past performance and can help predict its future direction. By analyzing charts, traders can identify recurring patterns, support and resistance levels, and trend lines that can guide their trading strategies.

“Technical analysis is like studying the DNA of a stock. It allows us to understand its past behavior and anticipate its future actions.” – John Murphy, Technical Analyst

One of the fundamental principles of technical analysis is that history tends to repeat itself. By recognizing patterns such as head and shoulders, double tops, or triangles, traders can anticipate potential price movements and time their trades accordingly.

Technical indicators such as moving averages, relative strength index (RSI), and Bollinger Bands are widely used tools in technical analysis. These indicators provide valuable insights into market momentum, overbought or oversold conditions, and potential trade entry and exit points.

Key Technical Indicators:

1. Moving Averages: Moving averages smooth out price data and help identify the overall trend. Traders often use the 50-day and 200-day moving averages to gauge the stock’s long-term trend.

2. Relative Strength Index (RSI): The RSI measures the speed and change of price movements. It helps identify overbought or oversold conditions, indicating potential reversals in price.

3. Bollinger Bands: Bollinger Bands consist of a middle band (simple moving average) and upper and lower bands that represent volatility. The bands expand when volatility increases and contract when volatility decreases, signaling potential price breakouts or consolidations.

Benefits of Technical Analysis:

- Identifying trends and patterns in stock price charts

- Timing entry and exit points for trades

- Understanding market sentiment

- Determining support and resistance levels

By incorporating technical analysis into their investment strategy, traders and investors can gain a deeper understanding of stock market dynamics and improve their trading decisions. However, it is essential to combine technical analysis with other forms of analysis, such as fundamental analysis, for a comprehensive view of a stock’s investment potential.

| Pros | Cons |

|---|---|

| Effective in identifying short-term price movements | Reliance on historical data may not accurately predict future performance |

| Provides clear entry and exit signals for trades | Subject to interpretation and may lead to false signals |

| Helps traders manage risk by setting stop-loss orders | Does not consider fundamental factors that can impact a stock’s value |

Trend Following Strategies: Riding the Wave of Market Momentum

Trend following strategies are an effective approach to capitalize on market momentum and maximize gains. By identifying trends in stock prices, investors can align their trades with the prevailing market direction, increasing the potential for profitability. One commonly used technique in trend following strategies is the utilization of technical indicators such as moving averages or trendlines to confirm the existence of a trend and pinpoint optimal entry and exit points.

By following the trend, investors can ride the wave of market momentum, amplifying their returns as the trend continues. However, it is essential to remain disciplined and execute risk management strategies to mitigate potential losses in case of a trend reversal.

When implementing trend following strategies, it is important to understand that not all trends are created equal. Some trends may be short-lived, while others can last for an extended period. Therefore, it is crucial to analyze the strength and sustainability of a trend before committing capital.

The Benefits of Trend Following Strategies

- Trend following strategies provide a systematic approach to trading, removing emotions from investment decisions.

- They allow investors to capture significant price movements and generate substantial profits.

- By following the prevailing market trend, investors align their trades with the forces driving the market, increasing the probability of favorable outcomes.

- Trend following strategies are versatile and can be applied in various markets and asset classes, including stocks, commodities, and currencies.

However, it is important to note that trend following strategies may not be suitable for all investors. The success of these strategies relies on accurate trend identification, proper risk management, and the ability to act swiftly when necessary.

Value Investing: Spotting Hidden Gems for Long-Term Growth

Value investing is a tried-and-true strategy for investors looking to capitalize on undervalued stocks and achieve long-term growth. By carefully analyzing a company’s financials, value investors can identify hidden gems in the market that have the potential to deliver significant returns over time.

To be successful in value investing, patience is key. This investment approach requires a long-term perspective, as it may take time for the market to recognize the true value of a stock. Value investors are not concerned with short-term price fluctuations but rather focus on the intrinsic value of a company.

“Price is what you pay; value is what you get.” – Warren Buffett

Warren Buffett, one of the most successful value investors of all time, famously said, “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.” This quote highlights the importance of finding companies with strong fundamentals and long-term growth potential, even if they may be currently undervalued by the market.

When practicing value investing, thorough research is crucial. Value investors meticulously analyze a company’s financial statements, including its balance sheet, income statement, and cash flow statement. They look for indicators of undervaluation, such as low price-to-earnings (P/E) ratios, high earnings per share (EPS), or a sizable gap between a company’s market value and its intrinsic value.

Benefits of Value Investing:

- Opportunity to buy stocks at a discount: Value investors seek out stocks that are trading below their intrinsic value, providing an opportunity for potential capital appreciation.

- Long-term growth potential: By investing in undervalued stocks, value investors position themselves to benefit from market recognition of the company’s true value, which can lead to substantial long-term growth.

- Lower downside risk: The focus on intrinsic value and solid fundamentals can offer some downside protection, as companies with strong financials are generally more resilient during market downturns.

Successful value investing requires discipline, patience, and a thorough understanding of company fundamentals. However, the potential for long-term growth and the opportunity to uncover hidden gems in the market make value investing a compelling strategy for investors seeking sustainable returns.

| Advantages of Value Investing | Disadvantages of Value Investing |

|---|---|

| Higher potential for long-term growth | Requires patience and a long-term perspective |

| Lower downside risk due to strong fundamentals | Market recognition of value may take time |

| Opportunity to buy stocks at a discount | Requires thorough research and analysis |

Risk Management Techniques: Safeguarding Your Capital in Stock Market Investments

Risk management techniques are crucial in stock market investments to minimize potential losses and protect capital.

Diversification plays a vital role in risk management. By spreading your investments across different sectors, industries, and asset classes, you can reduce the impact of any single investment on your overall portfolio. This helps to protect your capital from significant losses that may arise from a downturn in a particular sector or company.

Setting realistic investment goals is another important aspect of effective risk management. By understanding your financial objectives, timeline, and risk tolerance, you can tailor your investment strategy to align with your personal circumstances. This approach allows you to make informed decisions that balance the potential for returns with the need to minimize losses.

Thorough research is essential before making any investment. By analyzing company fundamentals, industry trends, and market conditions, you can gain valuable insights that inform your investment decisions. This in-depth research helps you identify potential risks and adjust your portfolio accordingly, ensuring you are well-prepared to face any challenges that may arise.

Using stop-loss orders and practicing position sizing are additional risk management techniques that can significantly protect your capital. A stop-loss order allows you to set a predetermined price at which you will sell a stock if it reaches that level. This helps to limit your potential losses and ensures that you exit a position before the decline becomes significant.

Position sizing, on the other hand, involves determining the appropriate amount of capital to allocate to each investment based on its risk level. By diversifying your position sizes, you can distribute your capital in a way that aligns with your risk tolerance and objectives, reducing the potential impact of any single investment on your overall portfolio.

In conclusion, implementing effective risk management techniques is essential to safeguard your capital in stock market investments. By diversifying your portfolio, setting realistic goals, conducting thorough research, and using stop-loss orders and position sizing, you can minimize losses and protect your capital while seeking profits in the dynamic world of the stock market.

FAQ

What are the different techniques for stock market analysis?

The different techniques for stock market analysis include fundamental analysis, technical analysis, trend following strategies, value investing, sentiment analysis, options analysis, quantitative analysis, swing trading, sector rotation, and risk management techniques.

What is fundamental analysis?

Fundamental analysis is a technique that helps investors evaluate a company’s financial health and determine its investment potential. It involves examining factors such as revenue, earnings, debt, and market position to gain insights into the company’s stability and growth prospects.

What is technical analysis?

Technical analysis is a technique that studies historical price and volume data to uncover patterns, trends, and potential future price directions. Traders and analysts use various technical indicators like moving averages, relative strength index (RSI), and Bollinger Bands to interpret stock charts.

What is trend following?

Trend following is a strategy that focuses on riding the waves of market momentum to maximize gains. By identifying trends in stock prices and using technical indicators like moving averages or trendlines, investors can jump in on trades that align with the prevailing trend and ride it until signs of reversal.

What is value investing?

Value investing is a strategy that aims to find stocks priced lower than their true worth. By meticulously examining a company’s financials and identifying undervalued stocks, value investors seek to benefit from market recognition of the company’s value, leading to price appreciation over time.

Why is risk management important in stock market investments?

Risk management techniques are crucial in stock market investments to minimize potential losses and protect capital. Diversification, setting realistic investment goals, conducting thorough research, using stop-loss orders, and position sizing are important aspects of effective risk management.

Source Links

- https://fastercapital.com/content/Stock-Market–Mastering-the-Stock-Market–A-Guide-for-New-Investors.html

- https://www.investopedia.com/articles/basics/06/invest1000.asp

- https://www.candlesticktrader.co.uk/blog/2/mastering-stock-market-analysis/

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.