Palladium is a rare metal belonging to the Platinum group, which also includes metals such as platinum, rhodium, osmium, ruthenium, and iridium. These metals are known for their high heat and corrosion resistance, making them valuable in various industries.

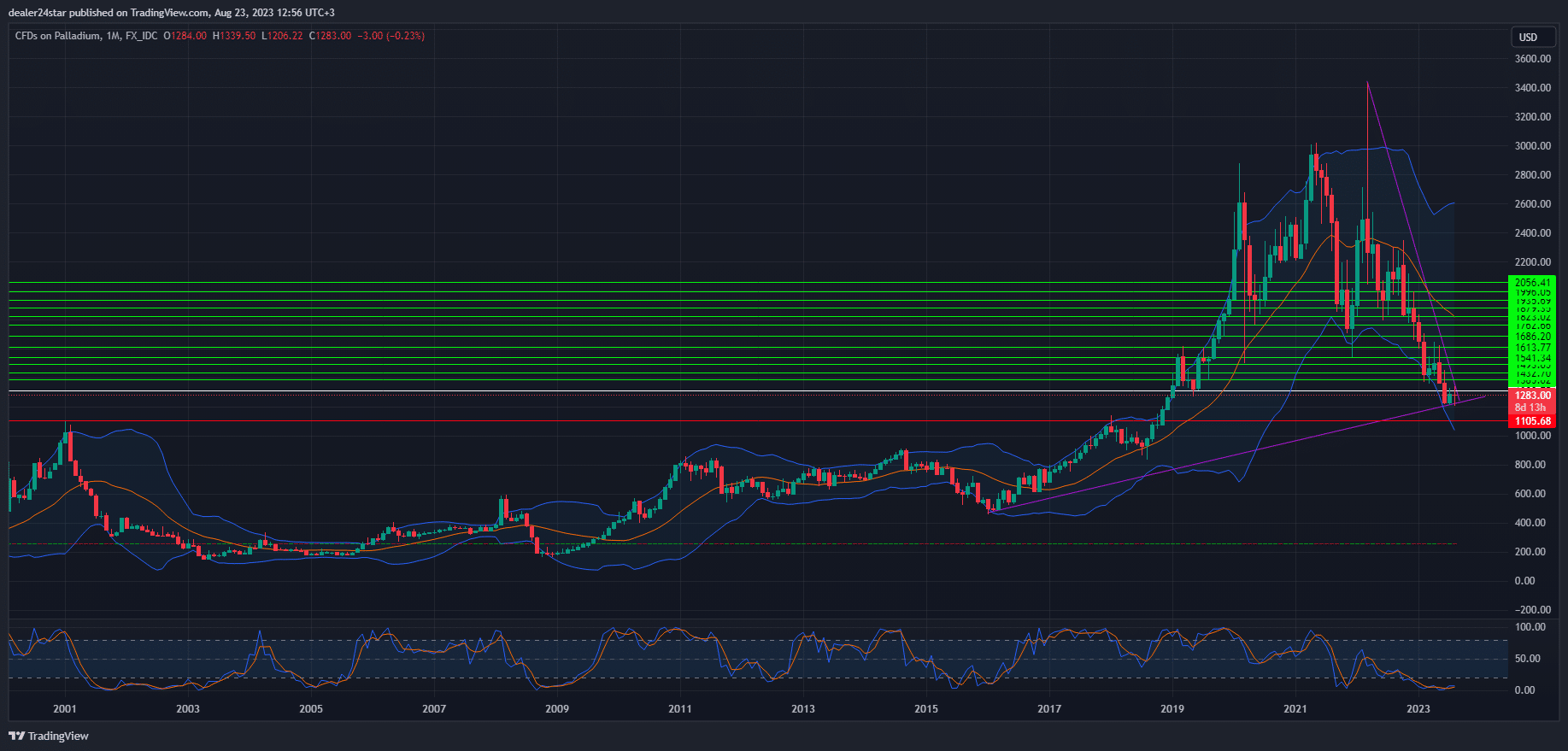

Unfortunately, during the first half of 2022, palladium’s value significantly decreased by more than 32%, making it one of the worst-performing commodities of that period. In my July 6 report on the precious metals sector, I highlighted how palladium continued to decline in Q2 and the first six months of 2023. Additionally, I noted that rhodium, a PGM only traded in the physical market, experienced an even more significant percentage drop of nearly 69% over the first six months of 2023. As of June 30, rhodium was valued at $3,700 per ounce, while nearby palladium futures were valued at $1,222 per ounce.

Although prices have slightly increased in Q3, they remain close to the year’s Q2 closing levels and lows.

Palladium production is low in Russia, and despite it being the leading producer of precious metal, the annual output of palladium in Russia is not as high as one might expect. When comparing the production levels of the world’s leading palladium-producing countries in 2022, it is clear that there is room for improvement.

Find more statistics at Statista

According to the chart, Russia and South Africa are the top producers of palladium in the world. Together, they produced 80% of the total 210 tons of palladium in 2022, with Russia producing slightly more than South Africa.

Palladium is mainly produced in Russia as a byproduct of nickel mining in the Norilsk region of Siberia. In 2022, gold was the leading precious metal produced globally, with a total output of 3,612 metric tons. Palladium production, on the other hand, accounted for less than 6% of the overall gold output.

The ongoing war in Ukraine, sanctions imposed on Russia, and Russia’s retaliatory actions against countries supporting Ukraine are all contributing to the instability of palladium supplies. Additionally, South Africa is part of the BRICS group, which controls 80% of the world’s palladium supplies through their cooperation.

Although the price of palladium has decreased, and the trend in August 2023 remains bearish, it is approaching a crucial technical support level. Given the limited supply and industrial demand, it is anticipated that the price of palladium will soon reach its lowest point and begin to recover.

Palladium has many industrial uses:

Despite being a precious metal, palladium plays a crucial role in various industrial sectors. Its unique properties make it ideal for use in the electronics and automotive industries, particularly in reducing exhaust fumes. Most of the palladium consumption is for catalytic converters. Palladium is also necessary for producing jewelry, dentistry tools, watches, aircraft spark plugs, surgical instruments, and blood sugar strips.

The goal for net zero and the electrification of vehicles are posing long-term challenges for palladium. Even if the goals for 2030 and 2040 are not achieved, there will be an imbalance in supply and demand by the turn of the decade due to the absence of scalable uses for palladium in electric vehicles. If optimistic goals are achieved, the automotive industry, which accounts for more than 80% of palladium demand, might become a net provider of the metal by 2040. Currently the second-largest producer of refined palladium, the scrapped autocats industry has the potential to overtake South Africa and take a third position if its problems are rectified.

These long-term concerns have been affecting market sentiment, causing Palladium to struggle. From the beginning of the year to the start of August, palladium prices fell by 34%, and by 56% from the peak in March 2021 (excluding the early 2022 spike). There has been recent activity toward a challenge of $1,300, which we will cover more in next month’s review.

Palladium Long (Buy)

Enter At: 1308.75

T.P_1: 1385.02

T.P_2: 1432.70

T.P_3: 1493.05

T.P_4: 1541.34

T.P_5: 1613.77

T.P_6: 1686.20

T.P_7: 1762.66

T.P_8: 1823.02

T.P_9: 1879.35

T.P_10: 1935.69

T.P_11: 1996.05

T.P_12: 2056.41

S.L: 1105.68

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.