Despite an uncertain economic outlook, oil prices rose again on Thursday as Saudi Arabia and Russia decided to prolong output limits through the end of 2023.

Goldman Sachs Commodities Research predicts that oil supply cuts could lead to Brent crude surging to as high as $107 per barrel in 2024. The impact of oil prices on energy stocks is significant, particularly in the oil and gas industry.

Yousef M Alshammari, the chief executive and head of oil research at CMarkits, observed that energy stocks experienced a rise in August due to the rally in oil prices. Brent crude is now trading 23% higher than its July levels and is expected to rise even further towards the end of the year, particularly due to the extension of the Saudi-Russian voluntary cuts. As a result, the financial performance of energy companies is likely to improve as we approach Q4 this year.

The energy sector is currently the best-performing industry of the S&P 500 index this quarter. After Russia’s invasion of Ukraine led to an increase in oil prices last year, it was the only sector to finish with gains.

Sophie Lund-Yates, the lead equity analyst at Hargreaves Lansdown, noted that the soaring oil price is driving up the share prices of major oil companies. When oil prices rise, oil majors benefit from increased free cash flow and can invest further in renewable research and development. However, not all oil and gas companies are focused on future-thinking energy solutions with the same level of enthusiasm.

Lund-Yates pointed out that the market recognizes that oil prices are cyclical and that they will eventually turn. Therefore, the changes made by companies such as ExxonMobil, BP, and Shell due to the rising oil prices have not been overly dramatic. The prices of these companies will continue to be influenced by developments from OPEC+. If there is a further extension of production cuts, oil prices could continue to climb. However, the opposite is also true.

Russ Mould, the investment director at AJ Bell, explained that the higher the oil price Goes, the better oil stocks tend to perform. Higher crude prices lead to higher profits and usually Higher cash flow, which can result in more generous dividends or buyback schemes. However, he also noted that oil companies often have downstream operations as well, and oil is an input cost and feedstock for those refining petrochemical and chemical operations. Therefore, higher prices can harm profit margins in these operations.

Furthermore, oil majors may also be exposed to gas, as shown by the drop in Europe’s Dutch TTF prices this year following the 2022 spike caused by the Russian invasion of Ukraine.

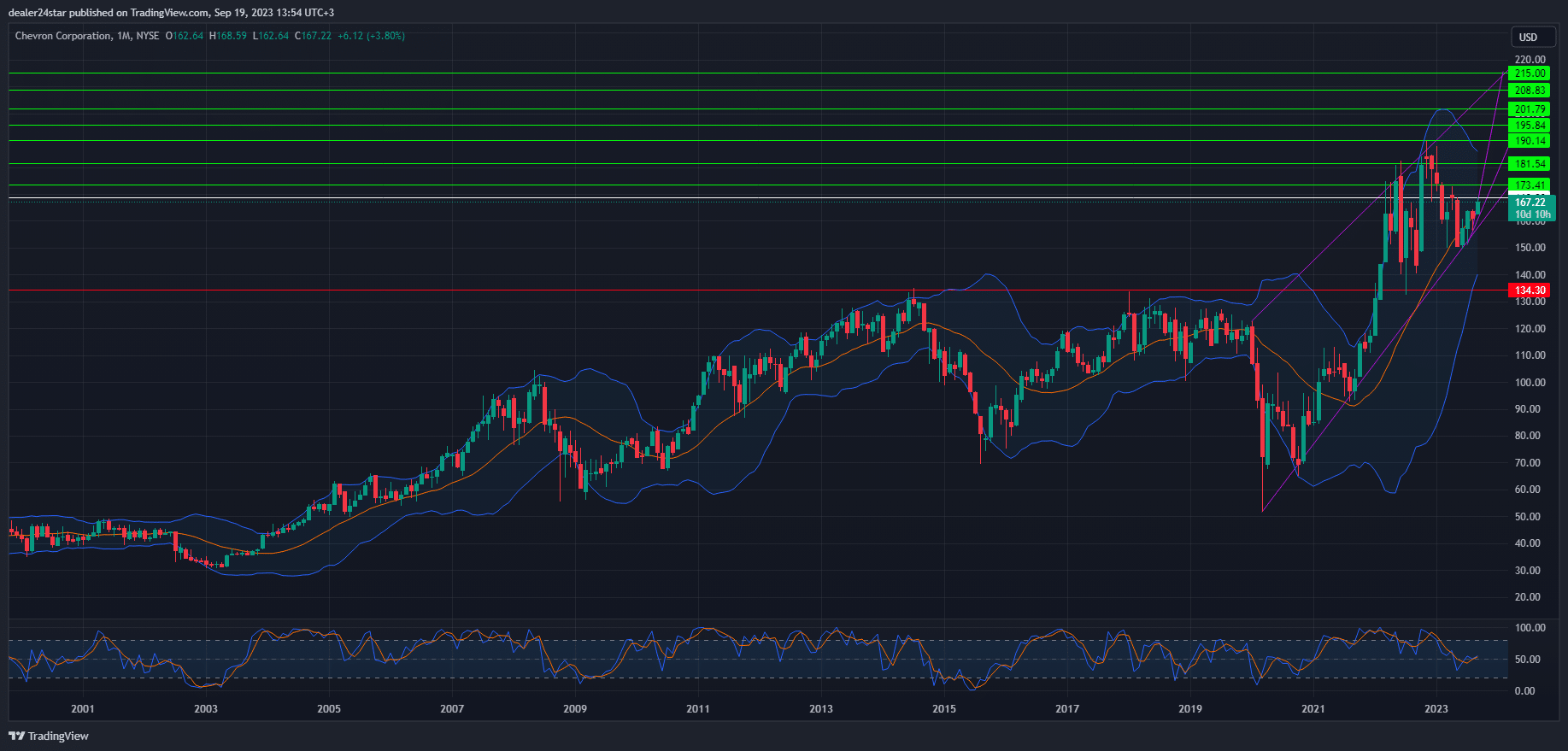

Chevron Long (Buy)

Enter At: 168.80

T.P_1: 173.41

T.P_2: 181.54

T.P_3: 190.14

T.P_4: 195.84

T.P_5: 201.79

T.P_6: 208.83

T.P_7: 215.00

S.L: 134.30

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.