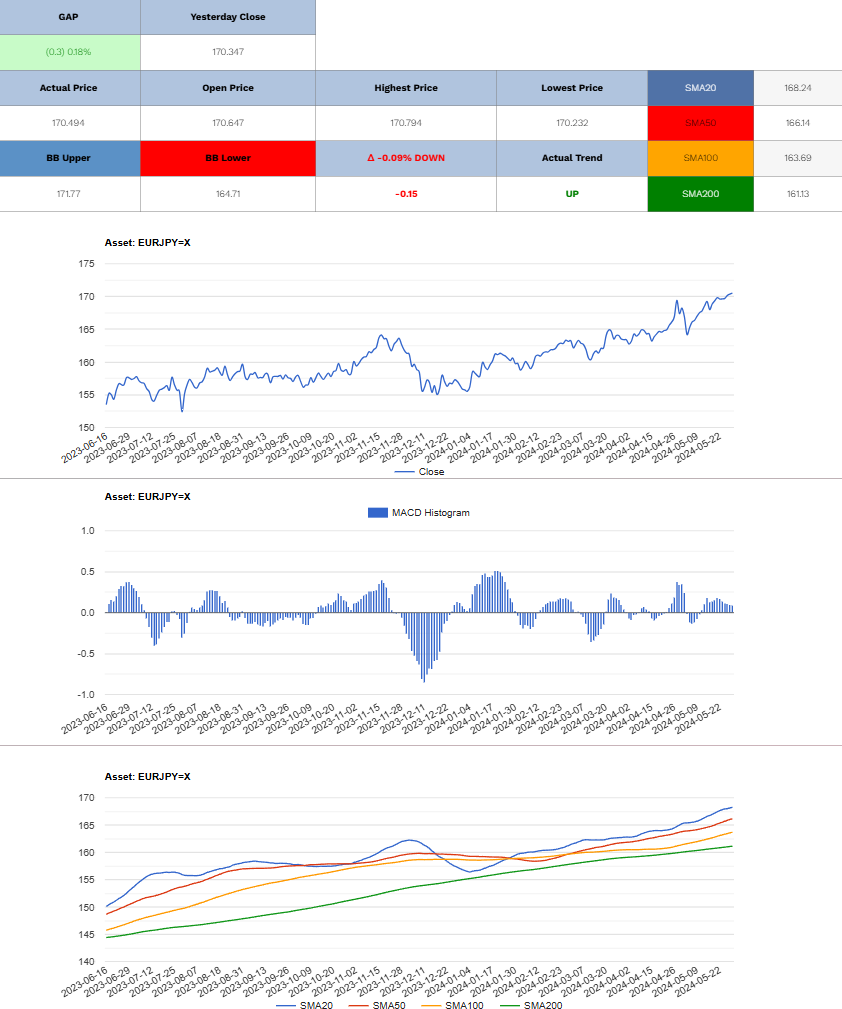

The value of the Japanese yen (JPY) has been steadily decreasing compared to the euro (EUR). It’s getting close to its all-time low of 171.56 yen per euro, which happened in April. This drop is caused by a few things, like the different approaches to interest rates by the Bank of Japan (BOJ) and the European Central Bank (ECB), and how interest rates are changing around the world.

Interest Rate Divergence

The ECB’s cautious approach to reducing interest rates contrasts sharply with the BOJ’s recent policy adjustments. Despite ending its negative interest rate policy in March, the BOJ’s rates remain significantly lower than those in the Eurozone. This disparity is a key factor driving the yen’s weakness against the euro.

ECB officials have been signaling a gradual approach to rate cuts, with some members advocating for caution due to persistent inflationary pressures. The eurozone’s inflation is expected to rise slightly to 2.5% in May from 2.4% in April, reflecting ongoing economic challenges.

Carry Trade Dynamics

Low volatility in the yen has bolstered its use in carry trades, where investors borrow in low-yielding currencies to invest in higher-yielding assets. This strategy has been particularly attractive given the current interest rate environment. Even with Japan’s 10-year government bond yield at its highest in over a decade, it remains significantly lower than equivalent yields in Europe, enhancing the appeal of the euro for such trades.

ECB’s Rate Cut Outlook

The ECB’s stance on rate cuts remains a point of contention among policymakers. While there is a consensus on the need for a rate cut in June, further reductions are uncertain. ECB Governing Council member Francois Villeroy de Galhau has advocated for a potential rate cut in both June and July, emphasizing a cautious approach to ensure economic stability.

In contrast, ECB board member Isabel Schnabel has warned against an aggressive rate-cut cycle, noting that despite a decline in some price pressures, domestic and service inflation remains stubbornly high. This debate within the ECB adds an element of uncertainty to the euro’s trajectory but provides it with underlying support due to the anticipation of continued relatively higher rates compared to Japan.

Yen Intervention Risks

The yen’s rapid depreciation against both the euro and the dollar has raised concerns about potential intervention by Japanese authorities. Suspected interventions in late April and early May have tempered the yen’s decline, but ongoing weakness continues to pose a risk.

Economic Assessments

Recent economic data from Japan indicates a mixed outlook. The BOJ’s policy board member Seiji Adachi has emphasized the need for careful policy adjustments to avoid derailing the economy’s recovery. While Japan’s consumer price index (CPI) has consistently exceeded the 2% target, maintaining accommodative monetary conditions is deemed essential for sustained growth.

On the European front, robust wage growth and sticky service inflation are providing support for the euro. The ECB’s cautious approach to rate cuts acts as a buffer against potential economic downturns, further strengthening the euro against the yen

Market Sentiment and Future Outlook

Market sentiment remains bullish on the euro against the yen, with some investors speculating on further gains. Options trading data shows positions for the euro-yen pair at higher strike prices, indicating expectations of continued strength in the euro.

The EUR/JPY pair remains firm around the psychological level of 170.00, with the euro benefiting from both fundamental and speculative support. As the ECB navigates its rate-cut decisions and the BOJ maintains a cautious stance, the yen is likely to face ongoing pressure unless there is a significant shift in economic conditions or policy direction.

In summary, the yen’s near-record low against the euro underscores the significant impact of monetary policy divergence and global interest rate dynamics. As central banks grapple with their economic challenges, investors navigating the complexities of international finance will keep a close eye on the EUR/JPY pair.

EUR/JPY Long (Buy)

Enter At: 171.273

T.P_1: 174.047

T.P_2: 175.947

T.P_3: 178.930

T.P_4: 181.418

T.P_5: 184.354

T.P_6: 186.721

T.P_7: 190.250

S.L: 161.161

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.