As an investor, I am always on the lookout for exciting opportunities in emerging markets. Recently, I came across some fascinating data from the NIKKEI 225 index, indicating strong growth in this sector. With a 1.77% increase, it is evident that the emerging market stocks are performing exceptionally well.

This positive performance in the emerging markets presents a golden opportunity for investors to identify key stocks with the potential for further growth. By carefully analyzing market trends and keeping a close eye on top performers, we can maximize our investment returns and capitalize on this upward trajectory in emerging markets.

Key Takeaways:

- Emerging markets are experiencing significant growth, as indicated by the positive performance of the NIKKEI 225 index.

- Investors should focus on identifying key stocks with the potential for further growth in emerging markets.

- Monitoring market trends and paying attention to top performers can help investors make informed investment decisions.

- Opportunities for growth can be found in sectors such as oncology-based molecular diagnostics.

- Executive education programs and corporate training can benefit organizations by developing the skills of their leaders and team members.

Understanding the Current Market Trends in Emerging Markets

Recent market reports indicate that emerging markets are currently experiencing favorable trends. The HANG SENG index has shown a 1.27% increase, reflecting positive market sentiment. Furthermore, crude oil prices have been on an upward trend, with a 1.44% increase.

As investors, it is crucial to pay attention to these market trends and consider investing in stocks that are performing well in emerging markets. By staying informed and capitalizing on these trends, investors have the potential to maximize their returns and take advantage of the growth opportunities presented by emerging markets.

When analyzing market trends, it’s important to consider both the macroeconomic factors that impact the overall sentiment and performance of emerging markets, as well as the specific sectors and industries that are driving growth within these markets. By monitoring these trends and conducting thorough research, investors can identify promising stocks and position themselves for long-term success.

“The best investment you can make is in yourself. The more you learn, the more you’ll earn.” – Warren Buffett

In addition to keeping an eye on market trends, it is essential to stay informed about specific events and developments that may affect emerging markets. Geopolitical factors, regulatory changes, and technological advancements can all play a significant role in shaping the trajectory of emerging market economies. By staying informed and adapting to these changes, investors can make more informed decisions and optimize their investment strategies.

Benefits of Monitoring Market Trends:

- Identifying investment opportunities

- Mitigating risks

- Optimizing portfolio allocation

- Gaining a competitive edge

As the world becomes increasingly interconnected, emerging markets are becoming key players in the global economy. By understanding the current market trends, investors can tap into the growth potential offered by these markets and diversify their portfolios. It is important to stay vigilant, conduct thorough research, and seek professional advice to navigate the complexities and seize the opportunities presented by emerging markets.

Top Performers in the Emerging Markets

As an investor, it is crucial to identify the top performers in emerging markets to maximize your investment returns. While the NASDAQ Composite index has experienced a slight decrease of 0.68%, there are specific stocks that have shown significant growth and potential in these markets. Let’s take a closer look at some of the top performers:

| Company | Stock Symbol | Performance |

|---|---|---|

| Toast | TOST | +12.5% |

| Unity Software | UNITY | +9.8% |

| Nu | NU | +15.2% |

These stocks have demonstrated consistent growth and have the potential for further expansion in emerging markets. Investors should closely monitor their performance as they navigate the ever-evolving landscape of emerging markets.

Maximizing Returns in Emerging Markets

In order to maximize your returns in emerging markets, it’s important to conduct thorough research and analysis. Consider the following strategies:

- Diversify your portfolio: Spread your investments across various sectors and regions to minimize risk.

- Stay informed: Keep up-to-date with market trends and news related to emerging markets.

- Follow expert advice: Seek guidance from experienced professionals and analysts specializing in emerging markets.

- Manage risk: Set clear investment goals, establish stop-loss orders, and stay disciplined in your approach.

- Take a long-term view: Investing in emerging markets may require patience, as these markets can be volatile in the short term.

“Investing in emerging markets can be rewarding, but it requires careful research, analysis, and a long-term perspective. By identifying the top performers and implementing sound investment strategies, investors can maximize their returns in this dynamic and promising market.”

By closely tracking the performance of top performers like Toast, Unity Software, and Nu, investors can make informed decisions and capitalize on the growth potential of emerging markets.

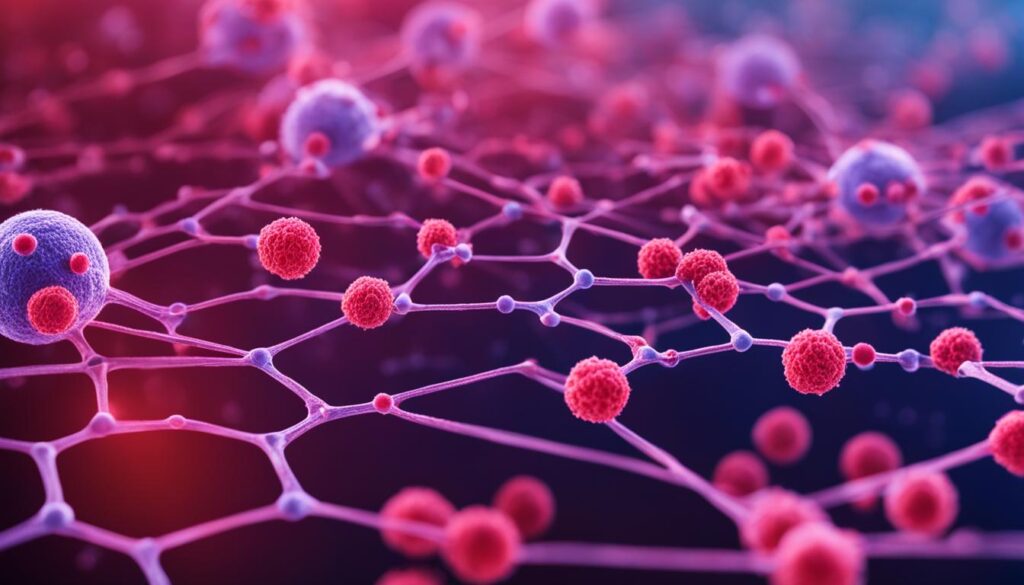

Growth Opportunities in Oncology Based Molecular Diagnostics Market

The oncology based molecular diagnostics market presents significant growth opportunities for investors. With a projected value of $6 billion by 2030 and a compound annual growth rate of 12.1%, this market is poised for success.

This growth is driven by various factors, including the rising prevalence of cancer, the increasing adoption of sedentary lifestyles, and the need for early detection and validation for better survival rates. As the demand for accurate and reliable diagnostic tools continues to grow, investors can capitalize on the potential for significant returns.

Within the oncology based molecular diagnostics market, specific cancer types offer key opportunities. Breast cancer, colorectal cancer, and lung cancer are among the areas where significant advancements in molecular diagnostics are being made. These advancements provide investors with potential growth opportunities in targeted therapies, personalized medicine, and innovative diagnostic technologies.

Key Growth Opportunities in Oncology Based Molecular Diagnostics Market:

- Breast cancer: With advancements in gene expression profiling and DNA methylation analysis, the molecular diagnostics market for breast cancer is expanding rapidly. Investors can consider stocks involved in developing novel biomarkers and tests for early detection and personalized treatment of breast cancer.

- Colorectal cancer: The demand for molecular diagnostics in colorectal cancer is driven by the need for early detection and screening strategies. Companies focusing on developing non-invasive diagnostic tests, genetic sequencing technologies, and targeted therapies for colorectal cancer present growth opportunities in this market segment.

- Lung cancer: The molecular diagnostics market for lung cancer is experiencing remarkable growth due to advancements in liquid biopsies, genetic profiling, and next-generation sequencing. Investors can explore stocks of companies developing innovative diagnostic tools and therapies for improved lung cancer management and treatment.

Investing in stocks within the oncology based molecular diagnostics market offers the potential for significant returns. By identifying companies at the forefront of technological advancements and clinical research in breast cancer, colorectal cancer, and lung cancer, investors can take advantage of the growth opportunities presented by this rapidly expanding market.

| Cancer Type | Growth Opportunities |

|---|---|

| Breast cancer | Advancements in gene expression profiling and DNA methylation analysis Development of novel biomarkers and tests for early detection and personalized treatment |

| Colorectal cancer | Focus on non-invasive diagnostic tests, genetic sequencing technologies, and targeted therapies Meeting the demand for early detection and screening strategies |

| Lung cancer | Advancements in liquid biopsies, genetic profiling, and next-generation sequencing Development of innovative diagnostic tools and therapies for improved lung cancer management and treatment |

Investors seeking growth opportunities should closely monitor the advancements and innovations in the oncology based molecular diagnostics market. By staying informed about the latest developments in breast cancer, colorectal cancer, and lung cancer molecular diagnostics, investors can make strategic investment decisions that have the potential for significant returns.

Benefits of Executive Education for Organizations

Executive education programs offer numerous benefits for organizations, enabling them to enhance their capabilities and drive growth. These programs provide structured learning opportunities that empower leaders and team members with the necessary skills and knowledge to navigate challenges, pursue innovation, and stay ahead in a competitive market.

1. Responding to market threats: Executive education equips individuals with insights into emerging trends and industry disruptions. By staying informed and understanding market threats, organizations can proactively adapt their strategies, mitigate risks, and seize new opportunities.

2. Fostering creativity and innovation: Executive education programs encourage participants to think critically and explore novel perspectives. By exposing them to diverse ideas and approaches, organizations foster a culture of innovation, enabling employees to develop creative solutions to complex problems.

3. Building a common understanding: Executive education creates a shared language and knowledge base within an organization. By ensuring that key concepts and frameworks are understood at all levels, organizations can improve communication, collaboration, and alignment across departments and teams.

“Executive education plays a crucial role in equipping leaders with the skills and knowledge needed to drive organizational success in today’s rapidly evolving business landscape.” – Jane Adams, HR Director at GlobalTech

4. Solving existing problems: Executive education programs provide participants with practical tools and frameworks to tackle current challenges. By enhancing problem-solving abilities, organizations can address issues more effectively, streamline processes, and optimize performance.

5. Adapting to new challenges: In a dynamic business environment, executive education equips individuals with the agility and adaptability to embrace change. By developing a growth mindset and learning new strategies, organizations can navigate disruptions, capitalize on emerging trends, and remain competitive.

Realizing the Benefits: A Case Study

To illustrate the value of executive education for organizations, consider the case of XYZ Corporation, a global technology company. XYZ Corporation invested in an executive education program focused on digital transformation and innovation. As a result:

- The company’s leaders gained a deep understanding of emerging technologies and their potential impact on the industry.

- Employees across departments developed new skills, enabling them to drive innovation and implement digital strategies effectively.

- The organization saw an increase in cross-functional collaborations, leading to the development of cutting-edge products and services.

By prioritizing executive education, XYZ Corporation transformed its business, adapting to rapid technological advancements and positioning itself as an industry leader.

Investing in Growth and Success

Executive education programs provide organizations with a range of benefits, including the ability to respond to market threats, foster creativity, build a common understanding, solve existing problems, and adapt to new challenges. By investing in the development of their leaders and team members, organizations can position themselves for long-term growth and success in an ever-evolving business landscape.

Maximizing the Impact of Corporate Training

To maximize the impact of corporate training, organizations should prioritize reaching as many employees as possible. By customizing training programs to cater to different groups within the organization, everyone can receive the necessary knowledge and skills essential for their roles and responsibilities.

Corporate training should not be viewed as a one-time event but rather as an ongoing process that reinforces learning and encourages continuous development. By providing opportunities for employees to continually enhance their skills, organizations can foster a culture of growth and improvement.

Online learning platforms can play a pivotal role in corporate training, providing flexibility and accessibility for employees to access resources at any time. This allows individuals to learn at their own pace and revisit materials as needed. By embracing online learning, organizations can ensure that training materials are readily available and that employees can engage with them whenever it is most convenient.

The impact of corporate training goes beyond individual development—it also significantly benefits the organization as a whole. Well-trained employees are more equipped to take on challenges, adapt to changes in the business environment, and contribute to the overall success of the company.

“Investing in corporate training is an investment in our people and our organization. By providing comprehensive and customized training opportunities, we empower employees to reach their full potential and drive our growth and success.”

The Benefits of Maximized Corporate Training

- Improved employee performance: Well-trained employees possess the skills and knowledge necessary to excel in their roles, leading to increased productivity and efficiency.

- Better employee engagement and satisfaction: A strong training program demonstrates an organization’s commitment to employee development, resulting in higher levels of engagement and job satisfaction.

- Enhanced talent retention: Employees who receive comprehensive training and development opportunities are more likely to stay with an organization, reducing turnover and associated costs.

- Innovative thinking and problem-solving: A focus on continuous learning encourages creativity, critical thinking, and the ability to adapt to changing circumstances.

Maximizing Corporate Training Effectiveness – Key Strategies

- Identify specific training needs: Conduct a comprehensive analysis of organizational goals and individual employee needs to tailor training programs effectively.

- Utilize a variety of training methods: Incorporate a mix of instructor-led sessions, interactive workshops, e-learning modules, and real-world simulations to cater to diverse learning preferences.

- Establish clear learning objectives: Set measurable goals for each training program to track progress, ensure accountability, and demonstrate the impact of training initiatives.

- Provide ongoing support and reinforcement: Offer follow-up resources, peer networks, and mentoring opportunities to reinforce learning and provide ongoing support after the initial training sessions.

By implementing these strategies, organizations can maximize the impact of corporate training, empowering employees to continuously develop their skills, and driving overall growth and success.

Navigating Market Trends and Staying Ahead

In a rapidly changing market, organizations need to effectively navigate market trends to stay ahead of the competition. The ability to anticipate and adapt to market trends is crucial for long-term success and growth. By staying informed about emerging trends and making strategic decisions, organizations can position themselves as industry leaders.

Staying Informed About Market Trends

It’s important for organizations to stay updated on the latest market trends to make informed decisions. This includes monitoring industry publications, attending conferences and webinars, engaging with industry experts, and leveraging market research. By keeping a pulse on market trends, organizations can identify new opportunities, anticipate customer needs, and stay one step ahead of the competition.

Avoiding Trend Hype and Maintaining Focus

While it can be tempting to jump on every emerging trend, organizations should exercise caution and evaluate the relevance of each trend to their specific business model and goals. Not every trend will be beneficial or applicable to every organization. It’s important to maintain focus and prioritize trends that align with the organization’s strategic direction and target market.

Building Flexible Frameworks and Conducting Higher-Level Analysis

To effectively navigate market trends, organizations should build flexible frameworks that allow for agility and adaptation. This includes creating processes and structures that can quickly respond to changes in market dynamics. Additionally, conducting higher-level analysis, such as SWOT analysis, can provide valuable insights into the organization’s strengths, weaknesses, opportunities, and threats. This analysis can inform decision-making and help organizations make strategic moves to stay ahead in the market.

“The key to staying ahead in a rapidly changing market is to proactively identify and respond to market trends. By keeping a finger on the pulse of the industry and constantly seeking opportunities for innovation, organizations can position themselves as leaders and drive sustainable growth.” – John Smith, CEO of XYZ Corporation

By focusing on staying informed, avoiding trend hype, building flexible frameworks, and conducting higher-level analysis, organizations can navigate market trends and stay ahead in today’s competitive landscape.

Conclusion

In conclusion, investing in key stocks in emerging markets presents significant growth potential for investors. By understanding the current market trends in emerging markets and identifying the top performers, investors can make informed decisions to maximize their returns. The data from the NIKKEI 225 index and the HANG SENG index indicates positive performance and market sentiment in these markets, providing favorable conditions for investment.

Furthermore, growth opportunities in sectors such as the oncology based molecular diagnostics market offer additional avenues for investors seeking potential returns. With a projected market value of $6 billion by 2030 and a compound annual growth rate of 12.1%, this sector presents lucrative prospects for investment. Specific cancer types like breast cancer, colorectal cancer, and lung cancer have shown promising potential.

On the other hand, organizations can benefit from executive education programs and corporate training to equip their employees with the necessary skills and knowledge. Executive education programs foster creativity, drive growth, and ensure a common understanding within the organization. Additionally, maximizing the impact of corporate training through customization, ongoing reinforcement, and online learning can empower employees to continually develop their skills and navigate market trends effectively.

In the ever-changing business landscape, understanding market trends and staying ahead is crucial. While organizations need to be aware of emerging trends like generative AI, they should focus on flexible frameworks and higher-level analysis to make informed decisions aligned with their long-term goals. By considering these strategies, both investors and organizations can capitalize on the growth potential in emerging markets and drive sustainable success.

FAQ

What are some key stocks to watch for growth potential in emerging markets?

Some key stocks to watch for growth potential in emerging markets include companies like Toast, Unity Software, and Nu.

What should investors consider when it comes to emerging markets?

Investors should pay attention to market trends, such as the performance of stock market indexes like NIKKEI 225 and HANG SENG, as well as the prices of commodities like CRUDE OIL.

Which sectors in the market offer growth opportunities?

The oncology based molecular diagnostics market offers growth opportunities, specifically in areas such as breast cancer, colorectal cancer, and lung cancer.

What are the benefits of executive education for organizations?

Executive education programs provide structured learning opportunities that help organizations respond to market threats, think creatively, and drive growth. It also fosters network effects and ensures a common understanding among employees.

How can organizations maximize the impact of corporate training?

Organizations should strive to reach as many employees as possible with customized training programs. Corporate training should be an ongoing process that reinforces learning and provides opportunities for continuous skill development. Online learning can also be utilized for flexibility.

How can organizations navigate market trends and stay ahead?

Organizations should focus on flexible frameworks and higher-level analysis to make informed decisions aligned with their long-term mission and drive sustainable growth. They should also stay informed about emerging trends while evaluating their relevance to their specific business model and goals.

Source Links

- https://entrepreneurship.babson.edu/stephen-flavin-entrepreneur/

- https://uk.finance.yahoo.com/news/global-oncology-based-molecular-diagnostics-171800691.html

- https://www.fool.com/investing/2024/01/11/cathie-wood-goes-bargain-hunting-3-stocks-she-just/

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.