After Federal Reserve Chair Jerome Powell cautioned investors that further rate hikes are on the horizon, the Dow Jones Industrial Average dropped 0.3%, or 102 points, on Wednesday.

Inflation, which came in at 4% in May, was still too high, according to Powell, who spoke before the House Financial Services Committee. He predicted that the Fed would likely have to raise interest rates once more to get inflation back to its goal level of 2%. The comments caused equities to decline, particularly rate-sensitive tech companies, Which contributed to declines; in the S&P 500 and Nasdaq.

Recently, JPMorgan issued a strong warning statement on stocks, stating that the effects of rising rates have “yet to be felt” and that “Recession Will Likely Be Necessary.”

The U.S. economy grew at an annualized pace of 1.3% in the first quarter, defying prior recessionary projections. However, JPMorgan Chase & Co. asserts that using the “R word” might not be possible.

That is an outcome of the U.S. Federal Reserve’s aggressive interest rate rises, Which were implemented to curb increasing inflation.

In a recent note to investors, JPMorgan strategists led by Marko Kolanovic stated that while the economy’s recent resilience may delay the start of a recession, they believe that most of the lag effects of the previous year’s monetary tightening have yet to be felt and that ultimately a recession will likely be required to bring inflation back to target.

Even if the stock market has rebounded significantly—the S&P 500 is up 15% in 2023—Kolanovic’s crew is still being cautious.

Given the disconnect between equities and bonds, the high likelihood of a recession over the upcoming quarters, high rates, tightening liquidity, rich valuations, and the still-narrow market breadth, they wrote, “We maintain a defensive asset allocation and believe the risk-reward for equities remains poor.”

For many investors, the macroeconomic climate over the last few years has been unprecedented. The Federal Reserve was compelled to hold interest rates near historic lows to prevent the economy from collapsing and politicians were compelled to spend trillions of dollars on stimulus programs as a result of company closures caused by the pandemic. But company closures also disrupted supply lines, leading to a scenario where there was an excess of cash chasing an insufficient amount of commodities.

The Federal Reserve increased interest rates at their fastest rate; since the early 1980s as the epidemic’s effects started to fade and inflation rocketed to its highest level in four decades. Due to these difficulties, the S&P 500 entered a bear market and is currently losing 8%. But many analysts—including some of the Federal Open Market Committee members —believe that the abrupt tightening of lending standards will eventually trigger a recession. For instance, according to JPMorgan Chase analysts, there is a greater than 50% chance that the United States will experience a recession by the end of the year.

In research released last week, analysts at Deutsche Bank expressed a similar viewpoint, although with considerably more certainty. They estimate that the likelihood of a U.S. recession in the coming year is “near 100%,” and the group’s senior economist David Folkerts-Landau said that avoiding one would be “historically unprecedented” given the economic challenges we are currently facing.

There is nothing new under the sun, in the words of King Solomon: “The thing that hath been, it is that which shall be; and that which is done, is that which shall be done.” – History is cyclical.

The S&P 500 began its ascent towards new highs in all but one of the eight recessions that the United States has experienced during the last five decades. In fact, between the time the index lowest was reached and the bottom of the GDP, throughout those eight recessions, the index achieved a median return of 30%. In other words, By the time recessions conclude, stock market recoveries are often well underway.

Investors are forward-looking, which means they respond to events before they occur, which is why it occurs. For instance, the S&P 500 entered a bear market in January 2022 as a result of investor concern over a downturn in the economy. However, GDP increased by 2.1% in 2022, somewhat more than the long-term trend of 2%, indicating a robust rate of economic growth. But investors recognized the signs. They were aware that to combat inflation, the Federal Reserve would have to raise interest rates, which may then result in a recession.

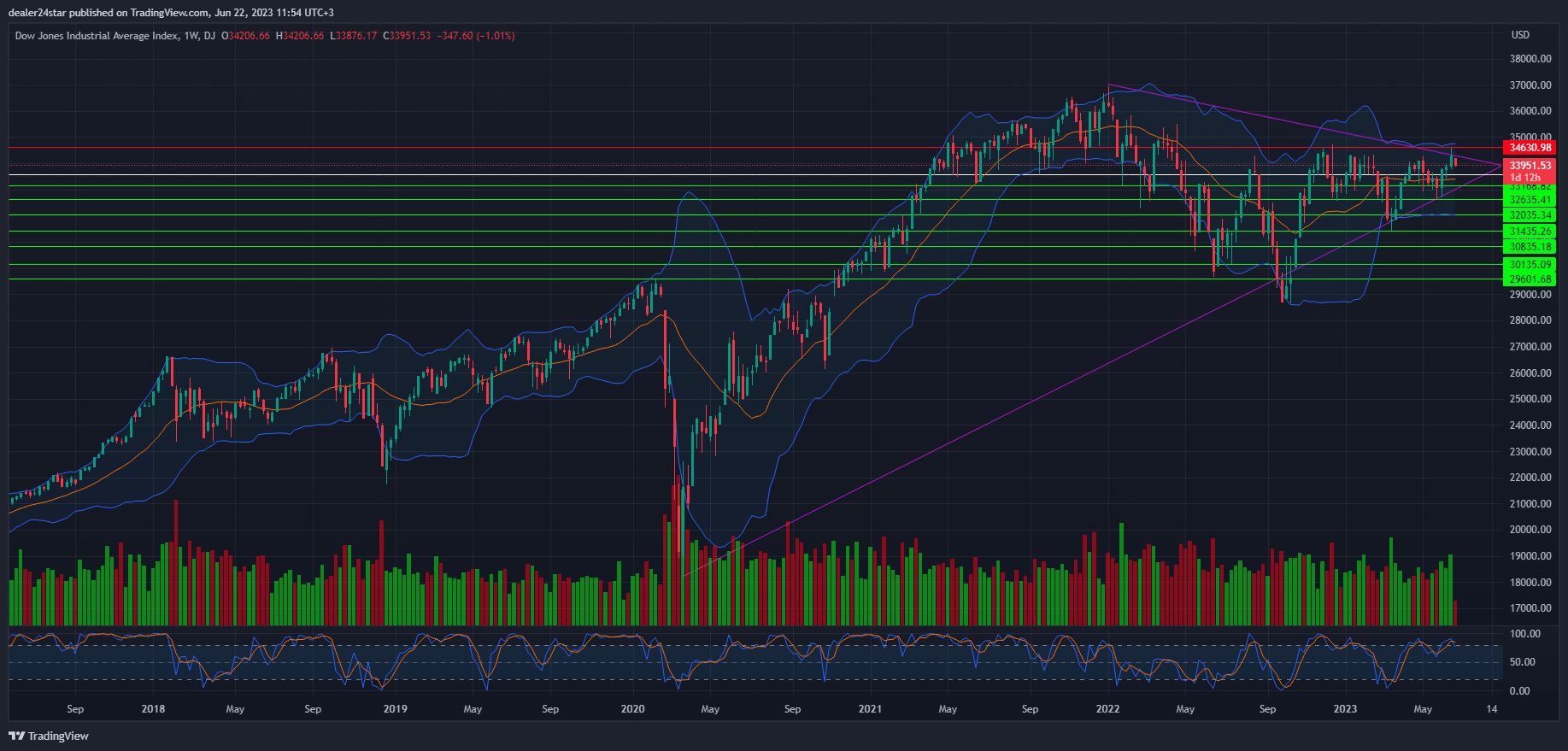

Dow Jones Short (Sell)

Enter At: 33583.38

T.P_1: 33168.82

T.P_2: 32635.41

T.P_3: 32035.34

T.P_4: 31435.26

T.P_5: 30835.18

T.P_6: 30135.09

T.P_7: 29601.68

S.L: 34630.98

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.