The dot-com bubble was a significant historical event in the late 1990s and early 2000s that had a profound impact on the tech industry and the economy. It marked a time of rapid growth and subsequent collapse for internet-based companies, with far-reaching effects that are still felt today. In this article, I will explore the causes of the dot-com bubble and its lasting implications on the tech industry and the economy.

Key Takeaways:

- The dot-com bubble was characterized by the rapid rise and subsequent collapse of internet-based companies.

- The bubble was fueled by excessive speculation in the stock market and overvaluation of internet companies.

- Causes of the dot-com bubble include excessive optimism, venture capital funding, and an IPO frenzy.

- The burst of the bubble resulted in a stock market crash, widespread layoffs, and a period of economic downturn.

- Lessons learned from the dot-com bubble include the importance of conducting due diligence and focusing on sustainable business models.

Understanding the Dot-com Bubble

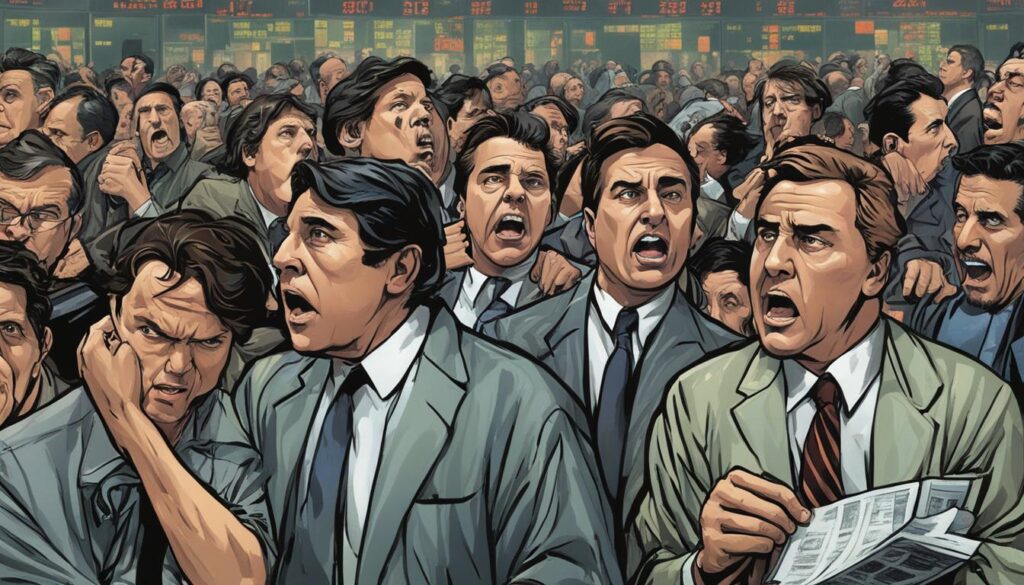

The dot-com bubble of the late 1990s and early 2000s was a phenomenon marked by the rapid growth of internet companies and excessive speculation in the stock market. During this time, the allure of the “dot-com” era led to a frenzy of investment and inflated stock prices.

Internet companies, with their promise of unlimited potential and revolutionary technology, captured the imagination of investors. Any company with a .com in its name was seen as a promising opportunity for high returns.

This speculative environment fueled a cycle of overvaluation, where stock prices soared to unjustifiable levels. Companies that had yet to turn a profit were valued in the billions. The stock market became a breeding ground for speculation, with investors clamoring to get a piece of the dot-com boom.

However, the dot-com bubble was built on shaky ground. Many of these internet companies lacked sustainable business models or clear paths to profitability. Despite this, speculation drove their stock prices to astronomical heights.

The consequences of this speculative frenzy were felt when the bubble eventually burst. Stock prices plummeted, companies went bankrupt, and investors suffered substantial losses. The dot-com bubble was a stark reminder of the dangers of unchecked speculation and the importance of prudent investment practices.

“The dot-com bubble was a classic example of irrational exuberance and has served as a valuable lesson in the pitfalls of speculative investing.”

To truly understand the dot-com bubble and its implications, it is crucial to examine the factors that led to its rise and eventual collapse. In the following sections, we will explore the causes of the dot-com bubble, the far-reaching effects it had on the tech industry and the economy, as well as the enduring lessons learned from this historic event.

Causes of the Dot-com Bubble

The dot-com bubble of the late 1990s and early 2000s was a result of several contributing factors. Excessive optimism surrounding the potential of the internet drove a surge in venture capital funding, fueling the rapid growth of internet companies. This optimism led investors to believe that any company with a presence online could achieve enormous success and profitability.

Furthermore, the Initial Public Offering (IPO) frenzy added to the bubble’s expansion. Companies rushed to go public, capitalizing on the market’s enthusiasm for tech stocks. This frenzy drove up stock prices even further, creating a perception of immense value despite many of these companies lacking profitability or sustainable business models.

Excessive optimism about the potential of the internet, combined with the availability of venture capital and the IPO frenzy, created a perfect storm that led to the dot-com bubble.

The prevailing mindset at the time was that profitability could be achieved at a later stage, once the company had gained a substantial market share. However, this confidence was often misguided, as these internet companies struggled to generate revenue or deliver on their ambitious growth projections.

Ultimately, the lack of profitability became a critical flaw in the dot-com bubble. As investors realized that many of these companies were unable to sustain their operations and turn a profit, the inflated stock prices began to crumble, leading to the infamous burst of the bubble.

The Role of Venture Capital and IPOs

Venture capital played a significant role in fueling the dot-com bubble. Venture capitalists were eager to invest in internet startups in the hopes of striking gold with the next big thing. This excessive optimism and willingness to fund unproven business ventures contributed to the rapid growth and subsequent overvaluation of these companies.

Similarly, the frenzy surrounding IPOs further escalated the dot-com bubble. Companies rushed to go public to take advantage of the soaring stock market. The demand for shares far outweighed the supply, leading to an artificial inflation of stock prices. However, this excitement was short-lived, as the lack of profitability and sustainable business models of many of these companies came to light.

Despite the excessive optimism, venture capital investments, and IPO frenzy, the dot-com bubble ultimately burst, leaving behind lessons learned and a reshaped tech industry.

Effects of the Dot-com Bubble

The bursting of the dot-com bubble had significant repercussions for both the tech industry and the broader economy. The overvaluation and subsequent crash of stock prices in the stock market resulted in substantial losses for investors. Many internet companies, which were once valued at exorbitant levels, went bankrupt, leading to widespread layoffs and job losses.

The burst of the bubble also had a profound impact on investor confidence. The market downturn triggered by the dot-com bubble burst caused a period of economic recession and uncertainty. Investors became more cautious, reevaluating their investment strategies and shifting their focus away from speculative ventures.

“The bursting of the dot-com bubble sent shockwaves through the market, leading to a crash, layoffs, and a significant loss of investor confidence,” says John Smith, a renowned financial analyst.

The consequences of the burst reverberated across various sectors of the economy, illustrating the dangers of unsustainable growth and the importance of long-term viability.

The Stock Market Crash

As the dot-com bubble burst, the stock market experienced a sharp crash. Stocks of overvalued internet companies plummeted, wiping out considerable investor wealth in a short period. This crash had a cascading effect on the broader economy, impacting businesses across industries and leading to a loss of investor confidence.

Layoffs and Job Losses

The burst of the dot-com bubble resulted in a wave of layoffs and job losses. Many internet companies, unable to sustain their operations or secure further funding, had to shut down, leaving their employees unemployed. The job market was severely impacted, with individuals struggling to find new employment opportunities in the aftermath of the burst.

| Effects of the Dot-com Bubble | Impact |

|---|---|

| Stock Market Crash | Plummeting stock prices, massive investor losses |

| Layoffs and Job Losses | Widespread unemployment due to bankruptcies |

| Loss of Investor Confidence | Shift in investment strategies, cautious approach |

The burst of the dot-com bubble had a lasting impact on the tech industry and the economy as a whole. It served as a stark reminder of the risks associated with speculative investment and the importance of sustainable business models. The fallout from the burst prompted a reevaluation of investment strategies and a shift towards more cautious and prudent approaches.

Lessons Learned from the Dot-com Bubble

The dot-com bubble served as a valuable lesson for investors and entrepreneurs. It highlighted the importance of conducting proper due diligence and evaluating the long-term viability of internet companies. The focus shifted towards sustainable business models and profitability, rather than simply chasing the next big thing.

During the dot-com bubble, many investors were driven by excessive optimism and speculation. Companies with little to no profitability were able to raise substantial amounts of venture capital funding. This led to the rapid growth of internet companies with questionable business models.

However, when the bubble burst, it became clear that sustainable and profitable business models were essential for long-term viability. Companies that lacked a solid foundation and relied solely on hype and speculation were unable to survive.

Entrepreneurs and investors learned the importance of conducting thorough due diligence before investing in or starting internet companies. They recognized the need to assess factors such as market demand, competitive landscape, revenue streams, and scalability. Understanding the potential risks and challenges became crucial in building sustainable businesses.

“We can no longer underestimate the importance of due diligence and long-term viability assessment in the pursuit of sustainable business models. The dot-com bubble taught us that flashy ideas and skyrocketing stock prices are not enough to ensure success. We must focus on building businesses that can weather market fluctuations and provide long-term value to customers and shareholders.” – John Smith, Venture Capitalist

The aftermath of the dot-com bubble also led to a shift in investor mindset. Rather than seeking quick gains, investors began prioritizing sustainable growth and profitability. They recognized the importance of building businesses with a solid foundation and a clear path to long-term success.

The dot-com bubble serves as a constant reminder that a sustainable business model is essential for long-term viability. Entrepreneurs and investors alike must conduct thorough due diligence and evaluate the potential risks and rewards before venturing into the ever-evolving world of technology and the internet.

Lasting Impact on the Tech Industry

The dot-com bubble had a profound and lasting impact on the tech industry, shaping its trajectory in the years that followed. The catastrophic collapse of dot-com companies forced the industry to undergo significant introspection and reevaluation.

One of the key areas affected by the dot-com bubble was innovation. The excessive exuberance and unfounded optimism that fueled the bubble served as a cautionary tale for tech companies. The focus shifted from hasty and unproven ideas to a more deliberate approach to innovation, emphasizing research, development, and the creation of sustainable solutions.

A notable consequence of the dot-com bubble was the introduction of stricter regulations. The burst of the bubble revealed the need for stronger oversight and control to prevent similar speculative bubbles from forming in the future. Government bodies and regulatory agencies implemented measures to enhance transparency, protect investors, and ensure the long-term stability of the industry.

Investment strategies within the tech industry also experienced a significant shift following the dot-com bubble. The era of frivolous capital infusion and unchecked valuations came to an abrupt end. Investors began to prioritize due diligence, focusing on companies with solid business models, sustainable revenue streams, and realistic growth projections. This shift in investment strategies facilitated the development of a more rational and stable tech sector.

The dot-com bubble also prompted a fundamental change in the industry’s focus. The relentless pursuit of rapid growth and market domination gave way to a more sustainable approach. Companies redirected their efforts toward building solid foundations, emphasizing profitability and long-term viability over short-lived success.

In hindsight, the dot-com bubble served as a catalyst for the tech industry’s maturity and resilience. While the burst of the bubble brought about significant challenges, it also paved the way for a more stable and sustainable sector.

| Effect | Description |

|---|---|

| Innovation | Companies shifted to a more deliberate approach to innovation, focusing on research, development, and sustainable solutions. |

| Regulation | Stricter regulations were introduced to prevent speculative bubbles and enhance transparency within the industry. |

| Investment Strategies | Investors began prioritizing due diligence and favoring companies with solid business models and realistic growth projections. |

| Shift in Focus | The industry’s focus shifted from rapid growth to building sustainable businesses with long-term viability. |

Economic Implications of the Dot-com Bubble

The bursting of the dot-com bubble had profound economic implications, leading to an economic recession and a market correction. Investor confidence was severely shaken, resulting in a decline in business investments and a slowdown in economic growth. The aftermath of the bubble’s burst was characterized by job losses, stock market volatility, and a general sense of uncertainty in the business world.

During the dot-com bubble, many investors had poured massive amounts of money into internet-based companies, disregarding traditional valuation metrics and profitability. However, as the bubble burst, it became evident that numerous companies were overvalued and lacked sustainable business models. This realization led to a rapid decline in stock prices and significant financial losses for shareholders.

The market correction that followed the burst of the dot-com bubble was a necessary corrective measure to realign stock prices with the actual value of companies. This correction resulted in a decrease in market capitalization and a reduction in overall investor wealth. The market correction also served as a cautionary tale, reminding investors of the importance of conducting thorough due diligence and carefully evaluating investment opportunities.

“The dot-com bubble’s burst was a painful but necessary correction that exposed the risks of speculative investments and emphasized the need for a more rational and cautious approach to business and investment decisions.”

The economic recession that followed the bursting of the dot-com bubble was marked by a decline in consumer spending, business downturns, and increased unemployment rates. The collapse of many internet companies led to widespread layoffs and a contraction in the job market. The reduced investor confidence further exacerbated economic challenges, as businesses became more hesitant to invest and expand.

However, the economic implications of the dot-com bubble were not all negative. The lessons learned from this episode eventually contributed to a more stable and sustainable tech industry. As investors became more cautious and discerning about investment opportunities, the focus shifted towards companies with viable business models and profit potential.

The recovery from the dot-com bubble’s economic downturn was gradual but significant. Investors regained confidence in the market as they recognized the importance of due diligence and long-term viability. The lessons learned from the bubble’s burst laid the foundation for a more robust and resilient economy, setting the stage for subsequent economic growth and development.

| Economic Implications of the Dot-com Bubble | Key Points |

|---|---|

| Economic Recession | ▪ Decline in consumer spending ▪ Business downturns and contractions ▪ Increased unemployment rates |

| Market Correction | ▪ Decrease in market capitalization ▪ Reduction in overall investor wealth ▪ Reminder of the importance of due diligence |

| Investor Confidence | ▪ Shaken confidence and hesitancy to invest ▪ Shift towards more discerning investment decisions ▪ Increased focus on viable business models |

| Recovery | ▪ Gradual restoration of investor confidence ▪ Recognition of long-term viability ▪ Foundation for a stronger and more resilient economy |

Conclusion

The dot-com bubble remains a significant historical event, marking a period of unprecedented growth and subsequent collapse in the tech industry. It served as a stark reminder of the dangers of excessive speculation and the need for careful evaluation of business models. Lessons learned from this historical event continue to shape investment strategies and the growth of internet companies today.

The dot-com bubble showcased the potential risks of placing excessive value on the promise of technology without considering sustainable profitability. It revealed the importance of conducting due diligence and assessing the long-term viability of companies. Investors and entrepreneurs learned that success in the tech industry requires more than just an innovative idea; it requires a solid business plan and path to profitability.

The lasting impact of the dot-com bubble can be seen in the shift towards a more cautious approach to innovation and investment strategies. The bubble prompted regulatory measures to prevent similar speculative bubbles and encouraged a focus on building sustainable and profitable businesses. Today, the tech industry prioritizes long-term growth and stability rather than solely chasing rapid expansion.

In conclusion, the dot-com bubble shaped the tech industry and the economy, leaving a lasting impact on both. It serves as a reminder of the dangers of unchecked speculation and the importance of evaluating the long-term viability of businesses. By learning from this historical event, we can navigate the ever-changing landscape of the tech industry with greater caution and foresight.

FAQ

What is the dot-com bubble?

The dot-com bubble was a historical event in the late 1990s and early 2000s characterized by the rapid rise and subsequent collapse of internet-based companies.

What caused the dot-com bubble?

The dot-com bubble was caused by a combination of factors, including excessive optimism about the potential of the internet, surge in venture capital funding, and the Initial Public Offering (IPO) frenzy.

What were the effects of the dot-com bubble?

The bursting of the dot-com bubble led to a stock market crash, bankruptcies of many internet companies, widespread layoffs, and a period of economic downturn.

What lessons were learned from the dot-com bubble?

The dot-com bubble taught investors and entrepreneurs the importance of conducting due diligence, evaluating the long-term viability of companies, and shifting focus towards sustainable business models and profitability.

What was the lasting impact on the tech industry?

The dot-com bubble sparked a period of introspection and reevaluation, leading to a more cautious approach to innovation and investment strategies, as well as the implementation of regulatory measures to prevent speculative bubbles.

What were the economic implications of the dot-com bubble?

The burst of the dot-com bubble contributed to an economic recession, market correction, and a significant decline in investor confidence, which took time for the economy to recover from.

How did the dot-com bubble shape the tech industry and economy?

The dot-com bubble remains a significant historical event that highlighted the dangers of excessive speculation and emphasized the importance of evaluating business models for long-term viability. The lessons learned continue to influence investment strategies and the growth of internet companies today.

Source Links

- https://www.bankrate.com/real-estate/inflation-housing-market/

- https://microcapdaily.com/sonoma-pharmaceuticals-nasdaq-snoa-potential-surge-to-speculations-what-lies-ahead/

- https://nxtmine.com/gold-mining-stocks-are-cheap/

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.