When compared to record prices in 2022, current natural gas market prices are still low. However, if China continues to exercise influence on international markets and completes its substantial LNG regasification projects in the anticipated timeframe, the current low costs may soon become a thing of the past. This initiative may have an impact on European petrol markets, but it will mostly benefit Chinese businesses. It’s possible that Brussels, Berlin, or The Hague might not find this arrangement to their tastes. Chinese natural gas imports (LNG and pipeline gas) rose by 17.3% alone in May.

China is showing signs of increasing its consumption of natural gas, but according to a forecast by GlobalData, China will dominate the expansion of LNG regasification capacity in Asia. China will account for 34% of all Asian additions, according to GlobalData. According to the study’s title, “LNG Regasification Terminals Capacity and Capital Expenditure (CapEx) Forecast by Region, Key Countries, Companies and Projects (New Build, Expansion, Planned, and Announced), 2023-2027,” China is expected to increase its capacity by about 5.7 TCF from projects that have already received project approvals, while another 2.1 TCF is currently in the conceptual stages.

China’s demand growth may be stepwise, but given the way things are going, Europe’s petrol consumers will need to act quickly or risk paying exorbitant spot freight costs. While Europe is still unwilling to sign long-term contracts because politicians believe it doesn’t fit their strategy for implementing an energy transition, China is thinking long-term and committing to using natural gas beyond 2045–2050.

Beijing is simultaneously implementing its natural gas policy and expanding its gas-related infrastructure, as well as engaging in a much more sinister strategic game. China reportedly knew about Russian invasion preparations before Putin chose to attack Ukraine, according to reports. The invasion of Ukraine was invaded in February 2022, although Chinese President Xi Jinping has adamantly denied knowing about it up to this point. However, China’s energy transactions before the attack aroused questions. Chinese participants, namely LNG purchasers, were quite active in the six months before the invasion.

Despite the ongoing Russian invasion, Chinese parties have remained active in closing deals. From September 2021 to April 2022, Chinese parties accounted for 57% of all LNG purchase deals, which totaled around 23 million tons of imports per year. This is a significant increase compared to the average of 5 million metric tons per year between 2006 and 2020. The 2021-2022 buying spree involved 11 different companies, 10 of which are owned by the Chinese government. As a result, there has been a surge in demand for LNG supplies from Qatar, Russia, and the US, leading to a shortage in the short term.

These changes occurred in tandem with Gazprom’s plan to reduce gas shipments to Europe in 2021 while cutting off its gas supply after the invasion. Gazprom is a state-owned gas company in Russia. It is increasingly obvious that Moscow and Beijing are working together politically. Russian gas cutbacks to Europe would have had a minimal impact if the Chinese had not entered the gas markets in full force in 2021–2022, eliminating concerns about both a lack of supply and an impending energy crisis. Even before the invasion of Ukraine, there was obvious extensive coordination between China and Russia. All indications point to a Russian-Chinese cornering of the market as a preventative attack on Europe’s energy industry, however, there is no concrete proof of this.

Currently, it seems like Europe is being passive and doing nothing to prevent Beijing and Moscow from working together more and more. By no means is it a novel idea to use energy as a weapon. Energy resources are no longer easily accessible to Europeans at a reasonable cost, as seen by the recent example of expanding collaboration between Beijing and the Gulf Cooperation Council (GCC) in Saudi Arabia. Russia and China are once more strengthening their control over the continent, increasing the likelihood of a turbulent winter in Europe.

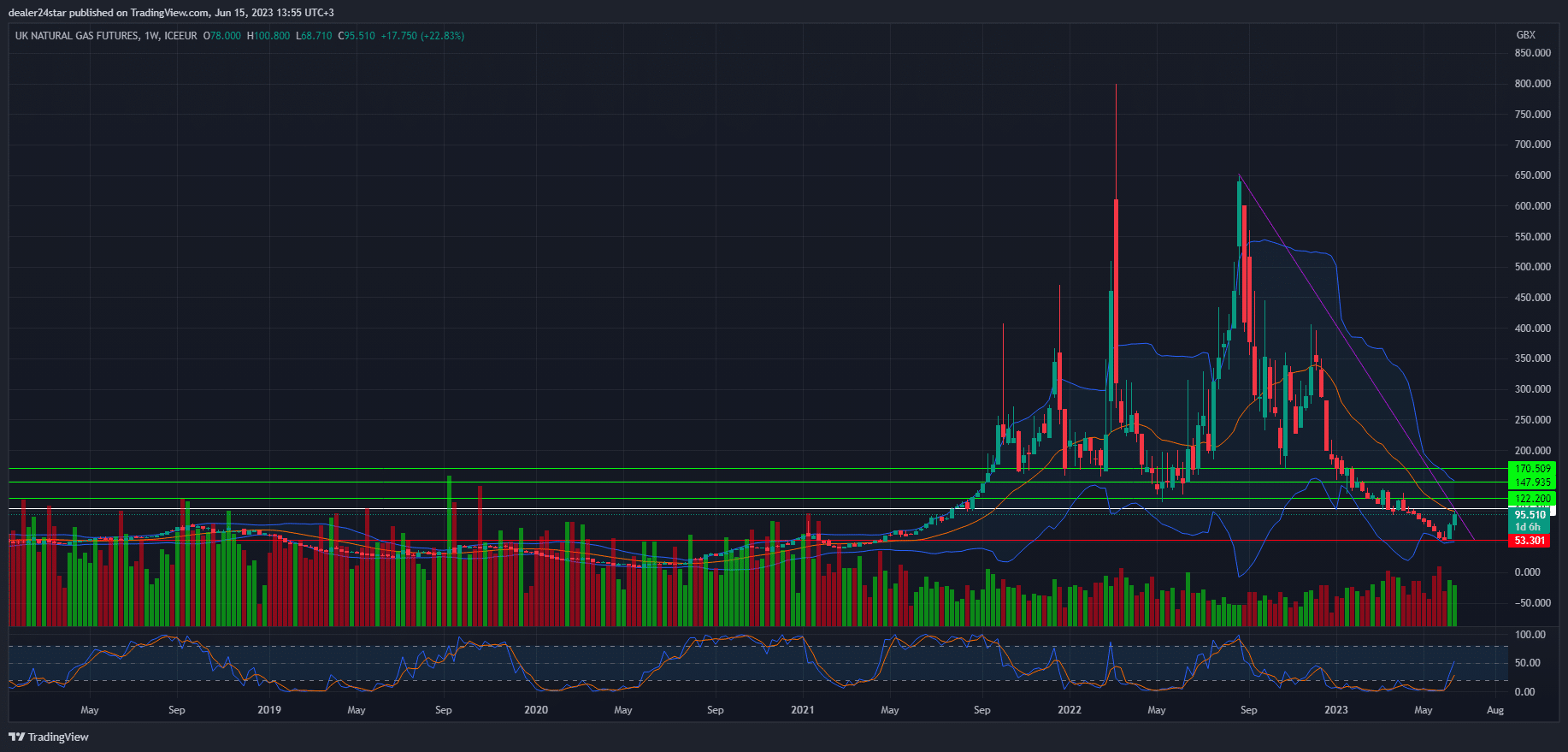

Natural Gas Long (Buy)

Enter At: 104.182

T.P_1: 122.200

T.P_2: 147.935

T.P_3: 170.509

S.L: 53.301

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.