The global chocolate industry is facing a period of significant turbulence as cocoa prices reach unprecedented highs. This surge stems from a confluence of factors that have severely constrained cocoa supply in West Africa, the world’s leading producer. The repercussions of this crisis are poised to directly impact consumer chocolate consumption in the form of potential price hikes, product reformulations, and even size reductions.

West Africa’s Cocoa Woes

Ivory Coast and Ghana, responsible for over 60% of global cocoa production, are grappling with several challenges that have significantly reduced cocoa output. These include:

- Rampant Disease: Crops are under siege by black pod disease and swollen shoot virus, leading to widespread devastation.

- Aging Trees: A substantial portion of existing cocoa trees have surpassed their peak yield potential, and significant new plantings haven’t occurred since the early 2000s.

- Unfavorable Weather Conditions: Heavy rains have exacerbated disease outbreaks, while El Niño and seasonal harmattan winds have negatively impacted cocoa yields in recent years.

- Farmer Dissatisfaction: Government-mandated cocoa prices remain low, disincentivizing farmers and prompting them to shift towards more lucrative crops like rubber.

The Ripple Effect on Consumers

The unprecedented rise in cocoa prices is exerting immense pressure on chocolate manufacturers. While some companies, like Hershey, have implemented hedging strategies to mitigate the immediate impact, the industry’s capacity to absorb these rising costs is finite. Consumers can brace for the following potential consequences:

- Price Increases: The cost of chocolate bars, confectionery products, and other cocoa-based treats is likely to rise proportionally to the cocoa price surge.

- Shrinkflation: To maintain price points, manufacturers may resort to reducing the size of chocolate bars while keeping the sticker price the same.

- Reformulated Products: Chocolate companies may consider reformulating products to use less cocoa or substitute ingredients. Dark chocolate, with its high cocoa content, may be particularly impacted by this trend.

A Bittersweet Forecast

Experts predict that the situation is likely to worsen before it improves. The International Cocoa Organization forecasts a substantial supply deficit for the 2023-24 season, and there are no readily available solutions to address the underlying issues in West Africa. These factors will likely cause cocoa prices to stay high:

- Limited Supply: The challenges plaguing West African cocoa production are not easily resolved, and a significant ramp-up in production is not anticipated soon.

- Panic Buying: Commercial buyers are likely to continue aggressive purchasing of available cocoa supplies, further inflating prices.

Some experts say chocolate prices could rise as early as Easter, but the biggest impact on consumers likely won’t hit until late 2024 or early 2025. Consumers should prepare for the possibility of paying more for their favorite chocolate treats or having to settle for smaller portion sizes or reformulated products.

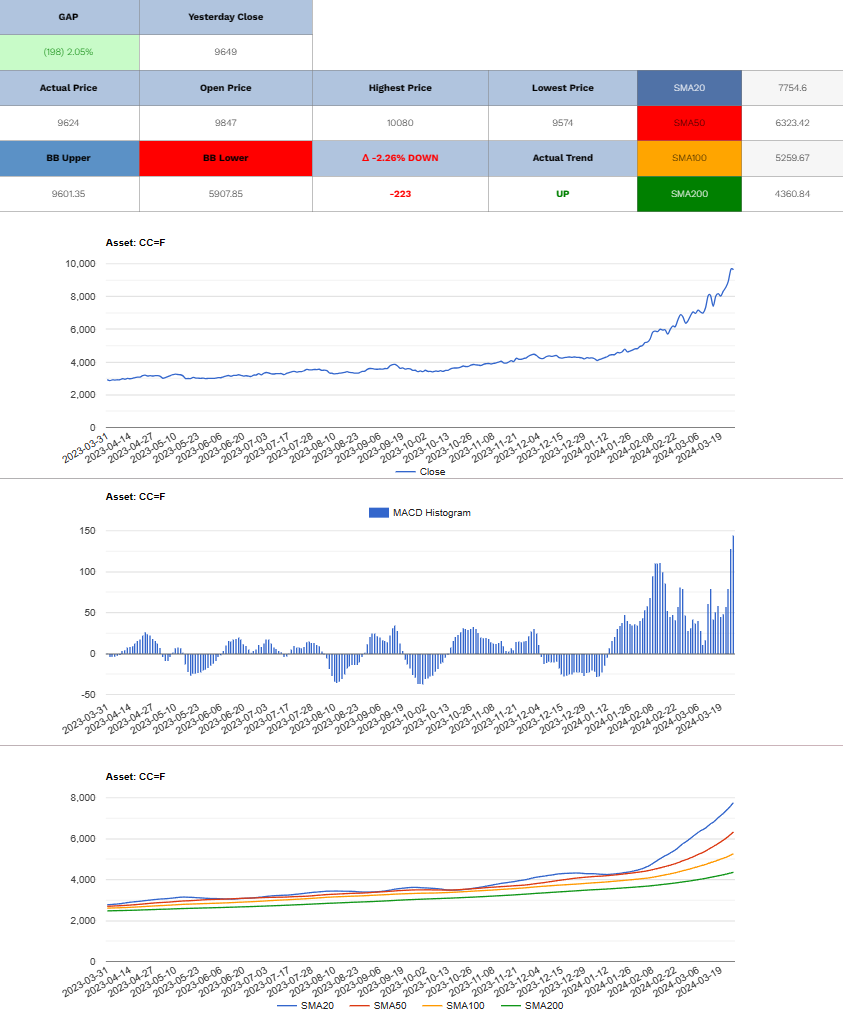

Cocoa Long (Buy)

Enter At: 9701

T.P_1: 9815

T.P_2: 10082

T.P_3: 10424

T.P_4: 10643

T.P_5: 10941

T.P_6: 11258

T.P_7: 11661

S.L: 8880

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.