In the ever-evolving landscape of the construction and heavy machinery industry, Caterpillar Inc. stands tall as a beacon of progress and adaptability. The company’s recent endeavors and market moves showcase a commitment to growth, sustainability, and cutting-edge technology. In this article, we delve into Caterpillar’s multifaceted approach to staying ahead in the game and why investors and industry enthusiasts should take note.

Expanding Portfolio and Growth Projections

Caterpillar’s recent financial performance is nothing short of impressive. Despite facing inflationary pressures and supply-chain challenges, the company has managed to achieve 10 consecutive quarters of year-over-year revenue and earnings growth. This remarkable feat is a testament to the company’s robust backlog, solid demand across various sectors, and its ability to control costs effectively.

One key driver of Caterpillar’s growth is its strategic focus on expanding offerings, services, and digital initiatives. The company’s investments in these areas are expected to drive long-term growth, ensuring it remains a leader in the industry.

Innovating for Sustainability

In a world increasingly concerned about environmental sustainability, Caterpillar is not lagging. The company has unveiled its first battery-powered construction equipment, including the innovative 301.9 mini excavator. This electric-powered machine is a response to customer demand for cleaner and more environmentally friendly options, particularly for indoor demolition work.

Caterpillar’s shift towards electric machinery is a clear indication of its dedication to reducing emissions and providing eco-friendly solutions to its customers. Although diesel engines continue to be a crucial part of Caterpillar’s business, the company is preparing itself to meet the rising demand for electric alternatives, which is driven by government regulations and industry sustainability objectives.

Remote-Controlled Efficiency

In addition to electrification, Caterpillar is pushing the envelope with remote-controlled construction equipment. This technology, originally developed for the mining industry, is now being applied to construction machinery. Remote control allows operators to manage heavy machinery from a safe distance, ideal for navigating steep slopes or confined spaces.

The adoption of remote-controlled equipment not only enhances worker safety but also demonstrates Caterpillar’s commitment to embracing technology trends that are revolutionizing various industries. This innovation aligns with the broader industry shift towards automation and remote operation, making construction sites safer and more efficient.

Investor Insights

For investors, Caterpillar presents an intriguing opportunity. The company’s stock has shown resilience, with strong financial performance, an impressive earnings surprise history, and positive growth projections. The recent 8% dividend hike underscores Caterpillar’s commitment to rewarding shareholders. Its dividend yield is higher than the industry average, making it an attractive option for income-oriented investors.

Furthermore, Caterpillar’s expansion into electric and remote-controlled machinery positions it at the forefront of industry trends, making it a potential long-term growth play. As construction contractors increasingly prioritize sustainability and efficiency, Caterpillar is well-positioned to capitalize on these evolving market dynamics.

Understanding Insider Transactions

While focusing on Caterpillar’s promising future, it’s essential to consider recent insider transactions. Anthony D. Fassino, Caterpillar’s Group President, recently sold a significant number of shares, raising questions about the motivations behind this move.

Insider transactions are valuable indicators of insider sentiments, but they should not be the sole basis for investment decisions. It’s crucial to interpret such transactions in context:

1. Diverse Motivations: Insider sales can result from various factors, not just a lack of confidence in the company’s prospects. Executives may sell shares for financial planning, diversification, or liquidity needs.

2. Regulatory Compliance: Insider transactions are subject to strict regulatory requirements, including prompt reporting to the SEC via Form 4 filings.

3. Market Dynamics: Insider sales can coincide with broader market trends or company-specific events. It’s essential to consider the broader market context.

4. Open Market Transactions: Transactions in the open market often carry more weight when assessing insider sentiment. Transaction codes, such as P (purchase) and S (sale), offer insights into transaction types.

Conclusion:

Caterpillar Inc. is a global leader in the heavy machinery industry. The company has a long history of innovation and has been a pioneer in the development of new technologies, such as electrification and remote control. These technologies are helping Caterpillar to meet the changing demands of its customers and the industry, and they are also helping the company to reduce its environmental impact.

Caterpillar’s journey into innovation, sustainability, and efficiency positions it as a compelling investment opportunity. The company has a strong financial performance and a solid track record of growth. It is also well-positioned to benefit from the growth of the global construction industry.

While insider transactions can provide insights into a company’s future prospects, they should be considered alongside other factors, such as financial performance and market dynamics. In the case of Caterpillar, the company’s strategic initiatives and strong financial performance make it a compelling investment opportunity.

Here are some additional points to consider:

- Caterpillar’s commitment to innovation is evident in its investment in research and development. In 2022, the company spent $2.6 billion on R&D, which is about 4% of its revenue.

- Caterpillar is also a leader in sustainability. The company has set ambitious goals to reduce its environmental impact, such as reducing its greenhouse gas emissions by 25% by 2030.

- The global construction industry is expected to grow by 4.5% per year from 2022 to 2027. This growth will create opportunities for Caterpillar to sell its products and services.

Overall, Caterpillar is a well-managed company with a strong financial performance and a solid track record of growth. The company is also well-positioned to benefit from the growth of the global construction industry. As a result, Caterpillar is a compelling investment opportunity.

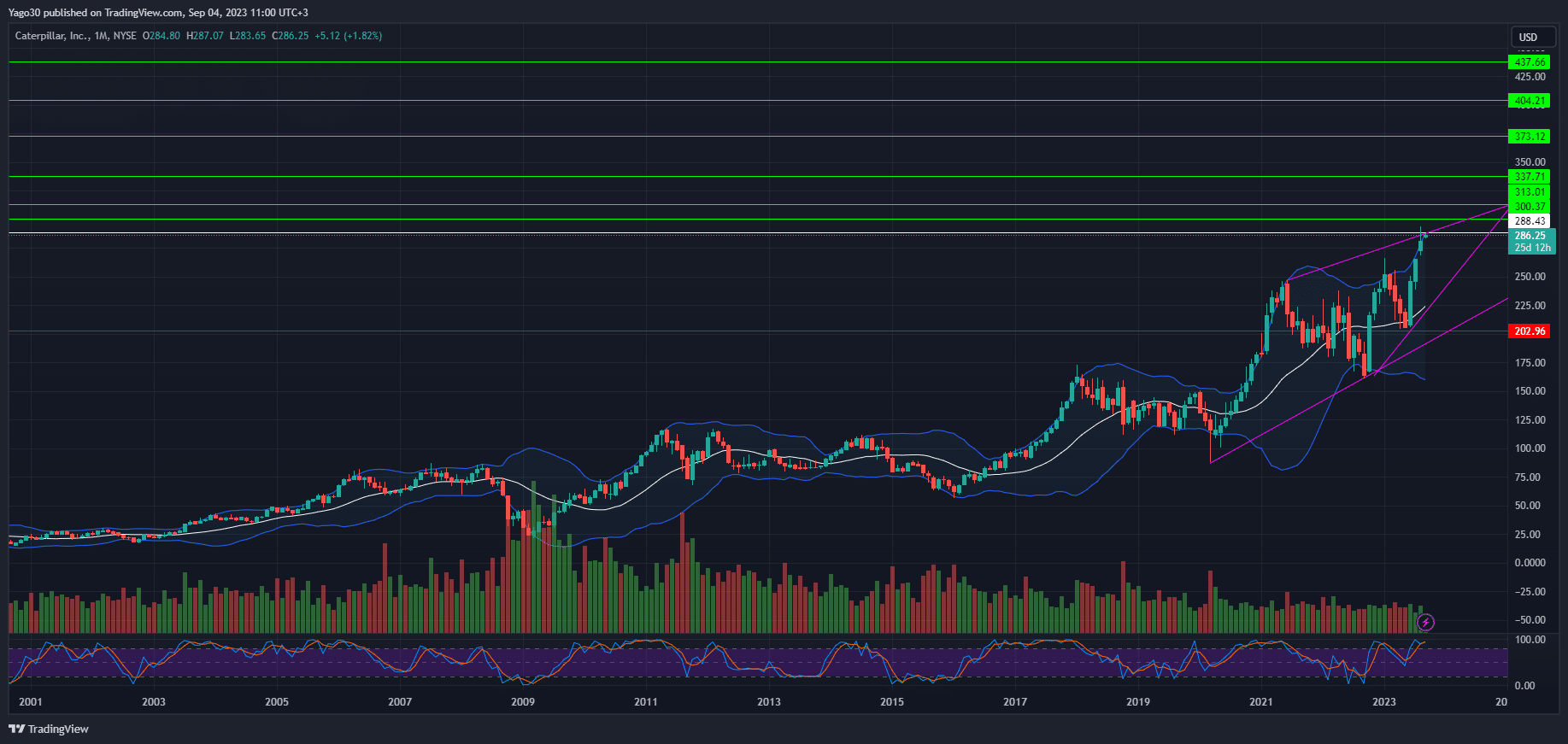

Caterpillar Long (Buy)

Enter At: 288.43

T.P_1: 300.37

T.P_2: 313.01

T.P_3: 337.71

T.P_4: 373.12

T.P_5: 404.21

T.P_6: 437.66

S.L: 202.96

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.