Accessing and Navigating Spot Markets as a Retail Trader

As a retail trader, I understand the importance of accessing and navigating spot markets effectively. Spot markets refer to the market where financial instruments, such as commodities or currencies, are traded for immediate delivery. By gaining knowledge and expertise in accessing and navigating these markets, I can optimize my trading strategies and achieve better results. […]

How Global Economic Indicators Influence Spot Trading

Global economic indicators play a crucial role in shaping spot trading activities across various financial markets. As a spot trader myself, I understand the significance of staying informed about the ever-changing economic landscape and how it can impact my trading decisions. In this article, we will delve into the ways in which global economic indicators […]

Comparing Spot Markets with Over-the-Counter Trading

When it comes to investment, two popular methods of buying and selling financial assets are spot markets and over-the-counter trading. While they both involve trading financial instruments, there are significant differences between the two. In this article, I will compare spot markets with over-the-counter trading and explore the key distinctions that investors should be aware […]

The Power of Real-Time Analysis in Spot Trading

Real-time analysis plays a crucial role in spot trading, especially in the cryptocurrency market. The ability to analyze data and make informed decisions in real-time can make a significant difference in a trader’s success. Whether it’s monitoring market trends, identifying trading opportunities, or managing risks, real-time analysis provides valuable insights that can give traders a […]

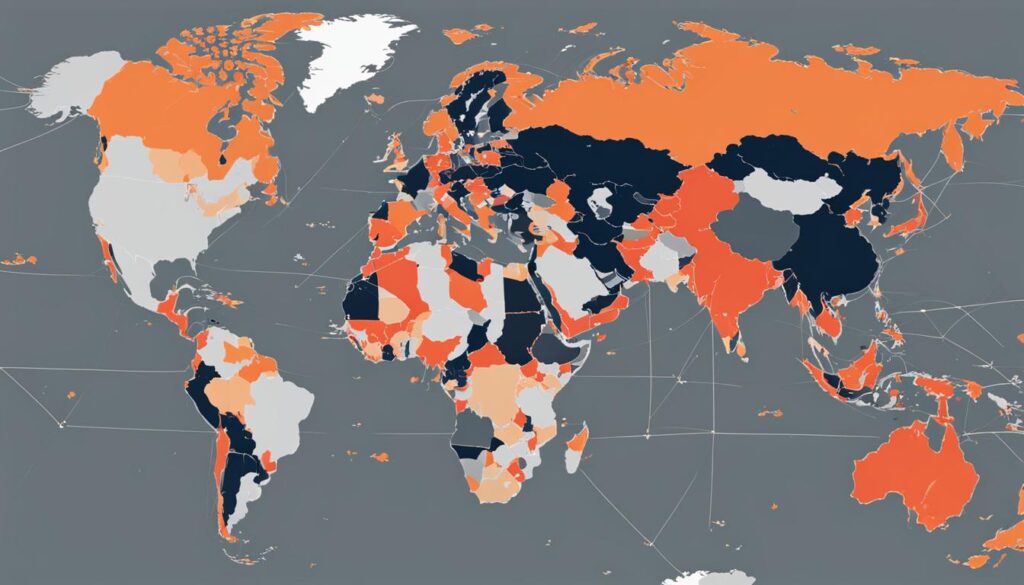

Geopolitical Events and Their Impact on Spot Markets

Geopolitical events can have a significant impact on spot markets, influencing global trade and financial markets. These events, such as political instability, trade wars, natural disasters, and geopolitical tensions, can cause ripple effects throughout the global economy. Investors and traders need to understand how these events can impact spot markets to make informed decisions and […]

Opportunities in Precious Metals: Spot Trading Insights

I am excited to share some insights into the world of spot trading in precious metals. The cryptocurrency market has been a hotspot for trading opportunities, especially when it comes to altcoins like Ethereum Classic (ETC), Xai, and Dogecoin (DOGE). These coins have seen significant price movements, particularly following the recent approval of 11 spot […]

Analyzing Trends in Spot Markets for Strategic Investment

In today’s dynamic investment landscape, staying ahead of market trends is crucial for making informed strategic investment decisions. One sector that has been attracting significant attention is the virtual reality (VR) industry, which is experiencing rapid growth and innovation. Analyzing spot market trends in this industry can provide valuable insights for investors looking to capitalize […]

Leveraging Technology for Success in Spot Market Trading

In today’s fast-paced and highly competitive spot market trading industry, leveraging technology is essential to gain a competitive edge and achieve better results. Incorporating advanced technological tools and strategies can significantly enhance trading strategies, improve decision-making, and optimize trading execution. In this article, I will explore the various ways in which technology can be leveraged […]

The Importance of Liquidity in Spot Market Trading

In spot market trading, liquidity plays a vital role in enhancing trading efficiency and achieving optimal investment returns. Spot market liquidity refers to the ease with which traders can buy or sell securities without significantly impacting their prices. It is crucial for traders to consider liquidity when making investment decisions to avoid higher trading costs, […]

Hedging Techniques in Spot Markets: A Practical Guide

Hedging is a crucial strategy for managing risk and stabilizing investment portfolios in spot markets. In this practical guide, I will explore effective hedging techniques that can be implemented in spot markets. Key Takeaways: Implementing hedging techniques is essential for managing risk in spot markets. Spot markets involve the buying and selling of financial instruments […]