Despite recent immobility at 102.60 in the early hours of Wednesday, the U.S. Dollar Index has been stronger for four days running. This illustrates how the market is positioning itself for Federal Reserve (Fed) Chair Jerome Powell’s biannual testimony in the hopes of seeing further gains for the U.S. Dollar Index, particularly when the Fed policymakers support higher rates, and the sentiment is uncertain.

Nevertheless, the news that U.S. President Joe Biden described Chinese President Xi Jinping as a tyrant on Tuesday prompted the U.S. Dollar Index bulls to trade close to the day’s high. The remarks raise grave worries about US-China relations after U.S. Secretary of State Antony Blinken’s trip to Beijing produced few notable successes. The same ought to provide the Gold pair sellers reason for hope.

It should be mentioned that the demand for the U.S. Dollar as a Safe Haven increased when the People’s Bank of China (PBoC) decreased the two Major lending rates (the Loan Prime Rate (LPR) and Medium-term Landing Facility (MLF) rate) for the first time in over a year.

Regarding the signals from the central bank, Fed governor and Vice Chair candidate Philip Jefferson stated, “I remain focused on returning it to our 2% target.” Federal Reserve Governor Lisa Cook echoed similar sentiments in a statement she would deliver before the Senate on Wednesday, saying, “I am committed to promoting sustained economic growth in a context of low and stable inflation.” Adriana Kugler, a candidate for the Fed Board, mentioned the necessity of getting inflation back to its 2% aim in her remarks, according to the prepared statements for Wednesday’s Testimony. The U.S. economy will benefit from this by getting off to a strong start.

Additionally, U.S. housing starts increased by 21.7% MoM in May VS a -2.9% (updated from +2.2%) recorded in April and a -0.8% market projection, which favors the U.S. Dollar Index bulls and brought them to their highest level since April 2022. Building Permits, which were up 5.2% MoM for the aforementioned month compared to -5.0% projected and -1.4% prior readings (updated from -1.5%), were also encouraging.

Amid these maneuvers, the Wall Street benchmark started the week on the downbeat side, but S&P500 Futures are still dormant, and U.S. Treasury bond rates likewise ended a two-day winning streak the day before exhibiting recent early-day inactivity.

Looking forward, the U.S. Dollar Index traders may face difficulties due to a light schedule before Fed Chair Jerome Powell’s biannual testimony. The U.S. Dollar Index may have further potential to watch should Fed Chair Powell support the hawkish stance of the U.S. central bank.

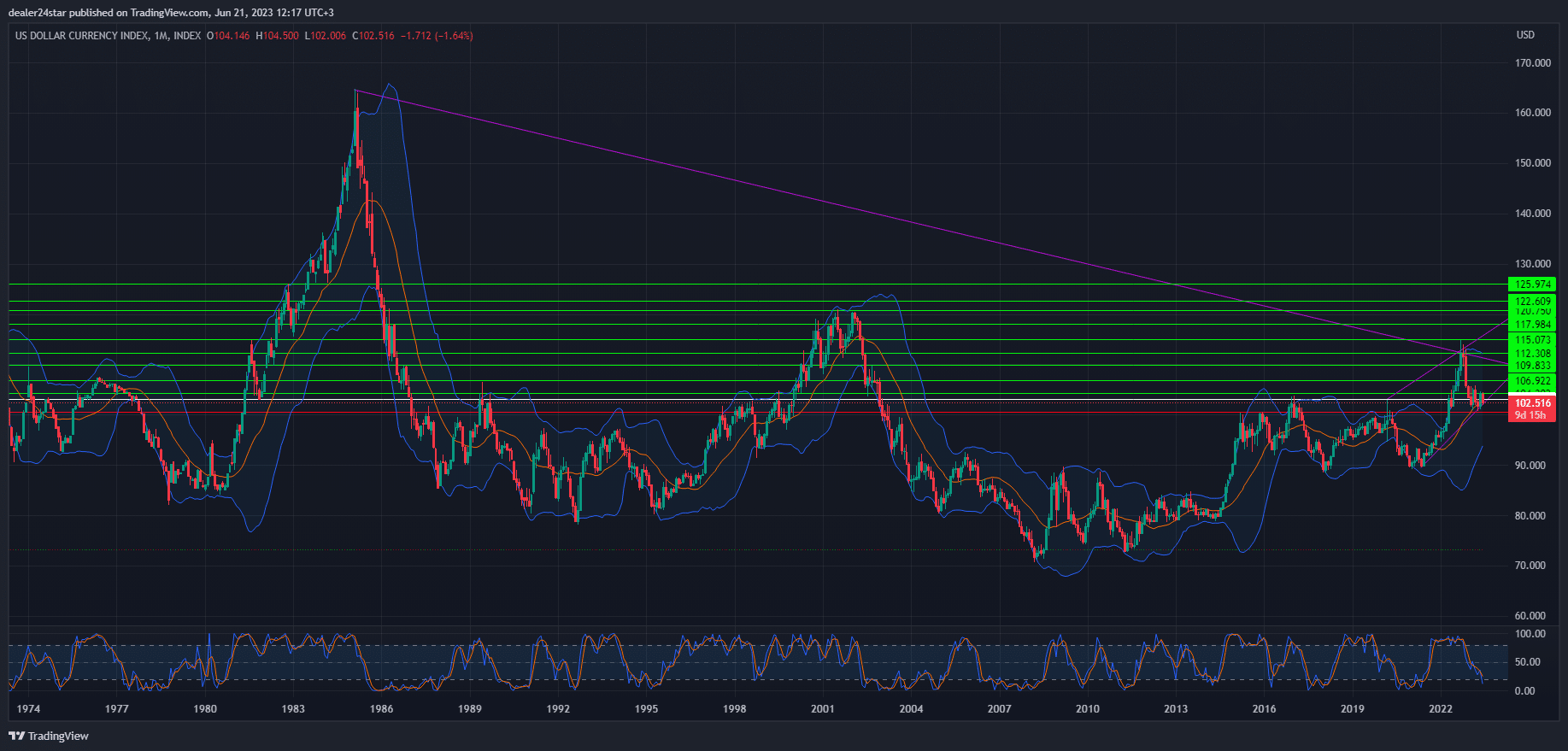

Dollar Index Long (Buy)

Enter At: 103.160

T.P_1: 104.302

T.P_2: 106.922

T.P_3: 109.833

T.P_4: 112.308

T.P_5: 115.073

T.P_6: 117.984

T.P_7: 120.750

T.P_8: 122.609

T.P_9: 125.974

S.L: 100.556

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.