When it comes to investing, there are countless options available, each with its own set of risks and rewards. One of the most fundamental decisions investors face is whether to invest in bonds or stocks. Both of these asset classes offer unique opportunities, but they also come with varying levels of risk. To make an informed decision, it is essential to understand and compare the risks associated with investing in bonds versus stocks.

Key Takeaways:

- Investing in bonds and stocks entails different levels of risk.

- Bonds are generally considered less risky, offering stable income and protection of principal.

- Stocks carry higher risk but offer the potential for higher returns through capital appreciation and dividends.

- Credit risk, interest rate risk, market risk, and company-specific risks are important factors to consider when assessing investment risks.

- Diversification and asset allocation strategies can help mitigate investment risk.

Understanding Bonds

Bonds are debt securities issued by governments or companies to raise capital. When I invest in bonds, I am essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity. Bonds are a popular investment choice for many individuals and institutions due to their relatively lower risk compared to stocks.

One of the primary reasons why bonds are considered less risky is because they offer a fixed income stream. The interest payments, also known as coupon payments, are made at regular intervals, providing investors with a predictable cash flow. Additionally, bonds are typically backed by the assets of the issuer or the government’s ability to repay its debt, providing an added layer of security.

Unlike stocks, which represent ownership in a company, bonds are essentially a loan agreement between the investor and the issuer. This means that while bondholders do not have equity in the company, they have a legal claim to the repayment of their investment. This characteristic of bonds makes them a favored investment option for individuals seeking stable income and capital preservation.

Let’s take a closer look at the advantages and features of bond investments:

Advantages of Bond Investments:

- Regular interest payments provide a fixed income stream

- Potential for capital preservation

- Diverse options across various sectors and issuers

- Typically less volatile than stocks

While bonds generally offer lower potential returns compared to stocks, they play a crucial role in a well-diversified investment portfolio. The bond market provides investors with a range of options, allowing them to tailor their investments based on their risk tolerance and investment objectives.

Now that we have a basic understanding of bonds, let’s delve deeper into the different risks associated with bond investments in the upcoming section.

Assessing Risks in Bond Investments

While bonds may be perceived as lower risk investments, they are not without their own set of risks. It is crucial for investors to understand these risks to make informed decisions.

Credit Risk

Credit risk refers to the possibility of the bond issuer defaulting on interest or principal payments. This risk can occur if the issuer’s financial health deteriorates, making it difficult for them to meet their payment obligations. Credit rating agencies assess the creditworthiness of issuers and assign ratings accordingly, helping investors gauge the level of credit risk.

Interest Rate Risk

Interest rate risk arises from changes in market interest rates, which can impact the value and yield of existing bonds. When market interest rates increase, bond prices generally fall, leading to potential capital losses for investors who sell their bonds before maturity. Conversely, when interest rates decline, bond prices tend to rise, resulting in capital gains for bondholders.

Inflation Risk

Inflation risk refers to the erosion of purchasing power due to rising prices of goods and services over time. While bonds offer fixed interest payments, inflation can erode the real value of these payments. As inflation rises, the purchasing power of future interest payments decreases, affecting the overall return of the investment.

Liquidity Risk

Liquidity risk pertains to the ease with which a bond can be bought or sold in the market without significantly impacting its price. Less liquid bonds may experience wider bid-ask spreads, making it more challenging for investors to enter or exit positions at favorable prices.

Call Risk

Call risk refers to the possibility that the issuer may choose to redeem a bond before its maturity date, especially if interest rates have fallen. This can lead to the investor receiving the principal earlier than expected and needing to reinvest the funds at potentially lower interest rates.

Understanding these risks is crucial for bond investors to effectively manage their portfolios and make well-informed investment decisions. In the next section, we will explore the risks associated with investing in stocks.

Introduction to Stocks

Stocks represent ownership in a company and give investors the opportunity to participate in the company’s growth and profits. When investing in stocks, individuals become shareholders, owning a portion of the company’s equity.

Unlike bonds, which offer fixed income, stocks provide the potential for capital appreciation and dividend payments. The value of stocks is determined by supply and demand in the stock market, leading to price fluctuations as investors buy and sell shares.

Investing in stocks requires a thorough understanding of the stock market and the individual companies in which one intends to invest. It involves analyzing financial statements, monitoring market trends, and assessing industry performance.

“The stock market is a complex and dynamic environment, with a wide range of investment opportunities. It is important to approach stock investing with a long-term perspective and a diversified portfolio.”

Benefits of Investing in Stocks

Investing in stocks offers several advantages:

- Ownership: Stocks provide individuals with a stake in a company, granting them certain rights and privileges, such as voting rights and attending shareholder meetings.

- Capital Appreciation: Stocks have the potential to increase in value over time, allowing investors to profit from their investments.

- Dividend Payments: Some companies distribute a portion of their profits as dividends to shareholders, providing a regular income stream.

- Liquidity: Stocks are highly liquid investments, meaning they can be bought and sold easily on the stock market, providing flexibility to investors.

It is important to note that while stocks offer the potential for significant returns, they also come with higher risks compared to bonds. Stock prices can be volatile, influenced by a multitude of factors, including economic conditions, market sentiment, and company-specific developments.

An Introduction to the Stock Market

The stock market is a centralized marketplace where investors can buy and sell securities, including stocks and other financial instruments. It serves as a platform for companies to raise capital by selling shares to the public through initial public offerings (IPOs).

The two primary stock exchanges in the United States are the New York Stock Exchange (NYSE) and the Nasdaq Stock Market. These exchanges facilitate the trading of stocks, providing a transparent and regulated environment for investors.

The Role of Equity Investments in a Portfolio

Equity investments, such as stocks, play a vital role in a well-diversified investment portfolio. They offer the potential for higher returns compared to fixed-income investments like bonds, which can help investors achieve their long-term financial goals.

Including stocks in a portfolio allows individuals to benefit from both income generation and capital appreciation. However, it is crucial to assess one’s risk tolerance, investment objectives, and time horizon when determining the appropriate allocation to stocks within a portfolio.

Next, we will explore the risks associated with investing in stocks and how to evaluate and mitigate them.

Evaluating Risks in Stock Investments

When considering investment options, it’s crucial to assess the risks involved. Investing in stocks carries a higher level of risk compared to bonds. Let’s explore the various risks associated with stock investments.

Market Risk

Market risk refers to the overall volatility of the stock market. It is influenced by a variety of factors such as economic conditions, geopolitical events, and investor sentiment. Fluctuations in the stock market can impact the value of stocks, potentially leading to gains or losses for investors. It is important to stay informed about market trends and developments to make informed investment decisions.

Company-Specific Risks

Alongside market risk, there are several company-specific risks to consider when investing in stocks:

- Business Performance: The success and profitability of a company directly impact the value of its stock. Factors such as revenue growth, earnings, and market share are critical indicators of a company’s performance.

- Industry Competition: Companies operating in competitive industries face the risk of losing market share and profitability due to intense competition.

- Management Decisions: Management decisions can significantly impact a company’s performance and outlook. Examples include mergers and acquisitions, strategic partnerships, and executive changes.

- Regulatory Changes: Government regulations and policy changes can have a profound effect on certain industries, leading to increased risks and uncertainties for companies operating within these sectors.

Liquidity Risk and Bankruptcy

Liquidity risk is another consideration when investing in stocks. Some stocks may have lower trading volumes, making it challenging to buy or sell them at desired prices. Additionally, there is always the risk of losing the entire investment if a company goes bankrupt. Investors should carefully evaluate the financial health and stability of companies before investing in their stocks.

To illustrate the risks associated with stock investments, refer to the following table:

| Risk Type | Description |

|---|---|

| Market Risk | Volatility of the stock market influenced by economic conditions, geopolitical events, and investor sentiment. |

| Business Performance | Company-specific risks arising from the success and profitability of the business. |

| Industry Competition | Risks associated with operating in competitive industries. |

| Management Decisions | Impact of executive decisions on the company’s performance and outlook. |

| Regulatory Changes | Risks arising from government regulations and policy changes. |

| Liquidity Risk and Bankruptcy | Risks associated with low trading volumes and the potential for a company to go bankrupt. |

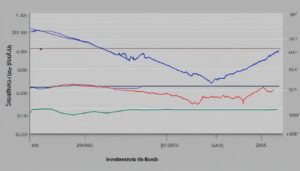

To further understand the risks associated with stock investments, I have included an informational image:

Understanding and evaluating the risks involved in stock investments is crucial for making informed decisions. It is essential to carefully weigh these risks alongside potential returns when creating an investment strategy.

Risk Comparison: Bonds vs Stocks

When comparing the risks of investing in bonds versus stocks, it is essential to consider both the inherent risks of each asset class and the individual characteristics of specific investments. Bonds generally offer more stability and predictable income but may have lower potential for long-term growth. Stocks carry higher volatility and the potential for greater returns but also come with higher risks and uncertainty. The risk tolerance and investment goals of individual investors should guide their decision-making process.

While bonds are generally considered less risky than stocks, they are not completely risk-free. Bonds are subject to credit risk, which refers to the possibility of the issuer defaulting on interest or principal payments. Changes in market interest rates can also pose a risk to bond values and yields, known as interest rate risk. Other risks associated with bonds include inflation risk, liquidity risk, and call risk.

On the other hand, stocks come with a higher level of risk compared to bonds. They are highly influenced by market conditions and can be affected by factors such as economic conditions, geopolitical events, and investor sentiment. Company-specific risks, such as business performance, industry competition, management decisions, and regulatory changes, also add to the overall risk of investing in stocks. Additionally, stock investors face liquidity risk and the potential for losing their entire investment if a company goes bankrupt.

To visually compare the risks of bonds versus stocks, the following table outlines the key risks associated with each asset class:

| Risks | Bonds | Stocks |

|---|---|---|

| Credit Risk | Medium to High | Low to High |

| Interest Rate Risk | Medium | Low |

| Inflation Risk | Medium | Low |

| Liquidity Risk | Low to Medium | Medium to High |

| Company Risk | Low | Medium to High |

As shown in the table, bonds carry medium to high credit risk, depending on the issuer’s financial health and creditworthiness. Interest rate risk for bonds is generally medium, while inflation risk and liquidity risk are also moderate. On the other hand, stocks have a lower range of credit risk, lower interest rate risk, and lower inflation risk. However, they have higher liquidity risk and medium to high company-specific risk.

It is important to keep in mind that these risks are not fixed and can vary depending on the specific bonds or stocks chosen for investment. Conducting a thorough risk assessment for individual investments and diversifying one’s portfolio can help mitigate these risks and align investment choices with risk tolerance and financial goals.

Risk Mitigation Strategies

When it comes to investing in bonds or stocks, mitigating risk is essential for long-term success. By implementing effective risk mitigation strategies such as diversification and asset allocation, investors can reduce their exposure to the fluctuations and uncertainties of the financial markets.

Diversification

Diversification involves spreading investments across different asset classes, sectors, and geographic regions. By diversifying their portfolios, investors can reduce the impact of adverse events on their overall returns. For example, if one investment performs poorly, the potential losses can be offset by other investments that perform well. This strategy aims to minimize risk by not putting all eggs in one basket.

“Diversification is an essential tool for risk management in today’s volatile market. By allocating investments across various asset classes, investors can protect themselves from the potential downsides associated with individual securities or sectors.” – John Smith, Senior Financial Analyst

It is important to note that diversification does not guarantee against losses or ensure a profit, but it can potentially help smooth out investment returns over time.

Asset Allocation

Asset allocation refers to the distribution of investment funds among different asset classes, such as stocks, bonds, and cash equivalents. The goal of asset allocation is to balance risk and reward based on an individual’s risk tolerance, investment goals, and time horizon.

By allocating funds strategically, investors can benefit from the potential returns of different asset classes while managing risk. For example, during periods of market volatility, a well-diversified portfolio with a higher allocation to bonds may be more conservative and provide stability. Conversely, during periods of economic growth, a higher allocation to stocks may capture potential market gains.

Regular Portfolio Review and Adjustment

Ongoing monitoring and adjustment of investment portfolios is vital to adapt to changing market conditions. The financial landscape is dynamic and influenced by various factors such as economic indicators, geopolitical events, and technological advancements. Regular reviews of portfolio performance, asset allocation, and investment goals can help investors make informed decisions to mitigate risk and maximize returns.

Conclusion

In summary, investing in bonds and stocks involves different levels of risk. Bonds are generally considered less risky than stocks, offering stability and predictable income. However, they may have lower potential for long-term growth. On the other hand, stocks carry a higher level of risk but also the potential for higher returns.

When making investment decisions, it is important for investors to understand their risk tolerance. This involves assessing their willingness and capacity to handle fluctuations in the value of their investments. It is also crucial to diversify investment portfolios by spreading investments across different asset classes, sectors, and geographic regions. This strategy can help reduce exposure to any single investment and mitigate risks.

Furthermore, aligning investment choices with long-term financial goals is essential. Investors should consider factors such as their investment horizon, income requirements, and desired rate of return. Seeking advice from a financial professional can provide valuable guidance in navigating the complexities of the bond and stock markets.

Ultimately, successful investing requires thorough research and analysis. It is important to stay informed about market trends, economic conditions, and company performance. By staying updated and making informed decisions, investors can strive to achieve their financial objectives while managing the risks associated with investing in bonds and stocks.

FAQ

What are bonds?

Bonds are debt securities issued by governments or companies to raise capital. Investors who buy bonds are essentially lending money to the issuer in exchange for regular interest payments and the return of the principal amount at maturity.

Why are bonds considered less risky than stocks?

Bonds are generally considered less risky than stocks because they offer a fixed income stream and are typically backed by the issuer’s assets or the government’s ability to repay its debt.

What are the risks associated with investing in bonds?

Bond investments carry risks such as credit risk, interest rate risk, inflation risk, liquidity risk, and call risk.

What are stocks?

Stocks represent ownership in a company and give investors the opportunity to participate in the company’s growth and profits. Stock prices fluctuate based on supply and demand in the stock market.

Why are stocks considered riskier investments?

Investing in stocks carries a higher level of risk compared to bonds due to market risk, company-specific risks, liquidity risk, and the risk of losing the entire investment if a company goes bankrupt.

How should investors compare the risks of bonds versus stocks?

Investors should consider the inherent risks of each asset class and the individual characteristics of specific investments. Bonds offer stability and predictable income but have lower potential for long-term growth. Stocks carry higher volatility and potential for greater returns but also come with higher risks and uncertainty.

What strategies can be used to mitigate investment risk?

Risk mitigation strategies include diversification, which involves spreading investments across different asset classes, sectors, and geographic regions, and asset allocation, which refers to the distribution of investment funds based on an individual’s risk tolerance and investment objectives. Regular review and adjustment of investment portfolios is also important to adapt to changing market conditions.

What should individuals consider before making investment decisions?

Individuals should understand their risk tolerance, diversify their portfolios, and align their investment choices with their long-term financial goals. Seeking advice from a financial professional and conducting thorough research and analysis are also advisable before making any investment decisions.

Source Links

- https://www.investorsobserver.com/news/crypto-update/bitcoin-classic-bxc-does-the-reward-outweigh-the-risks-11

- https://www.investorsobserver.com/news/crypto-update/lido-staked-eth-steth-how-risky-is-it-thursday-2

- https://www.fxstreet.com/analysis/gold-price-forecast-xau-usd-at-fresh-weekly-lows-post-us-cpi-202401111729

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.