Both the bond and equities markets have gotten uneasy as a result of the imminent debt limit crisis, which shows no signs of ending soon.

However, while some investors worry about a historic default, one asset may be able to survive it: Bitcoin.

Geoff Kendrick, head of FX analysis at Standard Chartered, described a US default as a “low-probability, high-impact event,” adding that it might force the price of bitcoin to soar by roughly $20,000, such as 68% from its current price.

He claimed that’s because the most valuable cryptocurrency by market capitalization has a track record of outperforming rivals under pressure and is frequently regarded as a safe haven since it’s a decentralized asset.

In contrast, Kendrick believes that Bitcoin would not increase in value in a straight line in the scenario of a US default, stating that “It probably comes a bit lower on day one, day two, or week.” In that case, he predicted that Bitcoin would initially decline by $5,000 before soaring by $25,000.

He also noted that not all cryptocurrencies would behave in the same way as Bitcoin, with some, like Ethereum, trading more like equities and likely experiencing a default.

A default might occur later in the summer if Congress fails to raise the $31.4 trillion federal debt ceiling, which would have a seismic impact on world financial markets. The US economy would suffer greatly from a default, Treasury Secretary Janet Yellen warned on Tuesday, leading to widespread unemployment, missed payments, and higher rates “into perpetuity.”

Three-month Treasury rates recently increased to a 22-year high, as they would mature around a hypothetical default date, with House Republicans and the White House still far from an agreement to raise the debt ceiling.

But as First Republic Bank’s troubles rekindled concerns about the financial sector, bitcoin has increased by almost 80% so far in 2023 and has recently been trading close to $30,000.

Kendrick, for his part, is already a supporter of Bitcoin and predicted in a note on Monday that it will reach $100,000 by the end of 2024 as a result of, among other things, bank turbulence, the halving of Bitcoin, and the anticipated end to Fed rate hikes. However, the statement omitted the possibility of a US default.

Although there are still some sources of uncertainty, he wrote, “We believe the pathway to the USD 100,000 level is becoming clearer.”

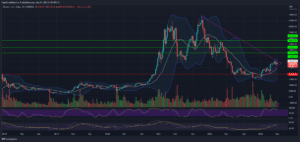

Bitcoin Long (Buy)

Enter at: 30669.99

T.P_1: 34362.12

T.P_2: 37576.48

T.P_3: 42333.72

T.P_4: 48070.90

T.P_5: 52165.21

S.L: 19369.38

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.