It has come to light that AT&T, a leading telecommunications company in the US, has amassed a significant amount of debt, totaling over $130 billion. This debt is larger than that of many countries.

Moreover, recent accounting changes have revealed that AT&T also has a substantial amount of “hidden debt.” This liability, worth billions of dollars, had not been previously disclosed.

One form of financing that AT&T has used is supply-chain finance, also known as “reverse factoring.” This method involves a financial institution paying a company’s suppliers earlier than expected, allowing the smaller suppliers to receive payment more quickly. However, the trade-off is that they receive a slightly lesser amount than what they are owed, while the financial institution later collects the full amount of the invoice from the larger company.

The use of supply-chain finance by companies has several benefits, such as increasing the time it takes to pay bills and improving balance sheets. However, the most concerning aspect is that accountants do not classify these facilities as debt, even though the company owes money to a financial institution. The lack of disclosure has made it difficult for investors to understand a company’s use of supply-chain finance.

Typically, supply-chain finance obligations are recorded under the “accounts payable” line of a company’s balance sheet. Unfortunately, these obligations are mixed with all other bills owed to suppliers, making it hard to determine how much is owed to financial institutions. In the past, there was no requirement to disclose the use of supply-chain finance.

Recently, the Financial Accounting Standards Board in the United States introduced new accounting rules mandating companies to disclose their use of “supplier finance.” Consequently, many U.S. companies revealed their supply-chain finance programs for the first time in their first-quarter results this year. Bloomberg analyzed the disclosures and discovered that $64 billion of “hidden leverage” was revealed across corporate America through these disclosures. They produced a chart of the largest users of supply-chain finance.

It has been noticed by FTAV that a well-known company is missing from the top five, despite having “payables finance” programs that extend to almost $13 billion.

Upon further investigation as to why this company doesn’t classify all of these facilities as supply-chain finance, it was discovered that there are critical limitations in the new FASB-mandated disclosures.

AT&T had over $2.5 billion in outstanding supplier financing as of March 31, which is more than 3.5 times the equivalent at Verizon. Additionally, they had even larger amounts outstanding under the “Direct Supplier Financing” and “Vendor Financing” programs, totaling $12.69 billion as of March 31, 2023, and $14.5 billion as of December 31, 2022.

AT&T books the majority of these liabilities through its accounts payable line, with a portion of the vendor financing being elsewhere due to its longer term. However, AT&T books repayments of the vendor financing through the financing activities section of its cash flow statements, along with debt and dividend payments.

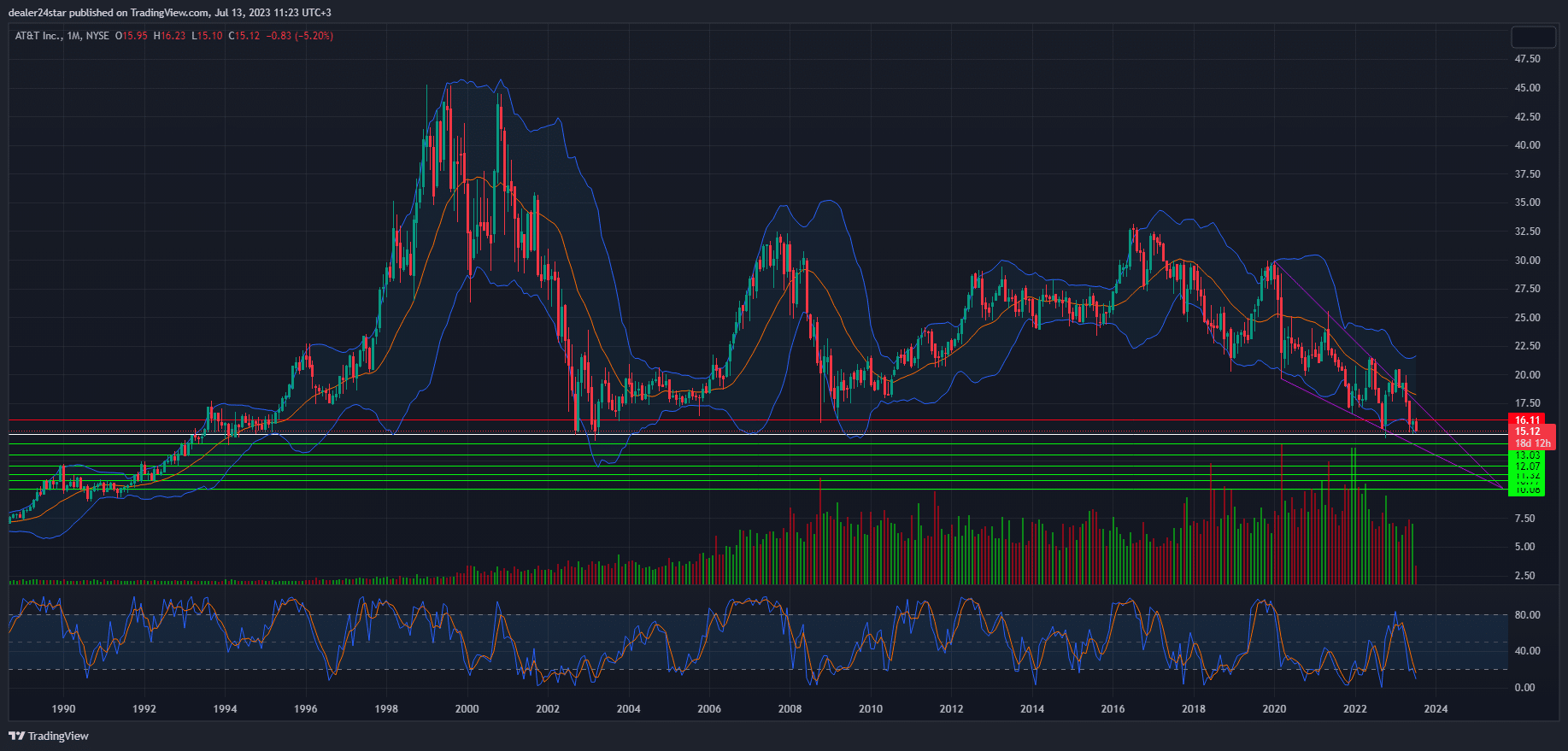

AT&T Short (Sell)

Enter At: 14.85

T.P_1: 14.03

T.P_2: 13.03

T.P_3: 12.07

T.P_4: 11.32

T.P_5: 10.77

T.P_6: 10.08

S.L: 16.11

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.