Despite struggling to make significant gains around 25.93, USD/TRY has broken its three-day downtrend during Tuesday’s European session. The currency pair appears to be taking cues from the broader US Dollar recovery and concerns about decreasing Turkish inflation, all while navigating the subdued markets due to the US holiday.

However, investors should be aware of potential recession risks as the US yield curve inversion continues to cause concerns. The previous day saw the inversion between the US 10-year and two-year Treasury bond yields reach its highest point since 1981, indicating potential economic troubles. Reuters stated, “The yield curve briefly inverted to 42-year lows Monday as investors increasingly expect the Fed to raise its benchmark borrowing rates to keep inflation in check.” As a result, the US two-year Treasury bond yields fell to 4.85%, while the 10-year counterpart dropped to 3.78%. They ended Monday’s trading at around 4.93% and 3.86%, respectively.

Although US Treasury Secretary Janet Yellen attempted to strengthen Sino-American economic connections when she was in Beijing, other news stories have raised questions about the ongoing US-China rivalry. The Biden administration is reportedly seeking to restrict Chinese corporations’ access to US cloud computing services, according to The Wall Street Journal. This may further exacerbate already tense ties between the two economic heavyweights.

Despite sluggish markets, buyers of gold remain unchallenged by downbeat US data and hawkish Fed bets. On Monday, the US ISM Manufacturing PMI for June dropped to its lowest level in three years and remained below 50.0 for the seventh consecutive month. It marked a 46.0 figure, lower than the expected 47.2 and the previous 46.9. In addition, the S&P Global Manufacturing PMI for June confirmed a 46.3 figure, the lowest in five months. However, there was good news as Construction Spending improved by 0.9% MoM for May, beating expectations of 0.5% and the previous readout of 0.4%.

The Central Bank of the Republic of Türkiye (CBRT) recently increased rates to 15%, the first hike since August 2021. Although the rate hike was lower than the anticipated 21%, buyers of the Turkish Lira (TRY) were still disappointed. However, the CBRT remains committed to achieving its 5% inflation target and is open to considering additional monetary tightening measures. Unfortunately, the announcement led to the USD/TRY reaching a record high of 24.61.

Looking ahead, traders of the Turkish Lira pair should pay attention to the Turkish Consumer Price Index (CPI) and Producer Price Index (PPI), set to be released on Wednesday. In addition, the Fed minutes on Wednesday and the US jobs report for June on Friday will also be important factors to consider for short-term directions.

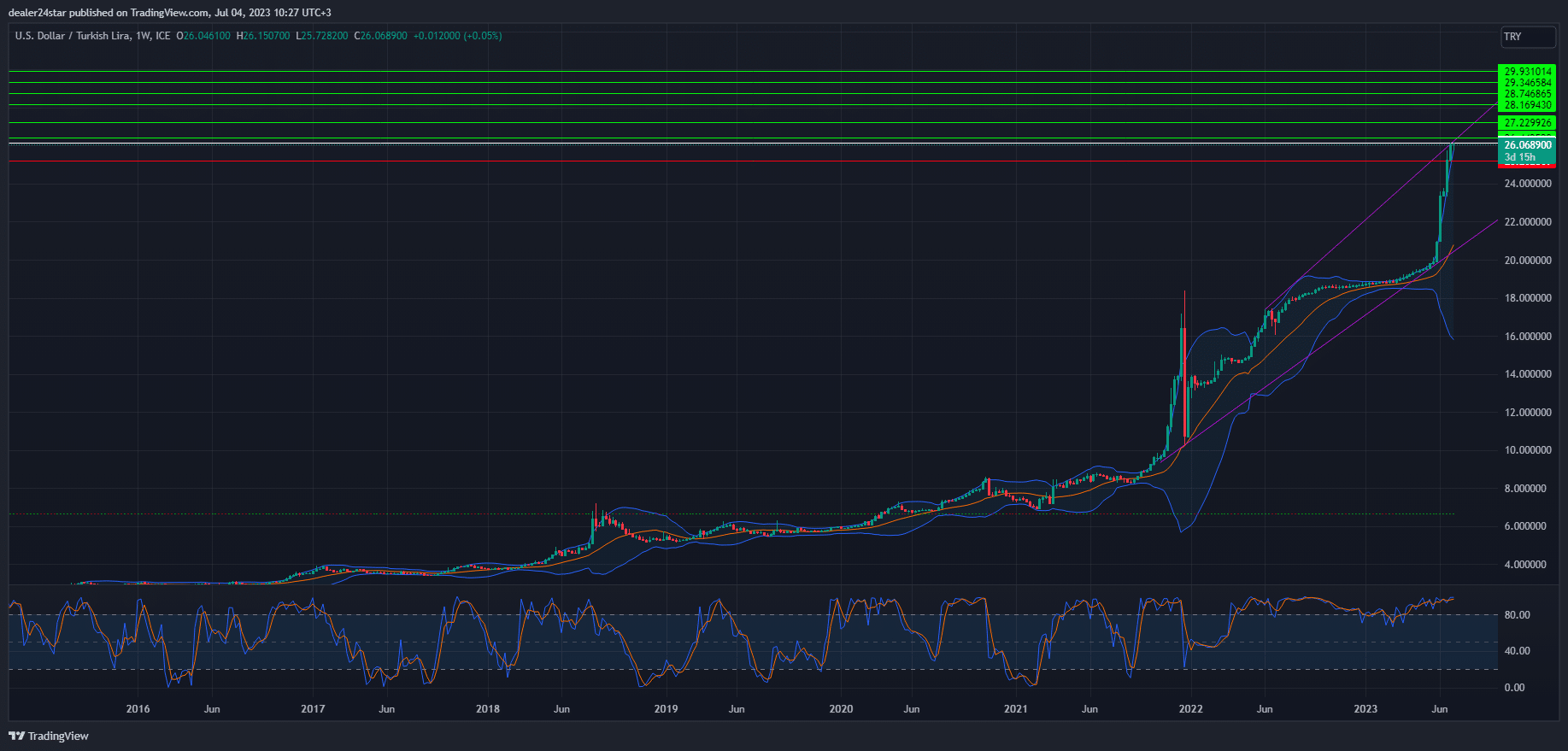

USD/TRY Long (Buy)

Enter At: 26.157402

T.P_1: 26.442529

T.P_2: 27.229926

T.P_3: 28.169430

T.P_4: 28.746865

T.P_5: 29.346584

T.P_6: 29.931014

S.L: 25.202859

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.