It appears that Apple Inc.’s CEO, Tim Cook, is on the brink of leading a $3 trillion empire. The share prices of this well-known consumer-electronics company have been steadily increasing and are now very close to reaching a $3 trillion valuation. As of Wednesday afternoon, the stock has risen by 0.5% to reach $188.93, and it only needs to close above $190.73 to achieve this impressive feat.

However, Apple’s last attempt to reach this milestone fell short. Even though the shares traded at levels that would have resulted in a $3 trillion valuation at the close of business on January 3, 2022, the stock failed to finish there. Nonetheless, Apple is determined to become the first U.S. company to end up in $3 trillion territory.

Apple’s shares have reached record highs once again this June, surpassing their pricing levels from January 3, 2022. However, due to a strong buyback program resulting in a decrease in the number of shares outstanding, the company has yet to exceed its early 2022 performance in terms of valuation.

It’s worth noting that Apple has come a long way since introducing the iPhone back in 2007, and has since achieved a market value of $100 billion.

Although Apple’s market cap has remained stagnant since the beginning of 2022, the company experienced significant valuation growth leading up to that point.

It took Apple 7,874 trading days from its public debut to reach a $500 billion market cap, based on Dow Jones Market Data. The company accomplished this feat on February 29, 2012. Apple then took another 1,617 days to double its valuation and become a trillion-dollar company on August 2, 2018.

Apple’s market value has been on a steady rise, taking 466 trading days to reach $1.5 trillion and hitting $2 trillion in just 50 days after that. Although it took 258 more days to notch a $2.5 trillion valuation, the company is still moving forward in its endeavor to hit the $3 trillion mark, currently being 477 trading days since cracking $2.5 trillion.

According to Wedbush analyst Daniel Ives, Apple’s valuation will continue to soar, with predictions of reaching a $3.5 trillion valuation by fiscal 2025 or even a $4 trillion valuation in his optimistic scenario. Ives believes that the market has underestimated the potential of a massive upgrade opportunity around iPhone 14, coupled with a mini super cycle iPhone 15 ahead, as 25% of Apple’s golden customer base has not upgraded their iPhones in over four years.

Apple has several emerging catalysts on the horizon, such as the launch of its $3,499 Vision Pro headset early next year. While the high price tag may impact early adoption, Apple is likely planning more for the virtual-reality category.

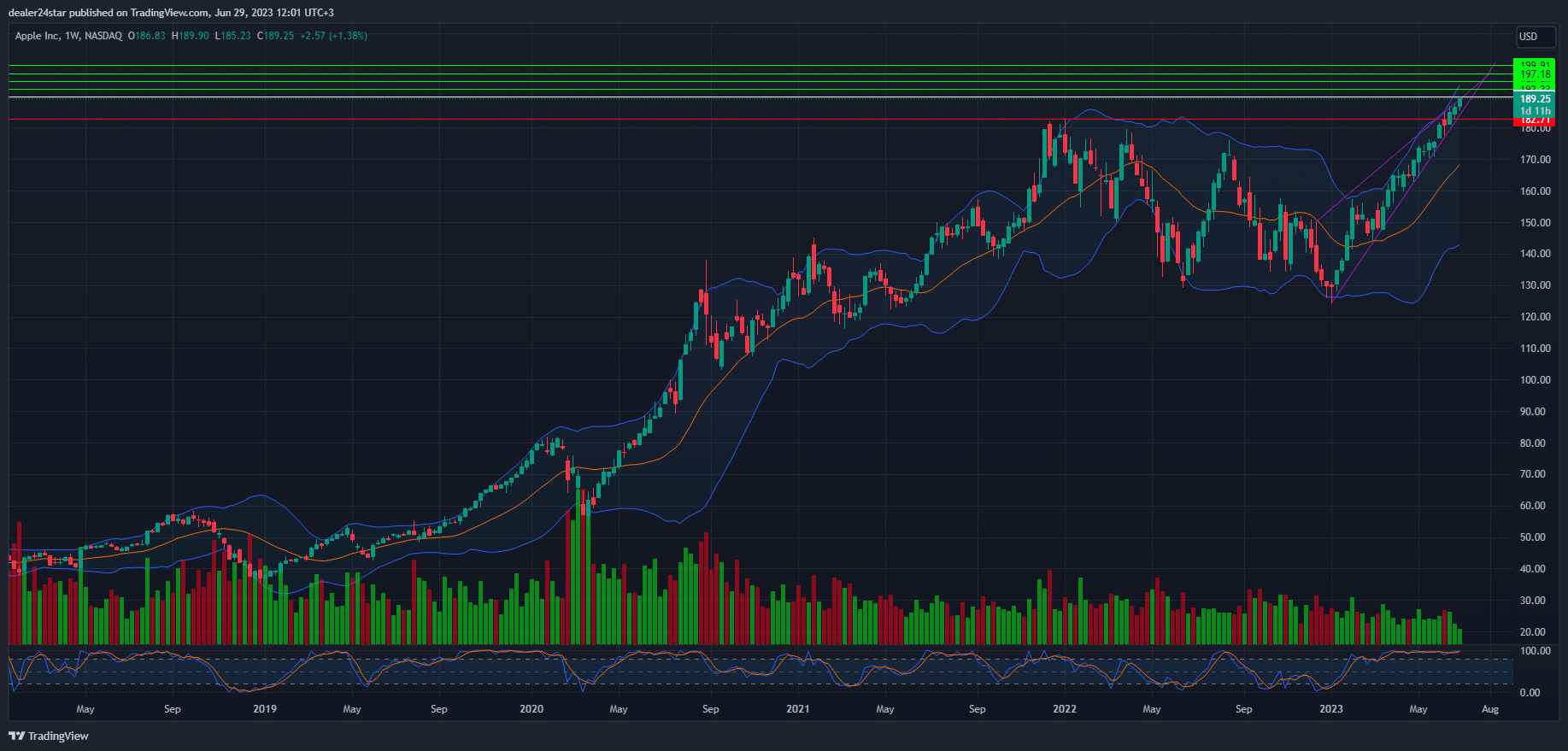

Apple long (Buy)

Enter At: 190.00

T.P_1: 192.23

T.P_2: 194.84

T.P_3: 197.18

T.P_4: 199.91

S.L: 182.71

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.