Financial Outlook and Leadership Changes

American Airlines has recently announced a downward revision of its financial forecast and the impending departure of Chief Commercial Officer (CCO), Vasu Raja. This news comes during a challenging period for the airline, as it has been lagging behind its rivals Delta Air Lines and United Airlines in terms of financial performance.

Financial Forecast Downgrade

The airline now anticipates a decrease in unit revenues of up to 6% in the second quarter compared to the previous year, which is a sharper decline than the previously forecasted maximum of 3%. As a result, the adjusted earnings per share estimate for the period has been lowered to a range of $1 to $1.15, down from the earlier range of $1.15 to $1.45.

This revised outlook reflects a more pessimistic view of revenues, indicating that American Airlines is facing significant headwinds in maintaining its profitability. The airline’s recent performance lagged behind competitors, with an 8% operating margin in 2023 compared to Delta’s 12% and United’s 10%.

Departure of Vasu Raja

Vasu Raja, who has served as the CCO since April 2022, will be leaving his position next month. During his tenure, Raja oversaw America’s customer organization, global network, alliances, and revenue management. His departure follows recent changes in the airline’s commercial strategy, including modifications to its ticket distribution approach aimed at increasing direct bookings through its platforms.

Stephen Johnson, the airline’s Vice Chair and Chief Strategy Officer, will assume Raja’s responsibilities on an interim basis and lead the search for a permanent replacement.

Challenges and Strategic Shifts

Furthermore, American Airlines has faced several challenges. One of these is weaker international connectivity compared to Delta and United. In addition, the airline recently lost its Northeast Alliance with JetBlue due to antitrust rulings. Moreover, changes in ticket distribution strategies have led to some pushback from corporate customers and travel advisors.

CEO Robert Isom has acknowledged the need for adjustments in the airline’s system to maximize revenue and retain cost savings. This sentiment was echoed in an April earnings call, where Isom admitted that competitors might have benefited from America’s strategic changes.

Market Reaction

Following the announcement, American Airlines’ stock dropped more than 8% in after-hours trading. This decline underscores investor concerns about the airline’s ability to navigate its current challenges and maintain competitiveness in a tough market.

Future Outlook

As American Airlines navigates these turbulent times, the focus will be on stabilizing its financial performance and finding a suitable successor to lead its commercial strategies. The airline’s leadership will need to address both internal and external pressures to regain momentum and align more closely with industry performance standards.

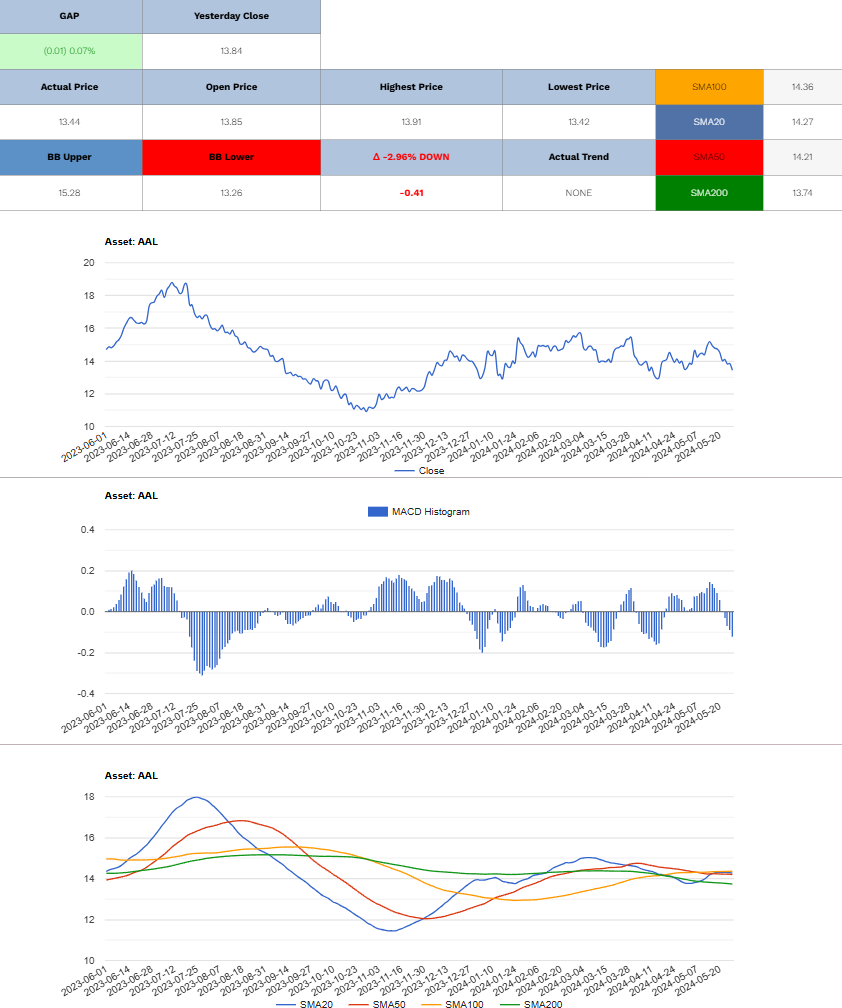

American Airlines Short (Sell)

Enter At: 13.19

T.P_1: 12.79

T.P_2: 12.25

T.P_3: 11.75

T.P_4: 10.89

T.P_5: 10.19

T.P_6: 9.39

T.P_7: 8.25

T.P_8: 7.61

T.P_9: 6.89

T.P_10: 5.73

T.P_11: 4.90

T.P_12: 4.06

T.P_13: 3.60

T.P_14: 2.89

S.L: 16.41

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.