The aluminum market has had a challenging year, with prices fluctuating significantly. The benchmark three-month futures contract on the London Metal Exchange (LME) peaked in January and has since fallen by nearly 20%. This decline is due to economic vulnerabilities in Europe and the United States, as well as diminished demand in China’s construction sector.

The current price of aluminum is around $2,180 per metric ton, a far cry from the highs of over $3,840 per ton seen last year. This decline reflects the looming global economic slowdown, as aluminum prices are often seen as a barometer of future industrial activity.

However, there is optimism among industry experts and producers about aluminum’s medium-term prospects. This is due to rising demand from the rapidly expanding clean technology sector, particularly in solar energy and electric vehicles (EVs). Aluminum is an essential component for solar panel frames, mounting systems, and EV production, positioning it favorably for future growth.

In recent months, the aluminum market has experienced its most significant contango since the global financial crisis of 2008-09. This contango trend indicates that current aluminum prices are lower than anticipated future prices, reflecting subdued immediate demand and expectations of price increases in the future.

Estimates suggest a global surplus of just over 800,000 metric tons this year, which has exerted downward pressure on prices. However, encouraging signs are emerging as global aluminum inventories seem to stabilize after a period of decline.

China has emerged as a bright spot in the aluminum market. The nation’s substantial investments in clean energy infrastructure have driven record-high demand for aluminum. In July, China’s aluminum imports surged by 20% compared to the previous year. However, this positive development is offset by China’s near-record levels of domestic aluminum production.

The price of aluminum is influenced by several key factors, including:

* Supply and demand: Aluminum prices are primarily driven by the balance of supply and demand. Oversupply tends to depress prices, while increased demand can push prices higher.

* Cost of production: The cost of producing aluminum, particularly the cost of energy, plays a significant role in price determination.

* Exchange rates: Fluctuations in exchange rates, particularly the strength of the US dollar, can impact aluminum prices. A stronger US dollar can make aluminum exports more expensive, leading to lower prices.

* Government policies: Government policies, such as tariffs and trade restrictions, can influence aluminum prices. Tariffs on imported aluminum, for example, can lead to higher consumer prices.

* Speculative trading: Speculation in the aluminum futures market can also affect prices. Investors buying aluminum futures contracts in anticipation of price increases can drive prices upward.

Several other elements can exert an influence on the aluminum market:

– Global Economic Conditions: The broader state of the worldwide economy can have repercussions on both the demand for and pricing of aluminum.

– Expansion of the Construction Industry: The growth of the construction sector wields significant influence over the demand for aluminum, rendering it a pivotal determinant.

– Surging Demand for Electric Vehicles: The increasing popularity of electric vehicles is propelling the need for aluminum, particularly in the context of lightweight components.

– Bauxite Availability: The availability of bauxite, which serves as the primary raw material for aluminum production, assumes a critical role. A scarcity of bauxite resources can lead to elevated aluminum prices.

Looking ahead to 2023, here is a forecast for the aluminum market:

- The global aluminum market is expected to grow by approximately 2.5% in 2023.

- Growth in the construction industry will be a key driver of aluminum demand.

- Increasing demand for aluminum in electric vehicles is anticipated in 2023.

- Bauxite availability is expected to be tight in 2023, potentially supporting aluminum prices.

In summary, the aluminum market is poised for a dynamic year in 2023. While positive growth is anticipated, price volatility may persist due to various factors, including the global economic outlook and shifts in supply and demand dynamics. Understanding these factors will be crucial for informed decision-making in the aluminum market.

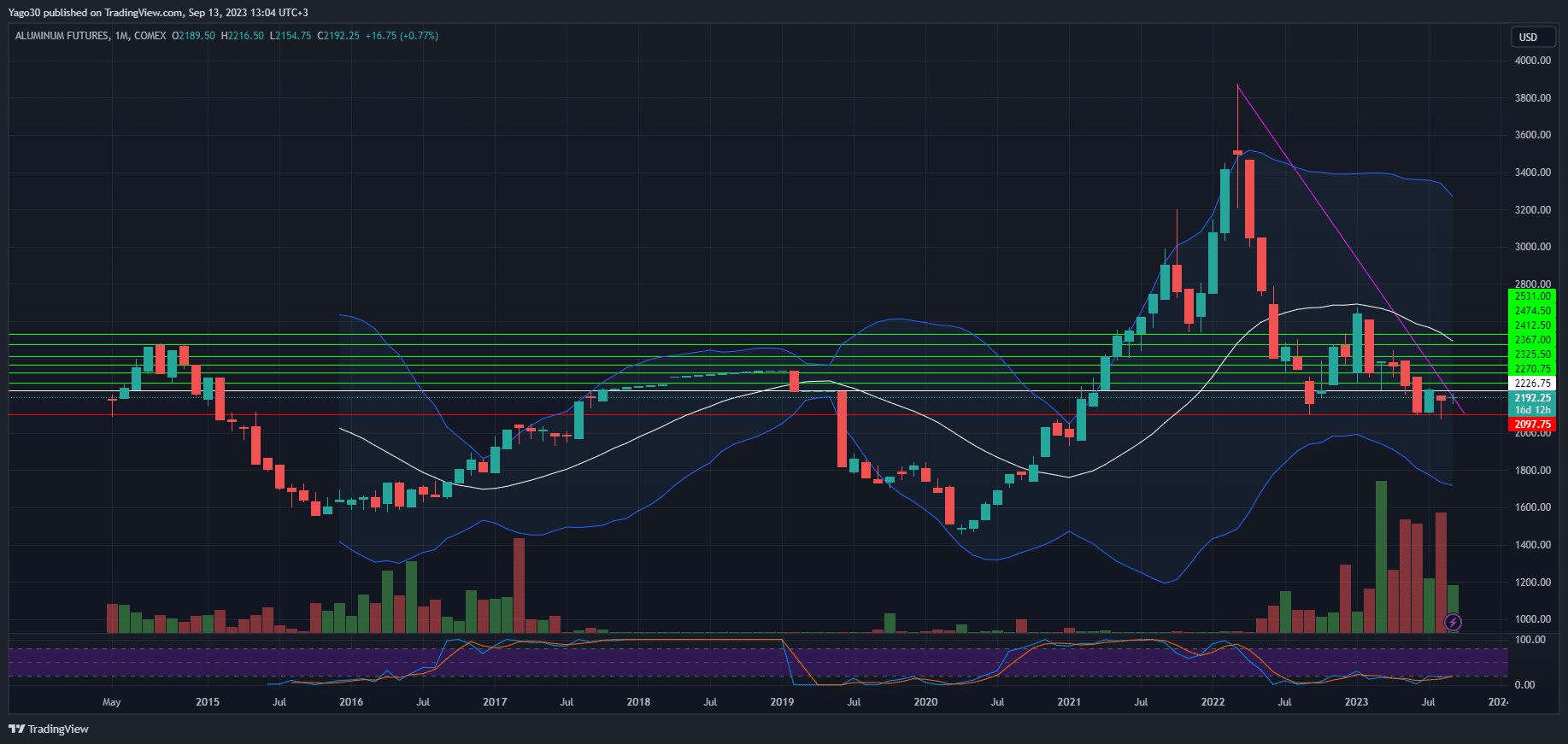

Aluminum Long (Buy)

Enter At: 2226.75

T.P_1: 2270.75

T.P_2: 2325.50

T.P_3: 2367.00

T.P_4: 2412.50

T.P_5: 2474.50

T.P_6: 2531.00

S.L: 2097.75

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.