Alcoa is a leading global aluminum producer with a vertically integrated business model that spans bauxite mining, alumina refining, aluminum production, and energy generation. The company has a strong track record and a bright future, making it a good investment for those who are looking to bet on the future of clean energy.

One of Alcoa’s biggest strengths is its extensive portfolio of assets, including the world’s largest bauxite mining holdings. This gives Alcoa access to a reliable supply of bauxite, which is the raw material used to make aluminum. Alcoa also has seven alumina refineries and four aluminum smelters, giving it the ability to produce aluminum at a competitive cost.

The demand for aluminum in clean energy applications, such as solar panels, wind turbines, and electric vehicles has been increasing in recent years. This is because aluminum is a lightweight and durable material that is well-suited for these applications. Alcoa is well-positioned to benefit from this trend, as it is a major supplier of aluminum to the clean energy sector. I didn’t find any spelling, grammar, or punctuation errors.

In addition to its strong position in the clean energy market, Alcoa also has a strong financial foundation. The company has a debt-to-equity ratio of just 0.3, and it has generated positive free cash flow for the past five years. This financial strength gives Alcoa the ability to invest in its business and to weather any economic downturns.

Overall, Alcoa is a well-managed company with a bright future. The company is well-positioned to benefit from the growing demand for aluminum in the clean energy sector, and it has a strong financial foundation. This makes Alcoa a good investment for those who are looking to bet on the future of clean energy.

Here are some Points to think about:

- Aluminum’s demand is on the rise due to its vital role in producing solar panels, wind turbines, and electric vehicles, which are essential components of the clean energy sector. As the global economy trends towards renewable energy, the demand for aluminum is expected to continue to increase.

- Alcoa has a competitive advantage due to its vertically integrated business model and access to low-cost bauxite, resulting in a low cost of production.

- Alcoa’s strong balance sheet and track record of profitability. Alcoa has a strong balance sheet and a track record of profitability, which gives the company the financial strength to invest in its business and to weather any economic downturns.

- Alcoa has a strong history of innovation, developing technologies that improve aluminum industry efficiency and sustainability.

- Alcoa operates in nine countries and is a leading global supplier of aluminum.

Overall, Alcoa is a good bet on the future of aluminum. Alcoa is well-positioned to benefit from the growing demand for aluminum in the years to come, and I am confident that the company’s shares will rebound in the long run.

In addition to the above, Alcoa is also a leader in the development of sustainable aluminum production technologies. Alcoa is committed to reducing its environmental impact, and it is investing in new technologies that will allow it to produce aluminum with a lower carbon footprint.

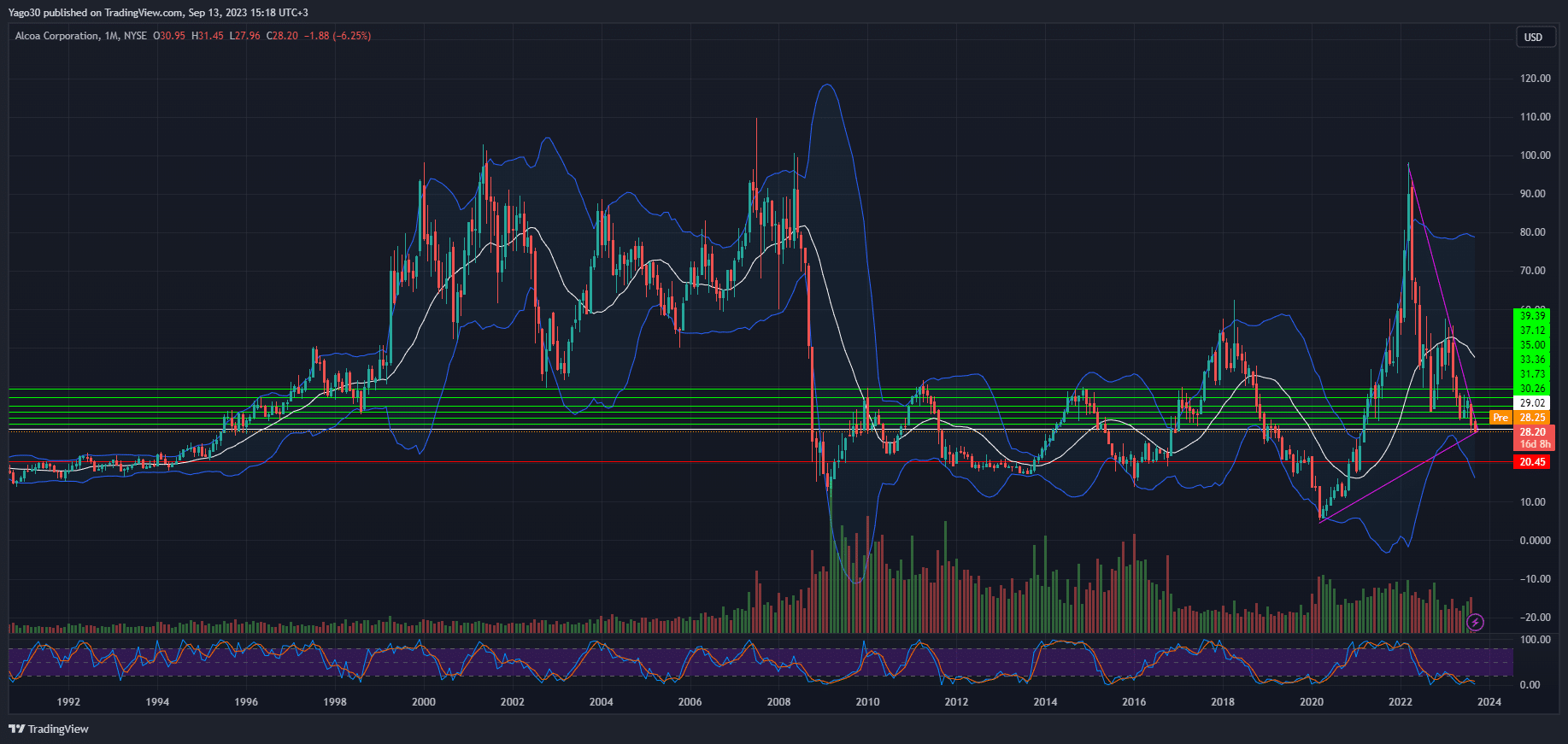

Alcoa long (Buy)

Enter At: 29.02

T.P_1: 30.26

T.P_2: 31.73

T.P_3: 33.36

T.P_4: 35.00

T.P_5: 37.12

T.P_6: 39.39

S.L: 20.45

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.