Due to a strong U.S. Dollar demand, GBP/USD declined below 1.2400 on Monday, pushing the major down for a second straight day. Markets’ revised assessment of the Fed’s interest rate forecast drives up yields on U.S. Treasury bonds, which in turn strengthens the U.S. dollar. The US ISM Services PMI comes next.

The U.S. Dollar gets upward traction for the second consecutive day as the Federal Reserve’s (Fed) next policy move remains unpredictable, and this proves to be a crucial element imposing some pressure on the major. It’s worth noting that a wave of influential Fed officials this week reinforced the case for not raising interest rates, yet markets are still pricing in another 25 basis point boost in June. Furthermore, following the release of U.S. monthly employment data on Friday, investors appear to have pushed out expectations for an impending pause in the Fed’s rate hike campaign to July and eased off on bets for rate cuts later in the year.

The headline NFP figure revealed that the U.S. economy added 339K jobs in May, well exceeding the previous month’s total of 294K and beyond consensus expectations of 190K. However, additional information revealed that the unemployment rate increased to 3.7%, as opposed to a projected increase to 3.5% from 3.4% in April. Furthermore, average hourly earnings fell to 4.3% from 4.4%, indicating that pay growth is slowing. Nonetheless, the data was solid enough to sustain the Fed’s expectations for additional policy tightening, which is pushing U.S. Treasury bond yields higher and boosting the Greenback. However, the existing risk-on atmosphere, as shown by a broadly optimistic tone in the equities markets, appears to cap the safe-haven buck and may give support to the GBP/USD pair.

The passing of legislation to increase the government’s $31.4 trillion debt ceiling in order to prevent a historic American default continues to provide strong support for the market attitude. Additionally, a private sector survey released on Monday revealed that China’s services activity increased in May, which encourages investors. In addition, rising anticipations of future interest rate increases by the Bank of England (BoE), supported by higher-than-anticipated UK consumer inflation data for May, may help to contain losses for the GBP/USD pair, at least temporarily. As a result, it is wise to hold off on setting up for any significant spot price drop until there has been considerable follow-through selling.

Market mood has improved with the approval of legislation to increase the government’s $31.4 trillion debt ceiling and avert a historic American default. Additionally, a private-sector poll issued on Monday indicated that China’s services activity increased in May, boosting investor confidence. Aside from that, the GBP/USD pair may continue to be under pressure for the time being due to strengthening expectations for future interest rate rises by the Bank of England (BoE), supported by stronger-than-expected U.K consumer inflation data for May. It is wise to wait until there has been a considerable amount of follow-through selling before positioning for any significant decrease in spot prices. Before the US ISM Services PMI, which is scheduled to be released later during the early North American session, traders are currently waiting for the publication of the final U.K Services PMI.

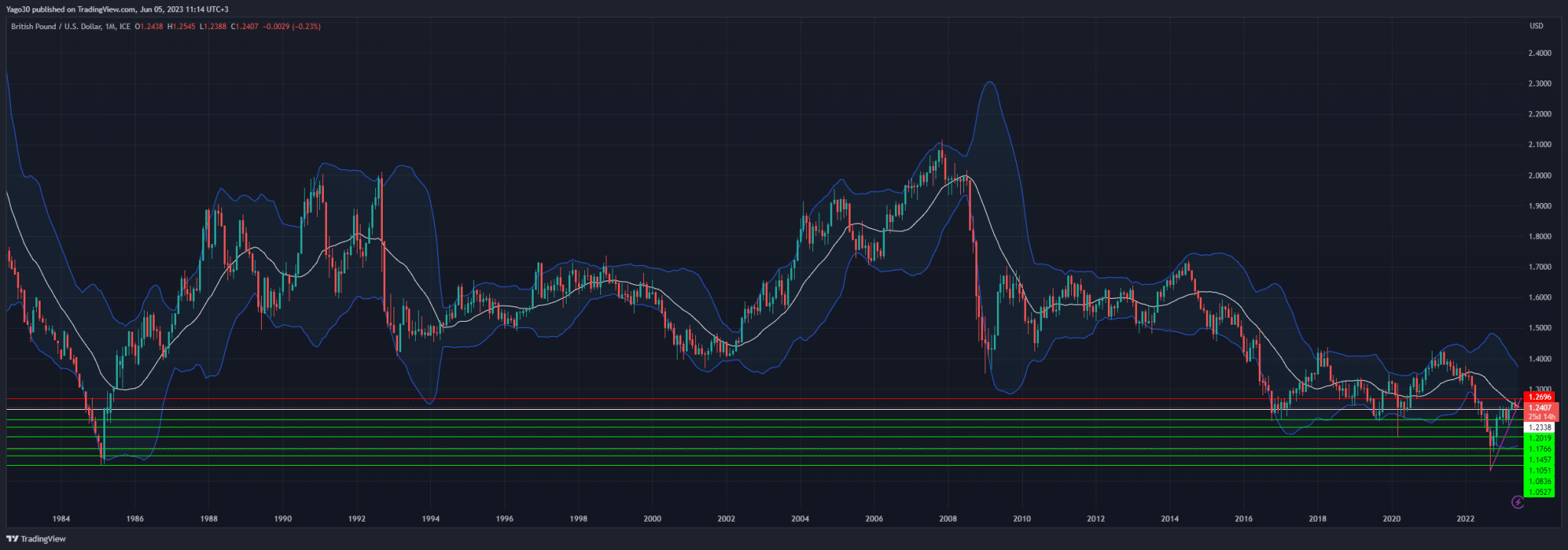

GBP/USD Short (Sell)

Enter At: 1.2338

T.P_1: 1.2019

T.P_2: 1.1766

T.P_3: 1.1457

TP._4: 1.1051

T.P_5: 1.0836

T.P_6: 1.0527

S.L: 1.2696

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.