It has been reported that Global Demand for platinum surged by 28% (+441 koz) in the first quarter of 2023, thanks to growing investment demand and strong momentum in the automotive and industrial sectors. This was coupled with a decrease in the supply of refined platinum production (-8% YoY, -96 koz) and a reduction in autocatalyst recycling (-15%, -52 koz) and jewelry recycling (-3%, -3 koz). As a result, the market experienced a deficit of 392 koz – the first quarterly deficit since Q2-21.

These developments have led to a significant increase in the deficit forecast for the whole of 2023, which has gone up by 77% from the figure predicted three months ago; to reach 983 koz. This is due to an expected total supply that is 1% lower than the already weak level of 2022, at 7,193 koz (-63 koz), and stronger year-on-year demand growth of 28% to reach 8,176 koz (+1,775 koz).

The Demand for investments has significantly increased, topping 400 Koz in Q1’23. This increase in Demand may be ascribed to the unpredictability of the global market, the rapid expansion of platinum consumption, and worries about the supply risks associated with mines. Investment in bars and coins increased significantly in Q1 of 23 (71% YoY), hitting 102 Koz, the highest level since Q3 of 21. The recovery in Japan served as fuel for the rise. With a predicted growth of 79% (+178 Koz), this trend is anticipated to last the entire year. Additionally, in Q1’23, platinum ETF holdings rose by 43 Koz, reversing the net disinvestment of the previous six quarters. Instead of PGM mining stocks, South African funds are once again interested in holding platinum ETFs. In 2023, it’s anticipated that this pattern will persist, leading to a net investment demand of 433 Koz and a swing of 1,073 Koz in 2022.

Industrial platinum demand has grown by 8% (+43 Koz) in Q1’23, primarily driven by the 108% (+123 Koz) growth in chemical demand due to paraxylene capacity additions in China. The increase in LCD glass capacity in China is expected to offset the closures in Japan, resulting in a 76% YoY growth (+316 Koz) in the demand for platinum in glass to 730 Koz. The medical sector (+3%, +9 Koz) and other industrial segments (+4%, +23 Koz) have also contributed to the growth in industrial demand. As a result, 2023 is anticipated to be a record year for industrial demand, growing by 17% YoY (+382 Koz) to 2,628 Koz.

Despite a weak macro outlook, the Demand for platinum in the automotive industry has seen a significant rise. In Q1’23, the demand increased by 9% (+69 koz) to 806 koz, primarily due to increased platinum usage per vehicle and partially due to higher vehicle production. Every year, it is expected that the global automotive demand for platinum will increase by 12% in 2023, reaching 3,255 koz (+357 koz YoY), driven by factors such as heavy-duty vehicle production growth of 6% in 2023, tighter emissions legislation, and a growing preference for platinum over palladium in gasoline after-treatment systems. This preference has led to an upward revision of the substitution estimate for 2023 to 615 koz.

However, the total supply of platinum struggling in 2023. Refined mine production declined by 8% (-96 koz) YoY in Q1’23 and fell by 11% (-151 koz) against Q4’22. The output in South Africa declined by 14% (-119 koz) YoY due to smelter maintenance and the country’s ongoing electricity shortages. Mined platinum supply is expected to fall by 1% (to 5,511 koz) in 2023, although gains in North America and Zimbabwe partially offset the reductions in South Africa. Nevertheless, uncertainties exist for the South African platinum supply.

The global recycling of platinum remained sluggish in Q1’23, falling by 12% (-56 koz) YoY to 413 koz due to reduced volumes of end-of-life vehicles and regulatory measures in North America aimed at curbing autocatalyst theft. As these issues are likely to persist throughout 2023, the full-year platinum recycling supply is forecasted to fall by 1% (-9 koz) to 1,682 koz.

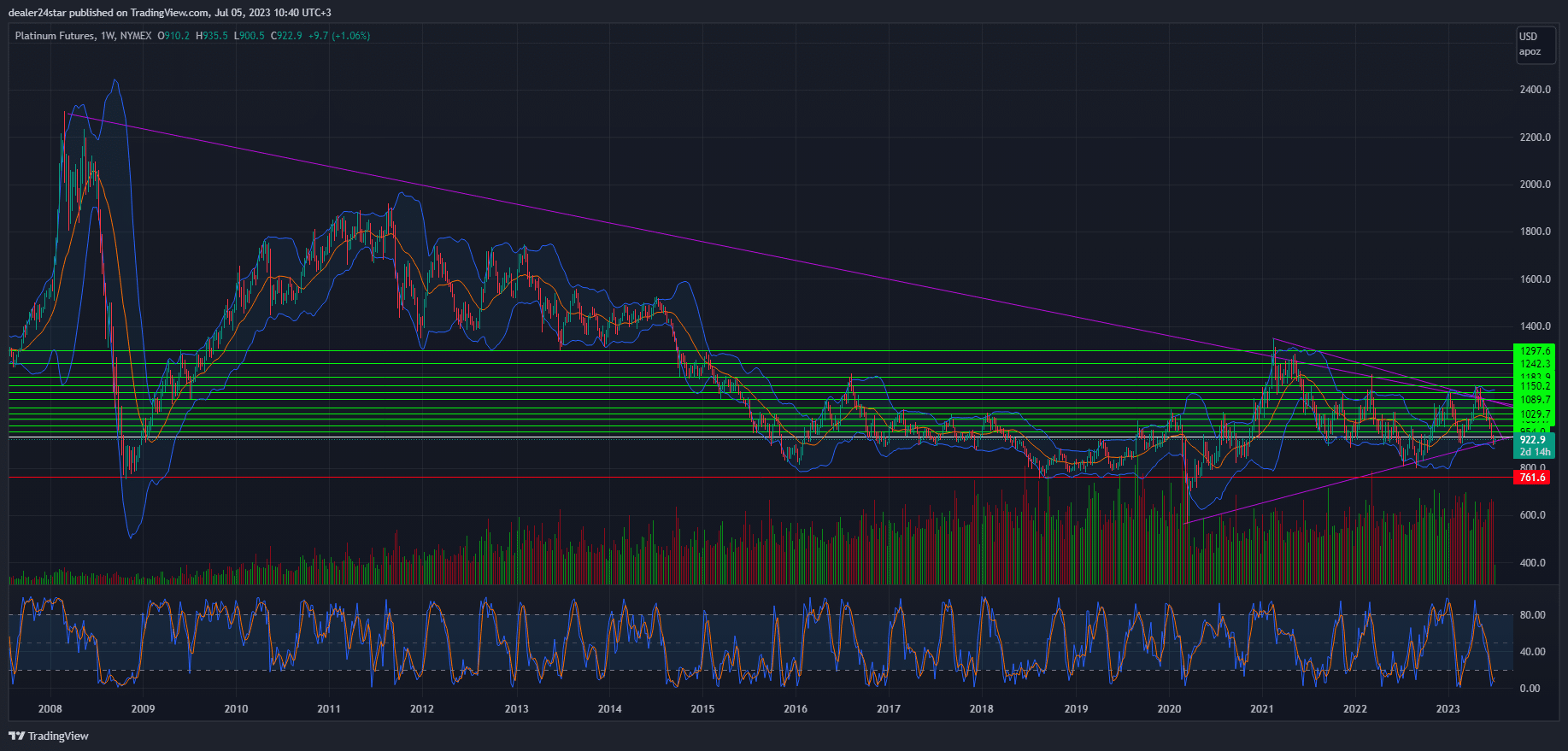

Platinum Long (Buy)

Enter At: 932.6

T.P_1: 954.0

T.P-2: 979.2

T.P_3: 1007.7

T.P_4: 1029.7

T.P_5: 1053.9

T.P_6: 1089.7

T.P_7: 1118.9

T.P_8: 1150.2

T.P_9: 1183.9

T.P_10: 1242.3

T.P_11: 1297.6

S.L: 761.6

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.