Overview of the Fed Meeting and Interest Rate Decision

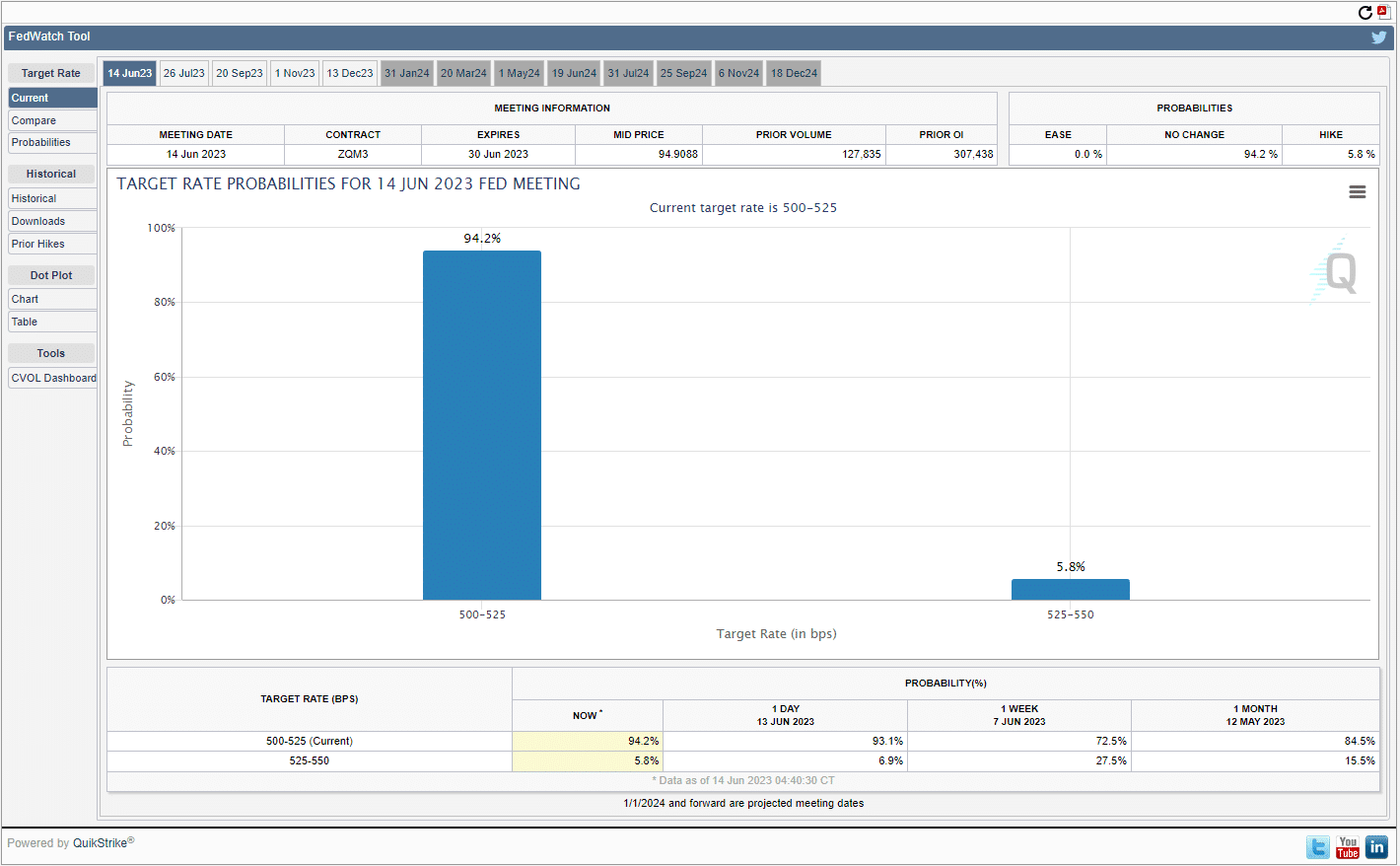

Ahead of the highly anticipated Fed meeting, the markets are predicting a 95% probability that interest rates will remain unchanged. The decision, expected at 21:00 GMT, will mark the first time since March 2022 that the Federal Reserve has not raised interest rates. The current rate is projected to remain steady at 5.0-5.25% for the coming months, and any deviation from this would be a significant surprise to market watchers. While inflation and interest rates are tightly linked, this decision is a temporary pause in the ongoing cycle of rate hikes, not the end of it.

Expectations of Future Interest Rate Increases

The market expects another quarter-percent interest rate hike in July, followed by a possible pause for several months. However, as always, such predictions are subject to change based on incoming macroeconomic data. This connection between inflation and interest rates has made forecasting particularly tricky, with analysts adjusting expectations as new data emerges.

Impact of Inflation Data on Rate Decisions

Last night’s inflation report added further weight to the expectation that rates will remain unchanged. Inflation has continued its disinflationary trend, with the annual rate now sitting at 4%. This significant drop has led to a swift 20% reduction in the likelihood of a rate increase, bringing the probability of an interest rate hike down to just 5%. Despite this, core inflation, which excludes more volatile items like food and energy, came in exactly as expected. Furthermore, super core inflation, which strips out the housing sector, continues to rise on a monthly basis. This divergence in inflation data provides the Fed with an excuse to surprise the markets, although this outcome is seen as unlikely by most analysts.

Insights from the Fed Press Conference

The press conference that follows the interest rate announcement, set for 21:30 GMT, will provide further clarity on the Fed’s stance. Of particular interest will be Fed Chairman Jerome Powell’s comments regarding the future path of inflation and interest rates. While inflation has been cooling, and recent data points to price increases returning to the Fed’s 2% target, core inflation remains stubbornly high. Powell will likely emphasize that the Fed is wary of repeating past mistakes by reducing interest rates too soon, as this could lead to inflation overheating once again.

Inflation Trends and Their Effects on Policy

Interest rates play a crucial role in controlling inflation. By raising interest rates, the Fed makes borrowing more expensive, which cools consumer spending and investment, thus reducing demand and slowing down price increases. Conversely, lowering interest rates stimulates the economy by making borrowing cheaper, which can lead to increased spending and investment. This balancing act between inflation and interest rates is the Fed’s primary tool for managing the economy, and any changes in the Fed’s approach can significantly impact the financial markets.

Core Inflation and Its Influence on Interest Rates

The recent inflation data shows that consumer prices are indeed cooling, but core inflation, which excludes food and energy prices, remains elevated. The Fed will closely monitor this figure, as sustained core inflation could signal that further rate hikes are needed to prevent the economy from overheating. Powell will likely stress that the full impact of the Fed’s recent rate increases has yet to be felt, as there is often a delay between a rate hike and its effects on the broader economy. For this reason, the Fed may adopt a “wait and see” approach, holding interest rates steady while assessing incoming data on inflation and growth.

Market Reactions to Interest Rate Decisions

From a market perspective, the stock market is keen to hear that interest rates will not rise again in the near future. Investors will also be looking for signs that inflation is under control, as this would support a more stable investment environment. Any indication that the Fed may consider lowering interest rates in the coming months, in line with bond market expectations, could trigger a rally in stock prices. On the other hand, if Powell signals that further rate hikes are likely, this could prompt a sell-off, as higher interest rates typically lead to lower corporate earnings and reduced investor confidence.

Bond Market Outlook Based on Inflation and Interest Rates

The bond market, which is highly sensitive to changes in inflation and interest rates, is also watching the Fed’s decision closely. Bond prices tend to move inversely to interest rates, meaning that if the Fed signals further rate increases, bond prices could fall. Conversely, if the Fed hints at a pause or reduction in rates, bond prices may rise. This dynamic underscores the importance of inflation and interest rates in shaping market behavior, as even small shifts in Fed policy can have outsized effects on financial markets.

Long-Term Implications of the Fed’s Strategy

Looking ahead, the key question for investors is whether the Fed’s current strategy of controlling inflation through higher interest rates will continue. Inflation has been cooling in recent months, with the headline figure dropping to 4%, but core inflation remains elevated. The Fed has indicated that it is willing to raise interest rates further if necessary, but it also recognizes that some of the effects of its previous rate hikes are still working their way through the economy. This suggests that the Fed may take a more cautious approach in the coming months, holding rates steady while waiting for clearer signals from the inflation data.

Conclusion: Inflation and Interest Rates in the Coming Months

In summary, inflation and interest rates remain closely intertwined, and the outcome of the Fed’s decision will have significant implications for the economy and the financial markets. The Fed is expected to keep interest rates unchanged at 5.0-5.25%, marking a temporary pause in its rate-hiking cycle. However, the prospect of further rate increases in the coming months remains on the table, depending on how inflation evolves. For now, investors should focus on the Fed’s press conference for clues on future monetary policy, as Powell’s comments could provide valuable insight into the Fed’s strategy for managing inflation and interest rates in the months ahead.

Source Links :

https://tradingeconomics.com/united-states/interest-rate

https://finance.yahoo.com/news/may-cpi-inflation-data-june-13-2023-123207667.html?.tsrc=372

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.