Walmart, the world’s largest retailer, announced on Tuesday that it will be doing a 3-for-1 stock split, surprising investors. This move reminds us that stock splits can take place at any company and not just high-flying tech stocks like those in the “Magnificent Seven.” Walmart’s shares closed at $165.25 on Wednesday, which is close to its all-time high.

This is Walmart’s first stock split since 1999 since the stock has mostly struggled over the past 25 years, falling behind Amazon and underperforming the S&P 500. Walmart aims to encourage employees to buy stocks, and it believes that the stock split will achieve that goal. More than 400,000 employees participate in the Associate Stock Purchase Plan, allowing them to purchase stocks through payroll deductions and benefit from a 15% match on the first $1,800 they contribute each year.

Doug McMillon, Walmart’s CEO, said that the decision to split the stock was influenced by the company’s growth and plans. He said, “Sam Walton believed it was important to keep our share price in a range where purchasing whole shares, rather than fractions, was accessible to all of our associates. Given our growth and our plans for the future, we felt it was a good time to split the stock and encourage our associates to participate in the years to come.”

The stock split will increase outstanding shares from 2.7 million to 8.1 million, and the new shares will begin trading post-split on Feb. 26.

What are the implications of the stock split for investors in Walmart?

Stock splits get a lot of attention in the media, especially when significant events can occur at large companies such as Walmart, but they don’t necessarily impact the core aspects of the business. Although the stock might seem cheaper after a stock split, the company’s overall size remains the same when measured by factors such as earnings, cash flow, or revenue.

Valuation ratios are not affected by a stock split, and it simply divides the company’s stock into more pieces, without changing the percentage of the business that investors own.

However, there is some indication that stock splits are linked to a stock’s performance in the following year. This may be due to the momentum leading up to the stock split, which typically happens after significant price gains or increased investor interest. Walmart is hoping that this move will encourage its employees to purchase more stock, which could boost the stock’s value.

Investing in Walmart’s stock has the potential to bring significant value to your financial portfolio.

Walmart has made significant progress in recent years in embracing the omnichannel retail model, adding grocery-pickup stations at most of its stores and building out its third-party e-commerce marketplace to compete with Amazon. Its e-commerce growth has been faster than Amazon’s in most recent quarters, and its grocery business, which makes up more than half of its revenue, has been able to withstand inflation and the pressure felt by consumer discretionary retailers.

In the third quarter, the company reported a 5% comparable sales growth (excluding fuel) and an adjusted operating income of $3.5 billion, a rise of 3%. It also raised its adjusted earnings-per-share guidance for the year to $6.40-$6.48.

Although Walmart is operationally strong, its valuation is similar to the S&P 500’s forward price-to-earnings ratio of 26, which means investors are paying a lot for Walmart’s modest growth prospects. Walmart is a safe stock with a long track record of raising its dividend, but investors should understand that that’s what they’re paying up for. For the right kind of investor, Walmart is a smart buy as it is a well-managed, dividend-paying recession-proof business. However, if you’re looking for growth or a stock that can beat the S&P 500 by a wide margin, there are better stocks to own.

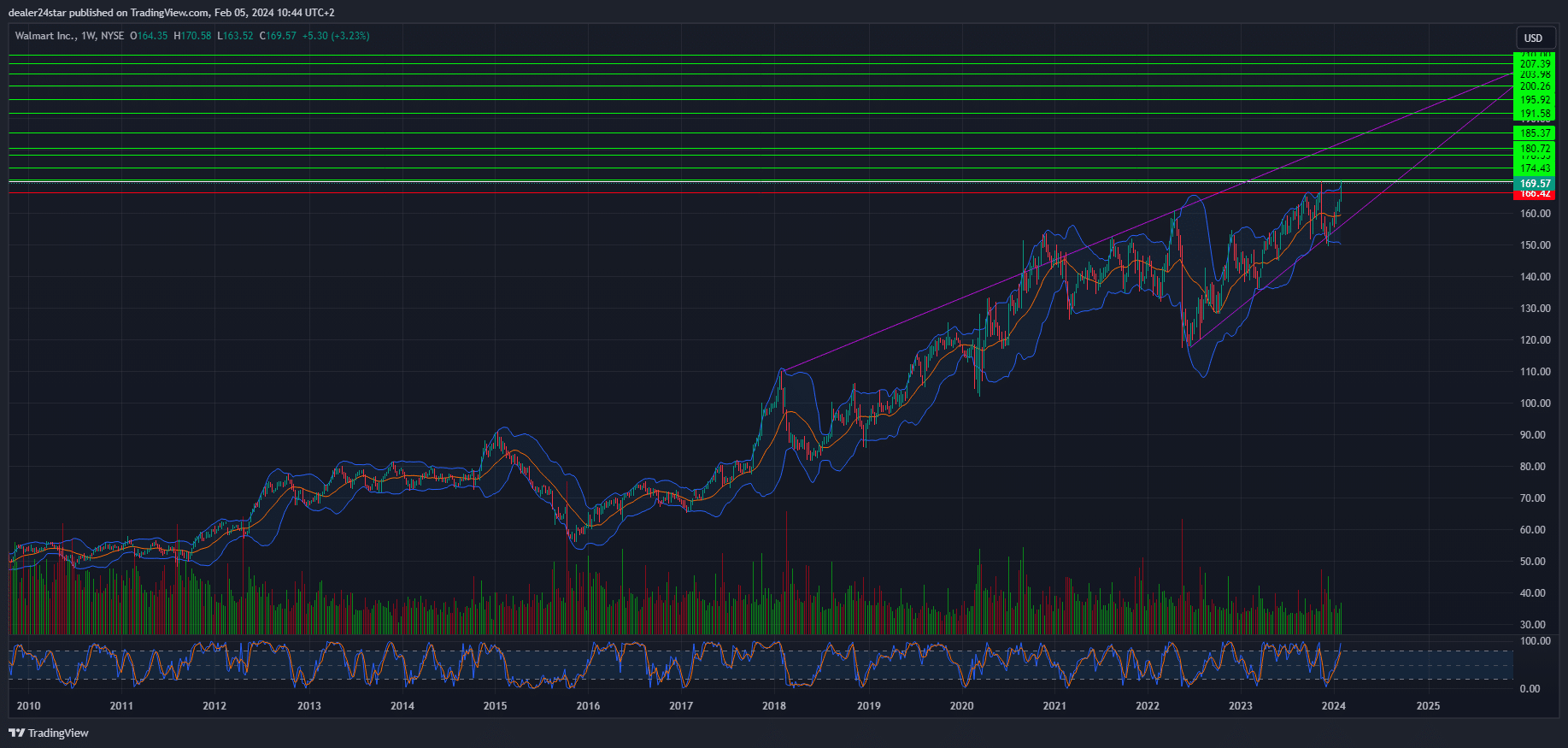

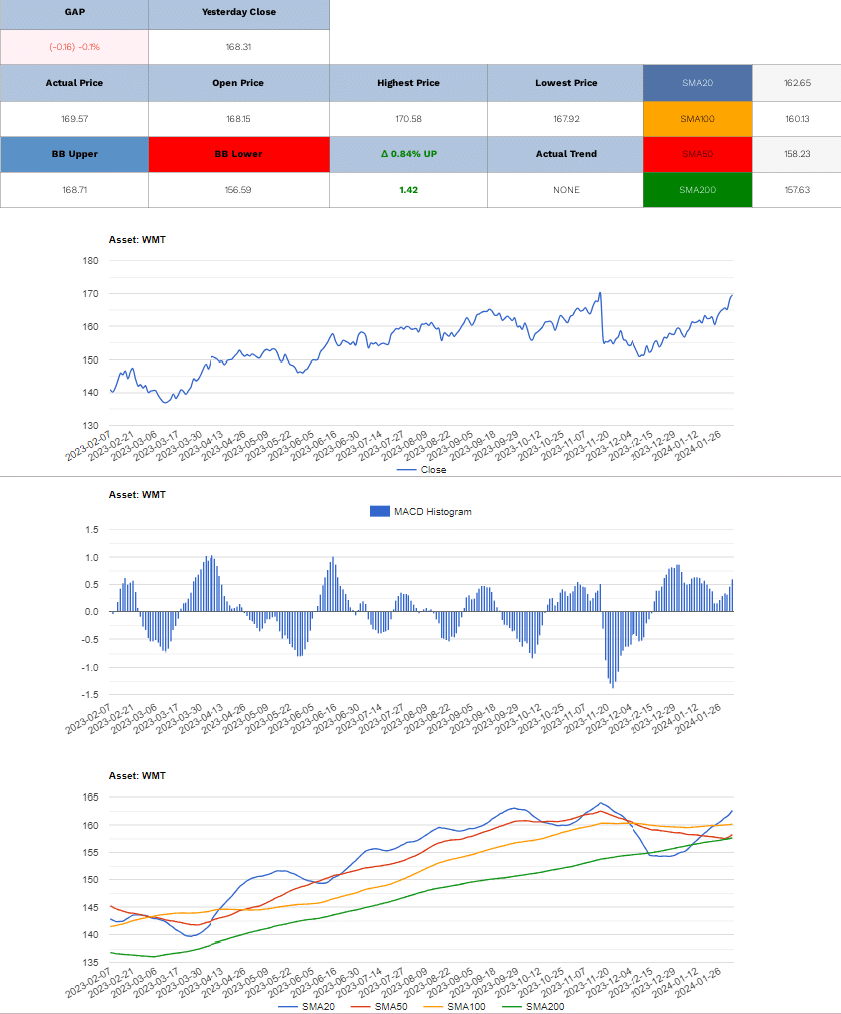

Walmart Long (Buy)

Enter At: 170.01

T.P_1: 170.47

T.P_2: 174.43

T.P_3: 178.55

T.P_4: 180.72

T.P_5: 185.37

T.P_6: 191.58

T.P_7: 195.92

T.P_8: 200.26

T.P_9: 203.98

T.P_10: 207.39

T.P_11: 210

S.L: 166.42

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.