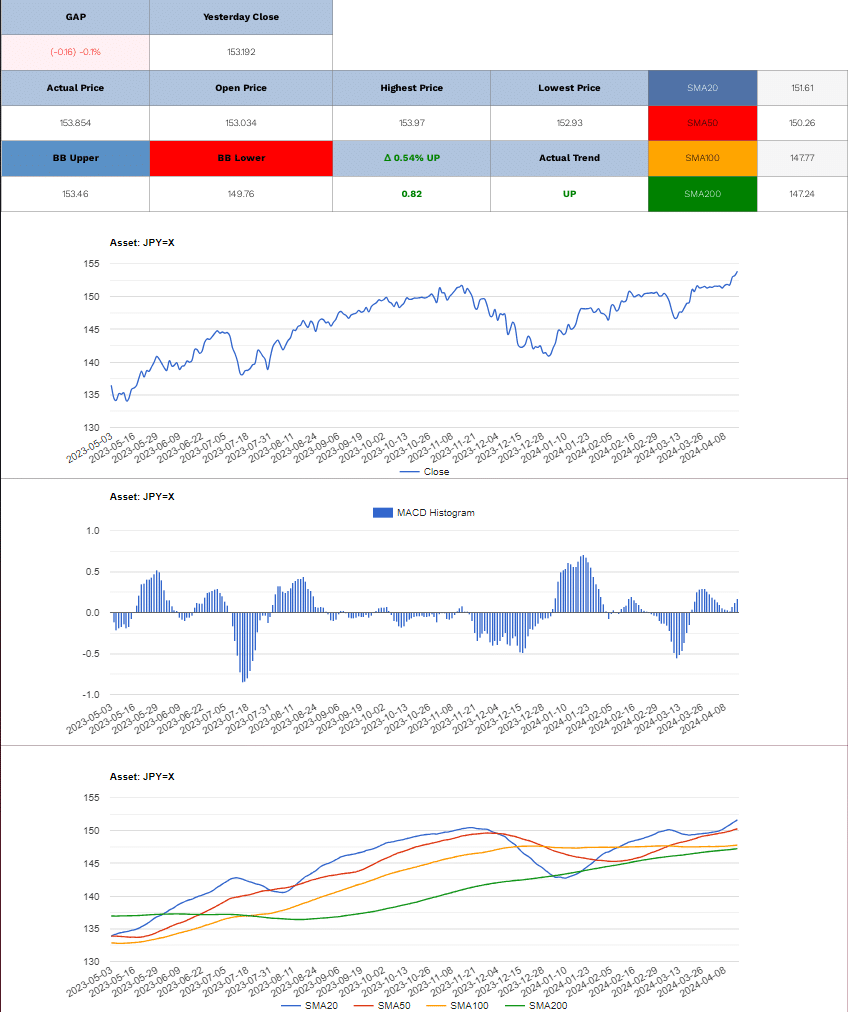

USDJPY is currently trading near multi-decade highs just below 154.00 in the European session on Monday. The Japanese Yen continues to be weakened by the Bank of Japan’s uncertain outlook about future rate hikes. However, concerns about possible intervention and persistent geopolitical tensions could help limit losses for the safe-haven JPY.

On Friday, the Japanese Yen (JPY) experienced some selling pressure and reached a fresh multi-decade low against the US dollar. The Bank of Japan (BoJ) adopted a dovish tone at the end of the March meeting and did not provide any guidance on future policy steps. Conversely, the Federal Reserve (Fed) is expected to delay cutting interest rates as inflation remains high. This suggests that the gap between US and Japanese interest rates will remain wide, which, combined with a stable performance around the equity markets, continues to undermine the safe-haven JPY.

Meanwhile, the US consumer inflation figures exceeded expectations, causing investors to delay their expectations about the timing of the first interest rate cut by the Fed until September instead of June. The hawkish outlook supports elevated US Treasury bond yields and pushes the US Dollar (USD) to its highest level since November. This, in turn, acts as another factor driving the USDJPY pair higher. However, speculation that Japanese authorities will intervene in the markets to stem any further JPY weakness requires caution before positioning for any further appreciating move in the near term.

On Monday, news of Iran attacking Israel may put selling pressure on the USD/JPY as investors consider the impact on the financial markets. While both currencies are safe-haven currencies, investors traditionally favor the Japanese Yen over the US dollar. However, the notice of the attack could limit its impact.

Early in the session, investors showed interest in economic indicators from Japan. Machine orders fell 1.8% YoY in February, following a decline of 10.9% in January. These better-than-expected numbers could influence expectations of a Bank of Japan move away from zero interest rates.

Investors should also monitor the Bank of Japan’s commentary as central bank responses to the rising threat of a prolonged Middle East conflict could move the dial.

Today, on Monday, the NY Empire State Manufacturing Index and retail sales data will be in focus. The USD/JPY currency pair is expected to be more affected by the US retail sales figures, which could decrease the likelihood of a June Fed rate cut. Economists are predicting a 0.3% month-on-month increase in retail sales for March, following a rise of 0.6% in February.

source: tradingeconomics.com

source: tradingeconomics.com

Better-than-expected numbers could further dampen expectations regarding a June Fed rate cut. Upward consumer spending trends could fuel demand-driven inflation. A higher-for-longer Fed rate path could raise borrowing costs, reducing disposable income, which could curb consumer spending, and dampening demand-driven inflation.

Investors should also track FOMC member chatter, with FOMC member Mary Daly scheduled to speak. Reactions to the Iran attack and possible implications for monetary policy could move the dial.

The probability of a June Fed rate cut fell from 50.8% to 26.9% in the week ending April 12, according to the CME FedWatch Tool, due to recent Fed speeches and US inflation numbers that impacted investor bets on a June Fed rate cut.

In the short term, trends for the USD/JPY depend on news updates from the Middle East and central bank commentary, with safety being a priority for investors, overshadowing the impact of economic data on the buyer demand for the USD/JPY.

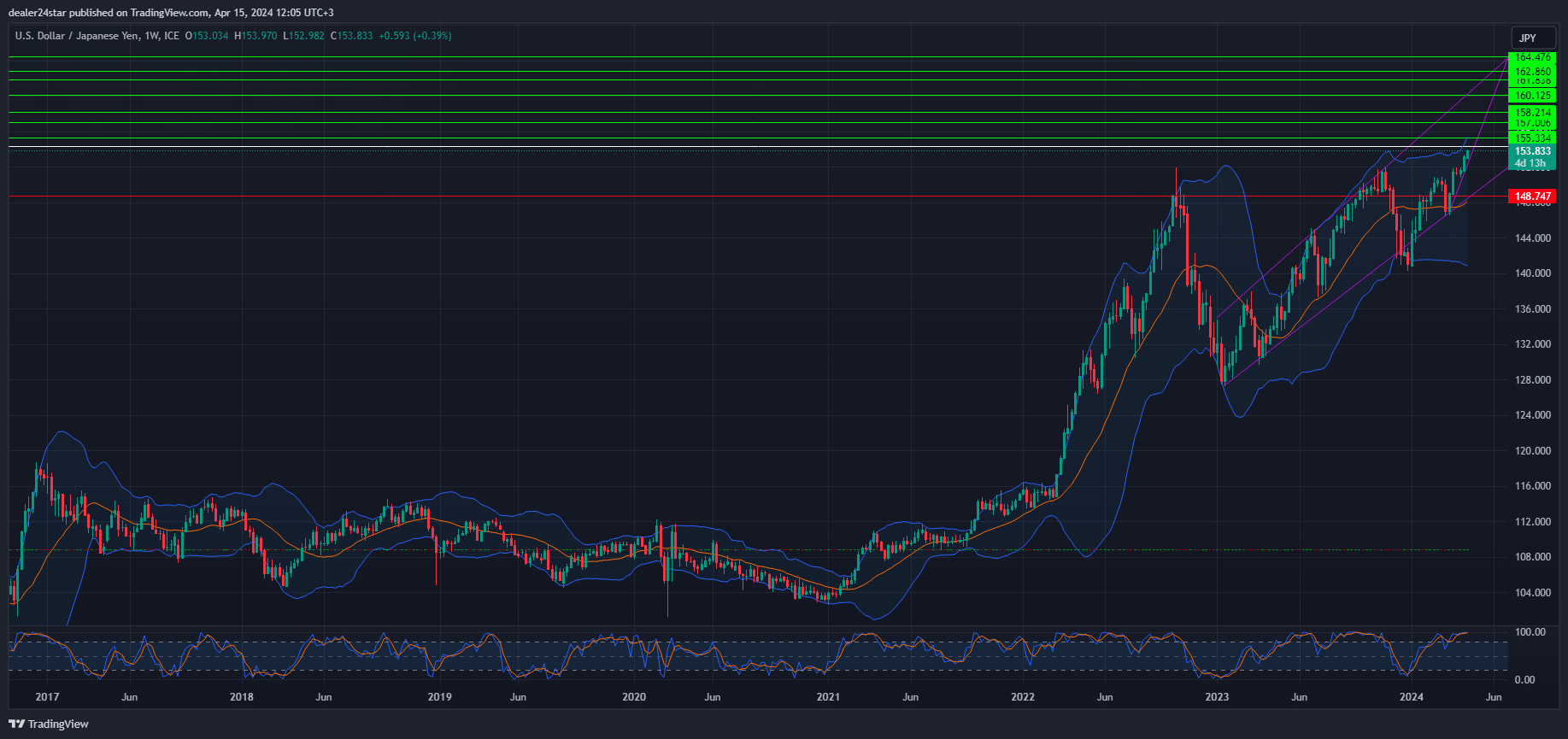

USD/JPY Long (Buy)

Enter At: 154.360

T.P_1: 155.334

T.P_2: 157.006

T.P_3: 158.214

T.P_4: 160.125

T.P_5: 161.838

T.P_6: 162.860

T.P_7: 164.476

S.L: 148.747

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.