The Turkish Lira (TRY) has become a focal point for currency watchers, experiencing significant depreciation against the US Dollar (USD) in recent months. This volatility stems from a confluence of economic and geopolitical factors.

Headwinds and Challenges:

- Persistent Inflation: Turkey battles a formidable foe – inflation exceeding 60%. This erodes consumer purchasing power and discourages foreign investment, hindering economic growth.

- Tightening Monetary Policy: The Central Bank of the Republic of Türkiye (CBRT) has embarked on a monetary tightening strategy, raising interest rates to combat inflation. While essential for long-term stability, this approach can dampen economic activity in the near term.

- Geopolitical Uncertainty: The ongoing conflicts in Ukraine and Gaza have exacerbated global energy prices, impacting Turkey’s import bill and contributing to inflationary pressures.

Emerging Signs of Resilience:

- Robust Economic Blueprint: The government’s medium-term program (MTP) outlines a path toward fiscal discipline, current account deficit reduction, and structural reforms aimed at enhancing competitiveness. Early indications suggest the program is yielding positive results.

- Relatively Sound Public Finances: Despite the challenges, Turkey maintains a public debt-to-GDP ratio lower than the average for emerging economies, demonstrating a commitment to fiscal responsibility.

- Strategic Trade Relationships: Turkey boasts strong trade ties with the European Union, the Middle East, North Africa, and Central Asia. New trends like “friend-shoring” and “near-shoring” present potential opportunities for diversification and growth.

- Infrastructure Investments: The government’s commitment to infrastructure development, exemplified by the Development Road project, enhances connectivity and has the potential to bolster trade.

- Resilient Tourism Sector: Tourism remains a critical pillar of the Turkish economy, with popular destinations like Istanbul and Antalya attracting international visitors. Collaboration with regions like Saudi Arabia, with differing tourism seasons, could further strengthen this sector.

The Road Ahead:

The Turkish Lira’s future trajectory remains uncertain. The CBRT’s unwavering commitment to inflation control through tight monetary policy will be critical. Additionally, successful implementation of the MTP’s structural reforms and capitalizing on new trade opportunities are essential for sustainable economic growth. Managing the impact of geopolitical tensions will also be a significant factor.

Conclusion:

The Turkish Lira faces undeniable challenges. However, the government’s economic program, coupled with the country’s strong trade relationships and robust tourism sector, offers a foundation for navigating the current headwinds and building a more resilient economy. By addressing the underlying causes of inflation and capitalizing on strategic opportunities, Turkey can pave the way for a more stable and prosperous future.

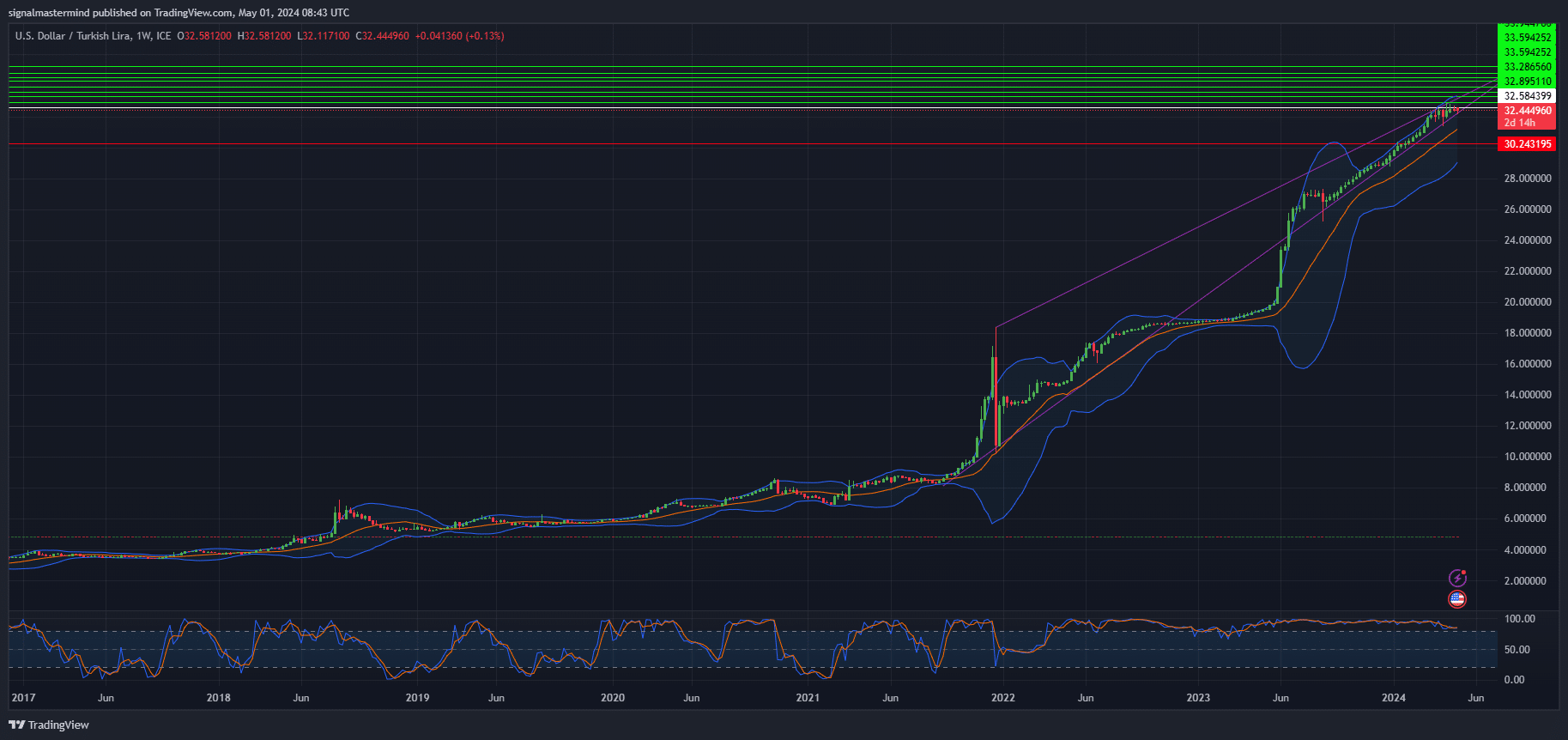

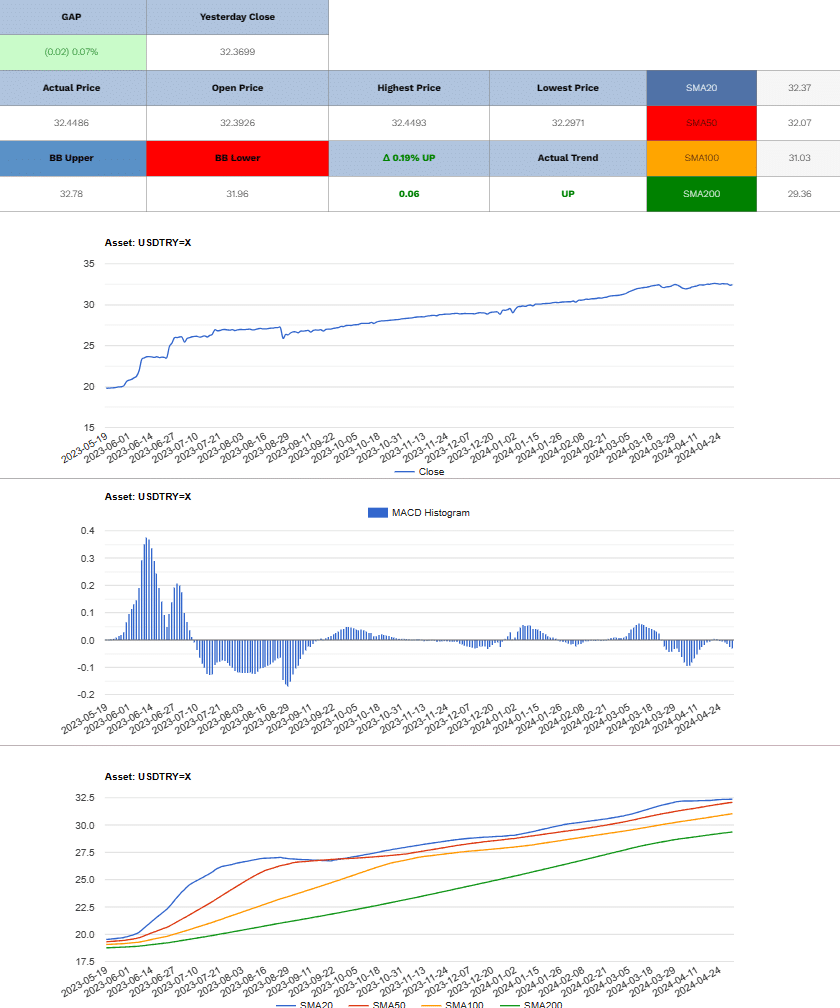

USD/TRY Long

Enter At: 32.584399

T.P_1: 32.895110

T.P_2: 33.286560

T.P_3: 33.594252

T.P_4: 33.944766

T.P_5: 34.334226

T.P_6: 34.528955

T.P_7: 34.801577

T.P_8: 35.226497

S.L: 30.243195

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.