The Cocoa market is facing a supply deficit of 374kt for 2023/24 due to falling production. According to the International Cocoa Organization (ICCO), production is expected to decrease by 11% to 4.5mt in 2023/24 due to lower output from major producing countries, including the Ivory Coast and Ghana. This decrease in production could push inventories further down and create shortages.

The falling cocoa production in Ivory Coast, the largest producer, and Nigeria, the fifth largest producer, is likely to push up the price of cocoa. The Ivory Coast farmers have shipped 1.16 MMT of cocoa to ports from October 1 to February 25, down -32% from the same time last year. Nigeria’s Jan cocoa exports also fell -15% y/y to 36,941 MT.

The Ghana Cocoa Board has cut its 2023/24 production estimate to a 14-year low of 650,000-700,000 MT from a previous forecast of 850,000 MT, citing smuggling and unfavorable weather. Ghana is the world’s second-largest cocoa producer. Some of its cocoa farmers are unlikely to fulfill some of their cocoa contracts for a second season.

Unfavorable growing conditions and crop diseases on West African farms over the past year have curbed cocoa production and fueled a scorching rally in cocoa prices. According to Maxar Technologies, the total precipitation in West Africa since the rainy season started May 1 has been more than double the 30-year average. The intense seasonal Harmattan winds and insufficient rain in West Africa are drying out cocoa fields and causing damage to the Ivory Coast mid-crop.

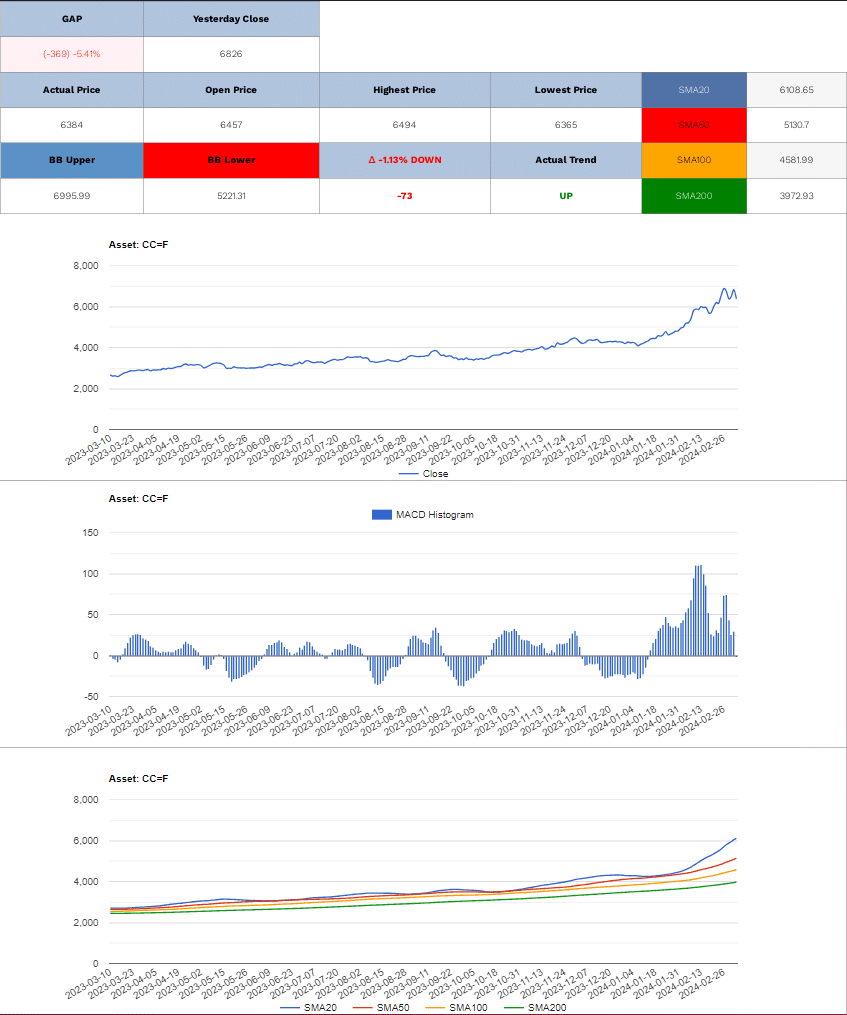

The total grindings are expected to decline by almost 5% for the 2023/24 season, pushing the stock-to-grindings ratio to the lowest in more than four decades. The projections are subject to risks arising from weather conditions and crop diseases. ICE Cocoa futures are up almost 45% this year amid expectations for global supply shortages primarily due to unfavorable weather conditions.

ICE-monitored cocoa inventories held in U.S. ports fell to a 2-3/4 year low of 4,100,035 bags on January 12. However, inventories have recently recovered and climbed to a 2-1/4 month high last Wednesday.

Record-high cocoa prices are starting to curb global demand. North American cocoa grindings fell -3.0% y/y to 103,971 MT, Asian Q4 cocoa grindings fell -8.5% y/y to 211,202 MT and European Q4 cocoa grindings fell -2.5% y/y to 350,739 MT. The concern that an El Nino weather event could undercut global cocoa production is also supporting cocoa prices.

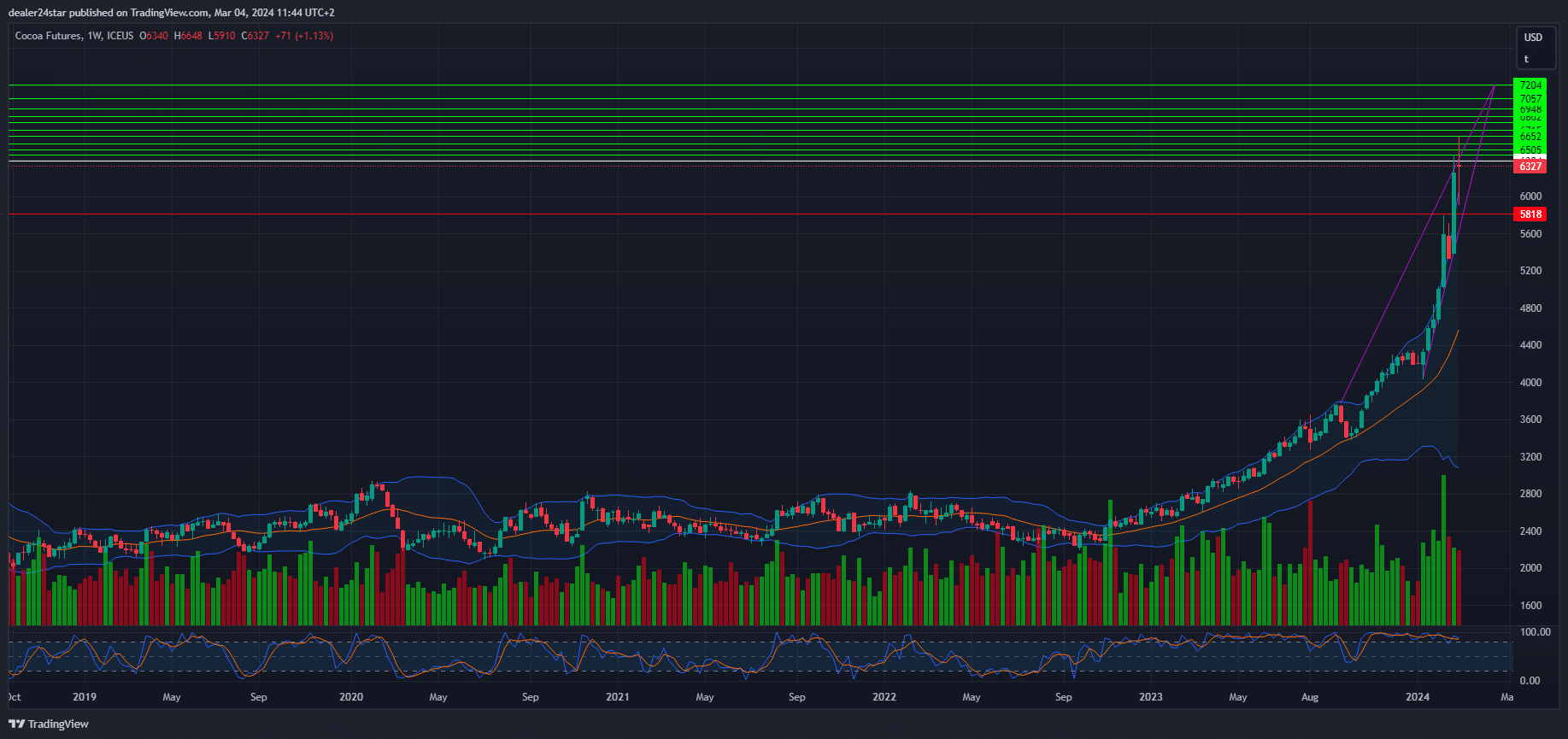

Cocoa Long (Buy)

Enter At: 6384

T.P_1: 6454

T.P_2: 6505

T.P_3: 6568

T.P_4: 6652

T.P_5: 6715

T.P_6: 6798

T.P_7: 6862

T.P_8: 6948

T.P_9: 7057

T.P_10: 7204

S.L: 5823

Disclaimer

All information on this website is of a general nature. The information is not adapted to conditions that are specific to your person or entity. The information provided can not be considered as personal, professional or legal advice or investment advice to the user.

This website and all information is intended for educational purposes only and does not give financial advice. Signal Mastermind Signals is not a service to provide legal and financial advice; any information provided here is only the personal opinion of the author (not advice or financial advice in any sense, and in the sense of any act, ordinance or law of any country) and must not be used for financial activities. Signal Mastermind Signals does not offer, operate or provide financial, brokerage, commercial or investment services and is not a financial advisor. Rather, Signal Mastermind Signals is an educational site and a platform for exchanging Forex information. Whenever information is disclosed, whether express or implied, about profit or revenue, it is not a guarantee. No method or trading system ensures that it will generate a profit, so always remember that trade can lead to a loss. Trading responsibility, whether resulting in profits or losses, is yours and you must agree not to hold Signal Mastermind Signals or other information providers that are responsible in any way whatsoever. The use of the system means that the user accepts Disclaimer and Terms of Use.

Signal Mastermind Signals is not represented as a registered investment consultant or brokerage dealer nor offers to buy or sell any of the financial instruments mentioned in the service offered.

While Signal Mastermind Signals believes that the content provided is accurate, there are no explicit or implied warranties of accuracy. The information provided is believed to be reliable; Signal Mastermind Signals does not guarantee the accuracy or completeness of the information provided. Third parties refer to Signal Mastermind Signals to provide technology and information if a third party fails, and then there is a risk that the information may be delayed or not delivered at all.

All information and comments contained on this website, including but not limited to, opinions, analyzes, news, prices, research, and general, do not constitute investment advice or an invitation to buy or sell any type of instrument. Signal Mastermind Signals assumes no responsibility for any loss or damage that may result, directly or indirectly, from the use or dependence on such information.

All information contained on this web site is a personal opinion or belief of the author. None of these data is a recommendation or financial advice in any sense, also within the meaning of any commercial act or law. Writers, publishers and affiliates of Signal Mastermind Signals are not responsible for your trading in any way.

The information and opinions contained in the site are provided for information only and for educational reasons, should never be considered as direct or indirect advice to open a trading account and / or invest money in Forex trading with any Forex company . Signal Mastermind Signals assumes no responsibility for any decisions taken by the user to create a merchant account with any of the brokers listed on this website. Anyone who decides to set up a trading account or use the services, free of charge or paid, to any of the Broker companies mentioned on this website, bears full responsibility for their actions.

Any institution that offers a service and is listed on this website, including forex brokers, financial companies and other institutions, is present only for informational purposes. All ratings, ratings, banners, reviews, or other information found for any of the above-mentioned institutions are provided in a strictly objective manner and according to the best possible reflection of the materials on the official website of the company.

Forex/CFD trading is potentially high risk and may not be suitable for all investors. The high level of leverage can work both for and against traders. Before each Forex/CFD investment, you should carefully consider your goals, past experience and risk level. The opinions and data contained on this site should not be considered as suggestions or advice for the sale or purchase of currency or other instruments. Past results do not show or guarantee future results.

Neither Signal Mastermind Signals nor its affiliates ensure the accuracy of the content provided on this Site. You explicitly agree that viewing, visiting or using this website is at your own risk.